Answered step by step

Verified Expert Solution

Question

1 Approved Answer

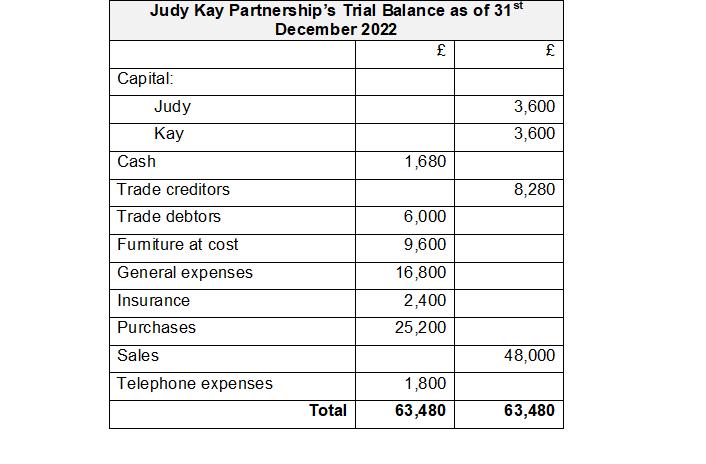

Judy Kay, a Partnership Organisation having trial balance for December 2022: The following information was obtained after the trial balance had been prepared: 1.Stock as

Judy Kay, a Partnership Organisation having trial balance for December 2022:

The following information was obtained after the trial balance had been prepared:

- 1.Stock as of 31st December 2022 is £3,600

- 2. Furniture is to be depreciated at a rate of 15 per cent on cost

- 3.As of 31st December 2022, Judy Kay owed £600 for telephone expenses, and insurance had been prepaid by £240

- 4.Bad debts of £1,200 should be written off and it is Judy Kay’s policy to maintain a provision for doubtful debts of 5% of remaining debtors (after bad debts have been written off)

- 5.Judy Kay have decided to charge interest on drawings at 5 per cent per annum, irrespective of when the drawing occur. Kay withdrew £1,200 from the business for private use on 1st November 2022.

- Required:

a. Prepare the Statement of Profit and Loss (Income Statement)

b. Statement of Financial Position (Balance Sheet)

Judy Kay Partnership's Trial Balance as of 31st December 2022 Capital: Judy Kay Cash Trade creditors Trade debtors Fumiture at cost General expenses Insurance Purchases Sales Telephone expenses Total 1,680 6,000 9,600 16,800 2,400 25,200 1,800 63,480 3,600 3,600 8,280 48,000 63,480

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION a Statement of Profit and Loss Income Statement for Judy Kay Partnership for the year ended ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started