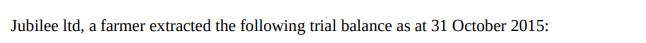

Jubilee ltd, a farmer extracted the following trial balance as at 31 October 2015: Managers salary Stocks as at 1 November 2014: Growing crops,

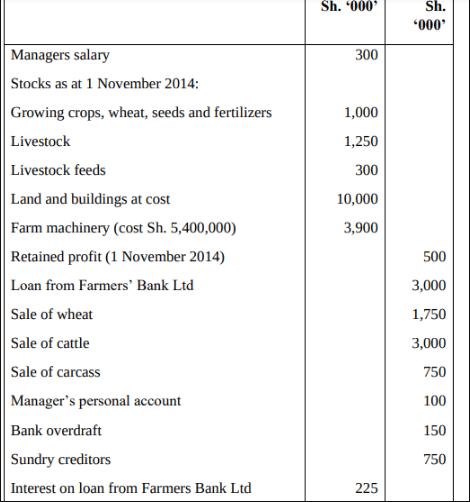

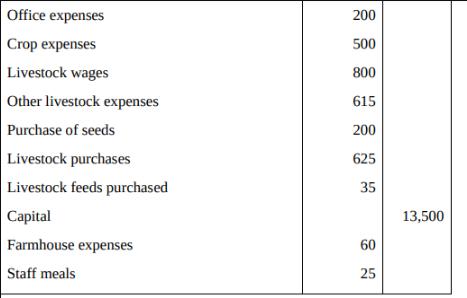

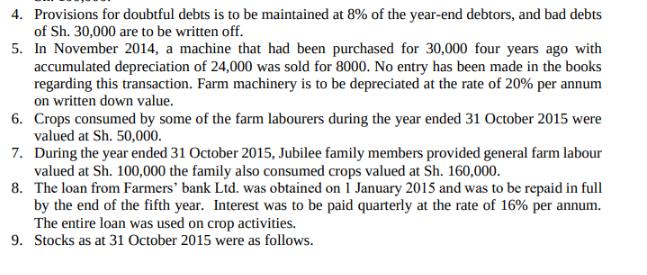

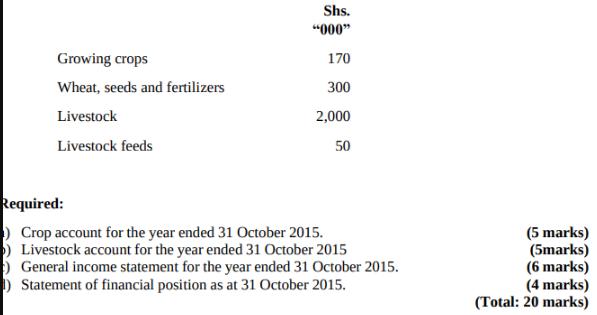

Jubilee ltd, a farmer extracted the following trial balance as at 31 October 2015: Managers salary Stocks as at 1 November 2014: Growing crops, wheat, seeds and fertilizers Livestock Livestock feeds Land and buildings at cost Farm machinery (cost Sh. 5,400,000) Retained profit (1 November 2014) Loan from Farmers' Bank Ltd Sale of wheat Sale of cattle Sale of carcass Manager's personal account Bank overdraft Sundry creditors Interest on loan from Farmers Bank Ltd Sh. '000' 300 1,000 1,250 300 10,000 3,900 225 Sh. '000' 500 3,000 1,750 3,000 750 100 150 750 Office expenses Crop expenses Livestock wages Other livestock expenses Purchase of seeds Livestock purchases Livestock feeds purchased Capital Farmhouse expenses Staff meals 200 500 800 615 200 625 35 60 25 13,500 Repairs to farm machinery Tools and implements (1 November 2014) Sundry debtors Cash in hand Crop insurance General farm labour wages 50 125 1,500 1,300 240 250 23,500 23,500 Additional information 1. The entire crop insurance was taken with effect from 1 November 2014 to provide an annual risk cover against crop losses due to climatic risks such as floods, drought and plant diseases. 2. Manager's salary and staff meals are charged to the livestock and crop activities each in the ratio of 4:3 respectively. 3. Depreciation on tools and implements is to be apportioned in the ratio of 3:2 between the crop and livestock activities. The book value of tools and implements as at 31 October 2015 was Sh. 100.000. 4. Provisions for doubtful debts is to be maintained at 8% of the year-end debtors, and bad debts of Sh. 30,000 are to be written off. 5. In November 2014, a machine that had been purchased for 30,000 four years ago with accumulated depreciation of 24,000 was sold for 8000. No entry has been made in the books regarding this transaction. Farm machinery is to be depreciated at the rate of 20% per annum on written down value. 6. Crops consumed by some of the farm labourers during the year ended 31 October 2015 were valued at Sh. 50,000. 7. During the year ended 31 October 2015, Jubilee family members provided general farm labour valued at Sh. 100,000 the family also consumed crops valued at Sh. 160,000. 8. The loan from Farmers' bank Ltd. was obtained on 1 January 2015 and was to be repaid in full by the end of the fifth year. Interest was to be paid quarterly at the rate of 16% per annum. The entire loan was used on crop activities. 9. Stocks as at 31 October 2015 were as follows. Growing crops Wheat, seeds and fertilizers Livestock Livestock feeds Shs. "000" 170 300 2,000 50 Required: ) Crop account for the year ended 31 October 2015. ) Livestock account for the year ended 31 October 2015 ) General income statement for the year ended 31 October 2015. 1) Statement of financial position as at 31 October 2015. (5 marks) (5marks) (6 marks) (4 marks) (Total: 20 marks)

Step by Step Solution

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Crop Account for the Year Ended 31 October 2015 Particulars Debit Sh 000 Credit Sh 000 Opening Stock Wheat Seeds Fertilizers 1000 Purchase of Seeds 20...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started