Question

Judgment Case 21-2 You are a loan officer for First Benevolent Bank. You have an uneasy feeling as you examine a loan application from Daring

Judgment Case 21-2

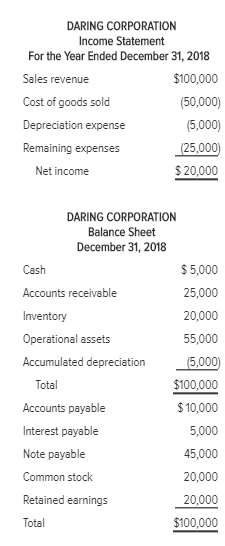

You are a loan officer for First Benevolent Bank. You have an uneasy feeling as you examine a loan application from Daring Corporation. The application included the following financial statements.

It is not Darings profitability that worries you. The income statements submitted with the application shows net income of $20,000 in Darings first year of operations. By referring to the balance sheet, you see that this net income represents a 20% rate of return on assets of $100,000. Your concern stems for the recollection that the note payable reported on Darings balance sheet is a two year loan you approved earlier in this year.

DARING CORPORATION Income Statement For the Year Ended December 31, 2018 Sales revenue Cost of goods sold Depreciation expense Remaining expenses 100,000 (50,000) 5,000) $20,000 Net income DARING CORPORATION Balance Sheet December 31, 2018 $5,000 25,000 20,000 55,000 Accumulated depreciation5,000 $100,000 $10,000 Accounts receivable Operational assets Accounts payable Interest payable Note payable Common stock Retained earnings Total 45,000 20,000 $100,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started