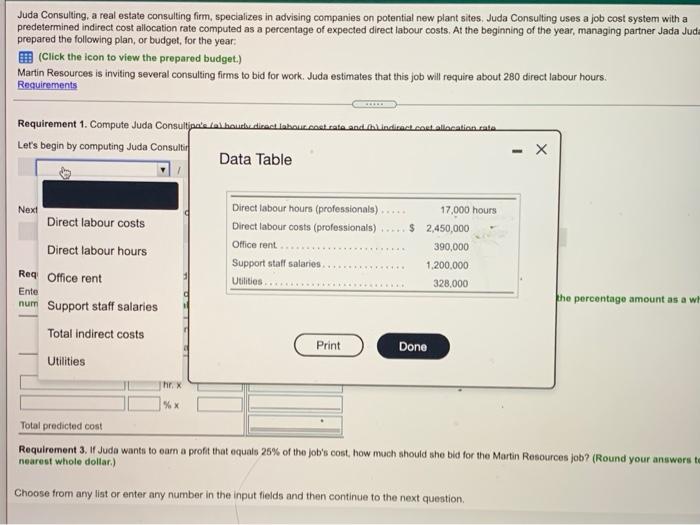

Juda Consulting, a real estate consulting firm, specializes in advising companies on potential new plant sites. Juda Consulting uses a job cost system with a predetermined indirect cost allocation rate computed as a percentage of expected direct labour costs. At the beginning of the year, managing partner Jada Juda prepared the following plan, or budget, for the year. Click the icon to view the prepared budget.) Martin Resources is inviting several consulting firms to bid for work. Juda estimates that this job will require about 200 direct labour hours Requirements Requirement 1. Compute Juda Consulting's (a) hourly direct labour cost rate and (b) indirect cost allocation rate Let's begin by computing Juda Consulting's hourly direct labour cost rate. (Round your answer to the nearest whole dollar) Direct labour cate /hour Next, compute Juda Consulting's Indirect cost allocation rate (Enter the result as a whole number) Predetermined indirect costullocation rate Requirement 2. Compute the predicted cost of the Martin Resources job Enter the direct labour and the Indirect costs for the Martin Resources, then calculate the total predicted cost for the job. (Enter the percentage amount as a whole number. Round your interim and final answers to the nearest whole dollar) Juda Consulting Estimated Cost of the Martin Manufacturing Job hr. ** Total predicted cost Requirement 3. Juda wants to earn a profit that equals 25% of the job's cost, how much should sho bid for the Martin Resources job? (Round your answers to t nearest whole dollar) Choose from any list or enter any number in the input fields and then continue to the next question Juda Consulting, a real estate consulting firm, specializes in advising companies on potential new plant sites. Juda Consulting uses a job cost system with a predetermined indirect cost allocation rate computed as a percentage of expected direct labour costs. At the beginning of the year, managing partner Jada Juda prepared the following plan, or budget, for the year. (Click the icon to view the prepared budget.) Martin Resources is inviting several consulting firms to bid for work. Juda estimates that this job will require about 280 direct labour hours. Requirements Requirement 1. Compute Juda Consultip'e dal bou direct labour cost rate and ti indicact cout allocation.cat Let's begin by computing Juda Consulti Data Table - X Next Direct labour costs Direct labour hours Req Office rent num Support staff salaries Total Indirect costs Utilities Direct labour hours (professionals) Direct labour costs (professionals) Office rent Support staff salaries Utilities 17,000 hours $ 2,450,000 390,000 1.200.000 328,000 Ente the percentage amount as a wh Print Done hr % Total predicted cost Requirement 3. If Judo wants to com a profit that equals 25% of the job's cost how much should sho bid for the Martin Resources job? (Round your answers to nearest whole dollar) Choose from any list or enter any number in the input fields and then continue to the next question 1. Compute Juda Consulting's (a) hourly direct labour cost rate and (b) indirect cost allocation rate. 2. Compute the predicted cost of the Martin Resources job. 3. If Juda wants to earn a profit that equals 25% of the job's cost, how much should she bid for the Martin Resources job