Julia , a secretary from the Bronx , NY , is thinking about jump - starting her retirement savings plan by investing the $ 40,000 gift that her elderly friend gave her . She also wants to invest $ 4,000 a year for the next 30 years for retirement . Julia knows little about investments and does not seem to have a big desire to learn .

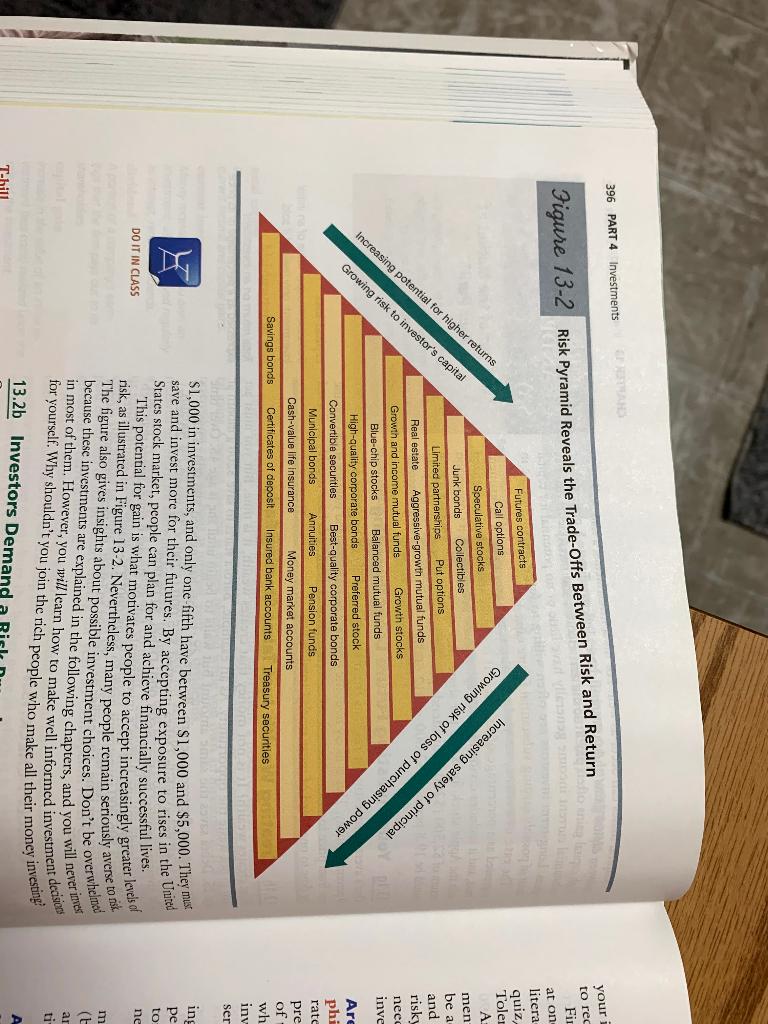

a ) What can you suggest to Julia about figuring out her investment philosophy ? ( Hint : Mention the information in Figure 13-2 on page 396 in your response .

b ) Would you recommend active or passive investing for her , and why ?

c ) Should Julia be a lender or owner ?

d ) Identify three mistakes people make when investing for retirement that Julia should try to avoid . e ) Select two of the four recommended investment strategies to recommend to Julia , and explain why she should follow them .

396 PART 4 Investments your traditi Figure 13-2 Risk Pyramid Reveals the Trade-offs Between Risk and Return to rec Fin at on litera quiz Toler A men Growing risk of loss of purchasing power Increasing safety of principal Increasing potential for higher returns Growing risk to investor's capital Futures contracts Call options Speculative stocks Junk bonds Collectibles Limited partnerships Put options Real estate Aggressive-growth mutual funds Growth and income mutual funds Growth stocks Blue-chip stocks Balanced mutual funds High-quality corporate bonds Preferred stock Convertible securities Best-quality corporate bonds Municipal bonds Annuities Pension funds Cash-value life insurance Money market accounts Certificates of deposit Insured bank accounts Treasury securities be a and risky need inve Arc phi rate pre of wh iny ser Savings bonds ing pe to ne DO IT IN CLASS $1,000 in investments, and only one-fifth have between $1,000 and $5,000. They mus save and invest more for their futures. By accepting exposure to rises in the United States stock market, people can plan for and achieve financially successful lives. This potential for gain is what motivates people to accept increasingly greater levels of risk, as illustrated in Figure 13-2. Nevertheless, many people remain seriously averse to nsk The figure also gives insights about possible investment choices. Don't be overwhelmed because these investments are explained in the following chapters, and you will never invest in most of them. However, you will learn how to make well informed investment decision for yourself. Why shouldn't you join the rich people who make all their money investing 13.2b Investors Demand m (L ar ti A T-hiul 396 PART 4 Investments your traditi Figure 13-2 Risk Pyramid Reveals the Trade-offs Between Risk and Return to rec Fin at on litera quiz Toler A men Growing risk of loss of purchasing power Increasing safety of principal Increasing potential for higher returns Growing risk to investor's capital Futures contracts Call options Speculative stocks Junk bonds Collectibles Limited partnerships Put options Real estate Aggressive-growth mutual funds Growth and income mutual funds Growth stocks Blue-chip stocks Balanced mutual funds High-quality corporate bonds Preferred stock Convertible securities Best-quality corporate bonds Municipal bonds Annuities Pension funds Cash-value life insurance Money market accounts Certificates of deposit Insured bank accounts Treasury securities be a and risky need inve Arc phi rate pre of wh iny ser Savings bonds ing pe to ne DO IT IN CLASS $1,000 in investments, and only one-fifth have between $1,000 and $5,000. They mus save and invest more for their futures. By accepting exposure to rises in the United States stock market, people can plan for and achieve financially successful lives. This potential for gain is what motivates people to accept increasingly greater levels of risk, as illustrated in Figure 13-2. Nevertheless, many people remain seriously averse to nsk The figure also gives insights about possible investment choices. Don't be overwhelmed because these investments are explained in the following chapters, and you will never invest in most of them. However, you will learn how to make well informed investment decision for yourself. Why shouldn't you join the rich people who make all their money investing 13.2b Investors Demand m (L ar ti A T-hiul