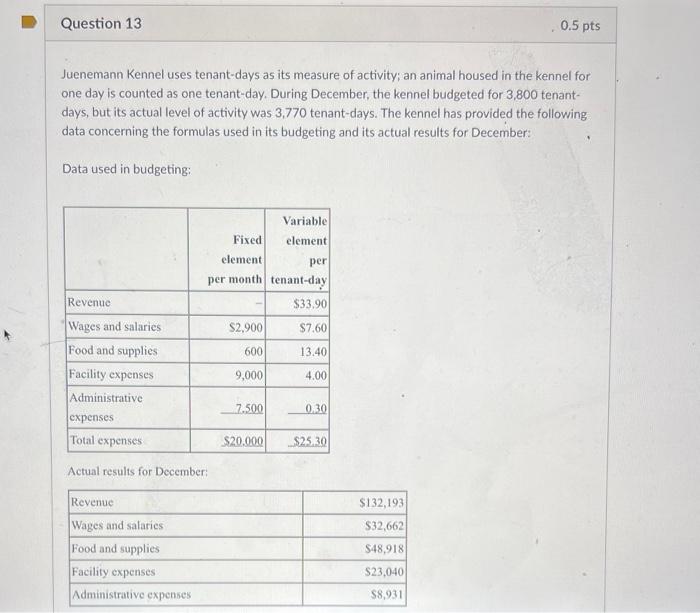

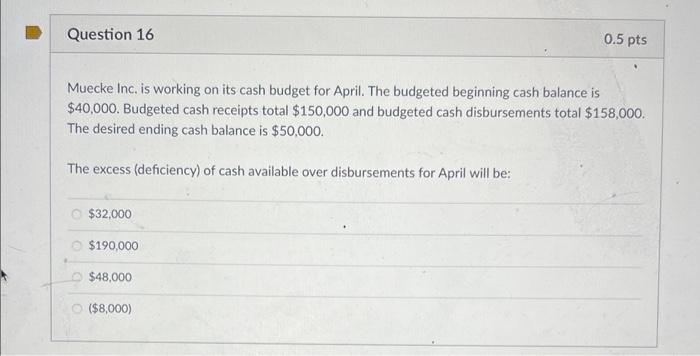

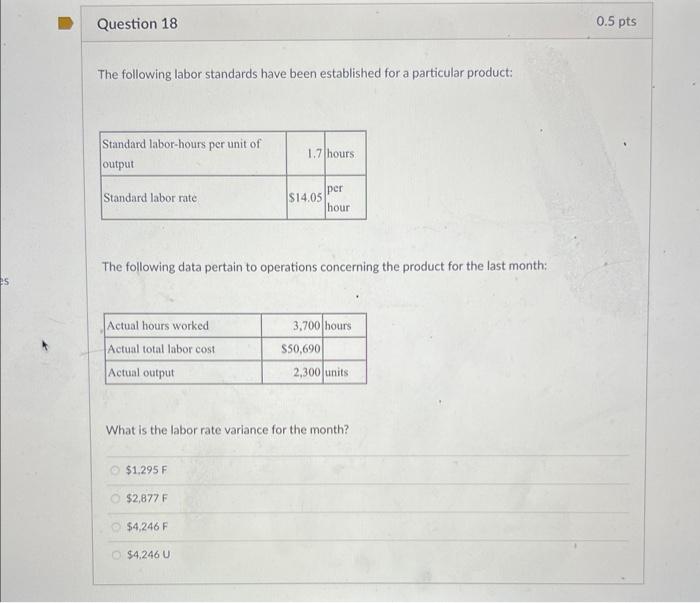

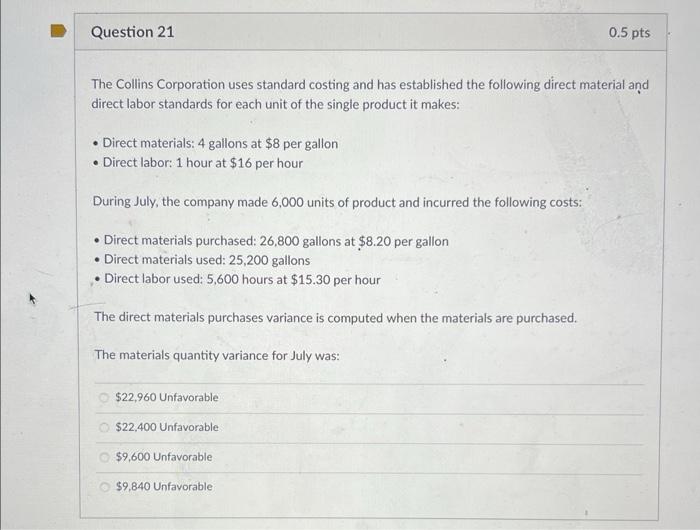

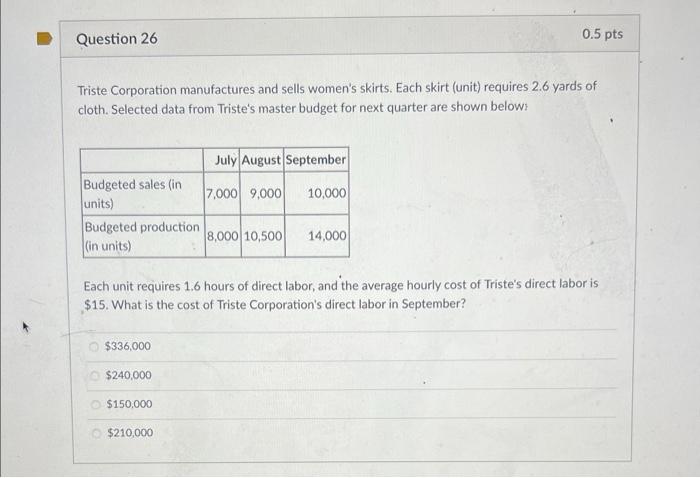

Juenemann Kennel uses tenant-days as its measure of activity; an animal housed in the kennel for one day is counted as one tenant-day. During December, the kennel budgeted for 3,800 tenantdays, but its actual level of activity was 3,770 tenant-days. The kennel has provided the following data concerning the formulas used in its budgeting and its actual results for December: Data used in budgeting: Actual results for December: The spending variance for facility expenses in December would be closest to: $1,040U$1,040F$1,160F$1,160U Muecke Inc. is working on its cash budget for April. The budgeted beginning cash balance is $40,000. Budgeted cash receipts total $150,000 and budgeted cash disbursements total $158,000. The desired ending cash balance is $50,000. The excess (deficiency) of cash available over disbursements for April will be: $32,000$190,000$48,000$8,000) The following labor standards have been established for a particular product: The following data pertain to operations concerning the product for the last month: What is the labor rate variance for the month? $1,295F $2,877F $4,246F $4,246U The Collins Corporation uses standard costing and has established the following direct material and direct labor standards for each unit of the single product it makes: - Direct materials: 4 gallons at $8 per gallon - Direct labor: 1 hour at $16 per hour During July, the company made 6,000 units of product and incurred the following costs: - Direct materials purchased: 26,800 gallons at $8.20 per gallon - Direct materials used: 25,200 gallons - Direct labor used: 5.600 hours at $15.30 per hour The direct materials purchases variance is computed when the materials are purchased. The materials quantity variance for July was: $22,960 Unfavorable $22,400 Unfavorable \$9,600 Unfavorable $9,840 Unfavorable Triste Corporation manufactures and sells women's skirts. Each skirt (unit) requires 2.6 yards of cloth. Selected data from Triste's master budget for next quarter are shown below: Each unit requires 1.6 hours of direct labor, and the average hourly cost of Triste's direct labor is \$15. What is the cost of Triste Corporation's direct labor in September? $336,000 $240,000 $150,000 $210,000