Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr. Amadu, an amputee, was the Financial Accountant of Richmond Mine Company Limited (a mining company) for many years with a basic salary of

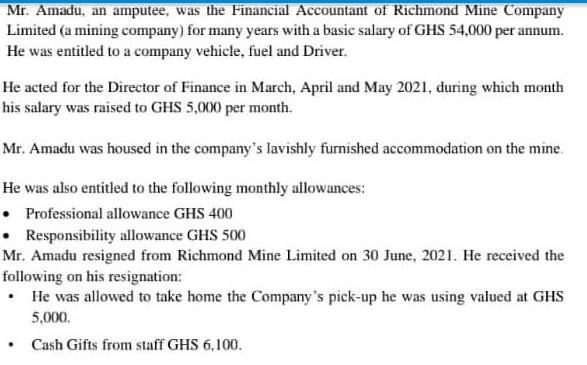

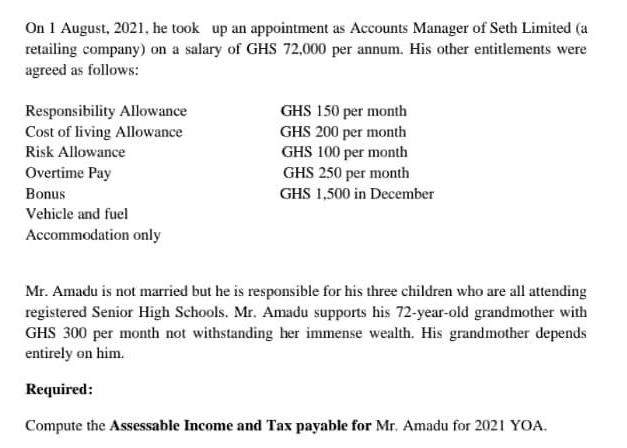

Mr. Amadu, an amputee, was the Financial Accountant of Richmond Mine Company Limited (a mining company) for many years with a basic salary of GHS 54,000 per annum. He was entitled to a company vehicle, fuel and Driver. He acted for the Director of Finance in March, April and May 2021, during which month his salary was raised to GHS 5,000 per month. Mr. Amadu was housed in the company's lavishly furnished accommodation on the mine. He was also entitled to the following monthly allowances: Professional allowance GHS 400 Responsibility allowance GHS 500 Mr. Amadu resigned from Richmond Mine Limited on 30 June, 2021. He received the following on his resignation: He was allowed to take home the Company's pick-up he was using valued at GHS 5,000. Cash Gifts from staff GHS 6,100. On 1 August, 2021, he took up an appointment as Accounts Manager of Seth Limited (a retailing company) on a salary of GHS 72,000 per annum. His other entitlements were agreed as follows: Responsibility Allowance Cost of living Allowance Risk Allowance Overtime Pay Bonus Vehicle and fuel Accommodation only GHS 150 per month GHS 200 per month GHS 100 per month GHS 250 per month GHS 1,500 in December Mr. Amadu is not married but he is responsible for his three children who are all attending registered Senior High Schools. Mr. Amadu supports his 72-year-old grandmother with GHS 300 per month not withstanding her immense wealth. His grandmother depends entirely on him. Required: Compute the Assessable Income and Tax payable for Mr. Amadu for 2021 YOA.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To compute Mr Amadus assessable income and tax payable for the year 2021 well need to calculate his ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started