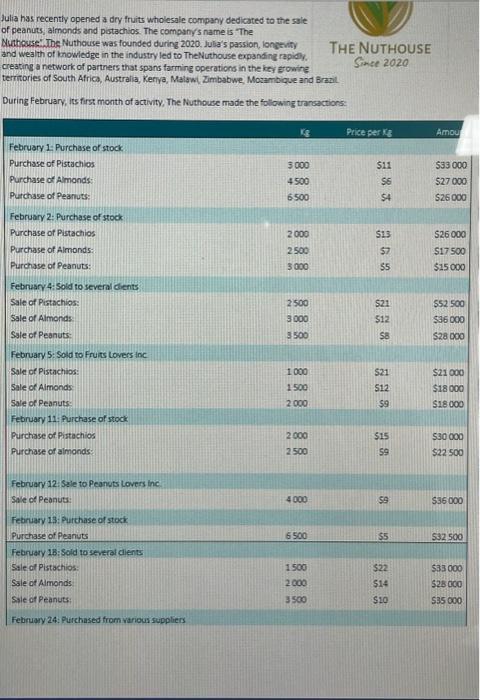

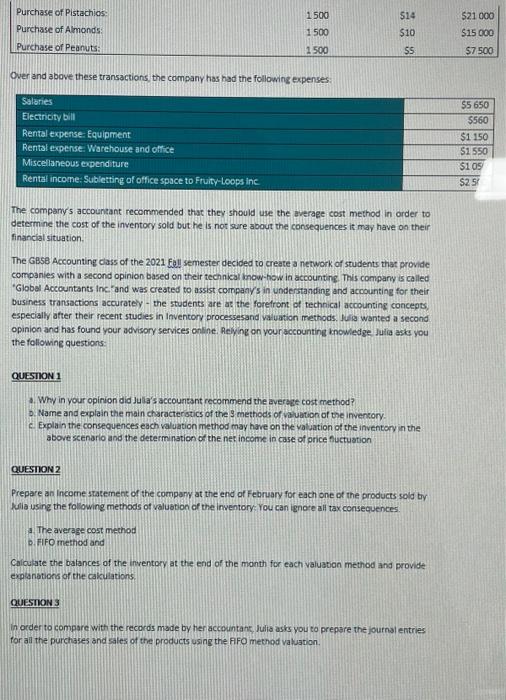

Julia has recently opened a dry fruits wholesale company dedicated to the sale of peanuts. almends and potachios. The company's name is "The Nutheuse: The Nuthouse was founded during 2020. Julia's passion, longevity and wealth of knowledge in the ind ustry led to Thekuthouse exponding rapialy. creating a network of partners that spans farming pperations in the key erowing territories of South Africa, Australia, Kerya, Malswi Zimbabwe, Mosambique and Branil. During February, its first month of activity, The Futhouse made the following trancactions: Over and above these transactions, the company has had the following expenses: The company's accountant recommended that they should use the average cost method in order to determine the cost of the inventory sold but he is not sure about the consequences it may have on their financial situation. The GBSa Accounting cass of the 2021 fill semester decided to create a network of students that provide companies with a second opinion based on their technical kow-how in accounting. This company is called - Global Accountants inc. and was created to assist companys in understanding and accounting for their busines transactions accurately - the students are at the forefront of technical accounting concepts. especially after their recent studies in Inventory processesand valuaticn methods. Jela wanted a second opinion and has found your advisory services online. Aelyng on your accounting knowiedze Julia ask you the following questions: QUESION 1 a. Why in your opinion did Jula's accountant recommend the ayerses cost method? D. Name and explain the main characteristics of the 9 methods of valuation of me inventorv. c. Explain the consequences each valuation method may have on the valuation of the inventory in the above scenario and the determination of the net inconse in case of price fuctuation QUESION2 Prepare an income szatement of the company at the end of February for each one of the products sold by fula using the following methods of valuston of the inventory: You can ignore all tax consequences. i. The average cost method b. FFO method and Caloulate the balances of the inventory at the end of the month for each valuation method and provide explanations of the cakulations. Questions in order to compare with the records made by her accocintans, lulia asks you to prepare the journal entries for ail the purchases and sales of the products using the AFO mechod valuation. Julia has recently opened a dry fruits wholesale company dedicated to the sale of peanuts. almends and potachios. The company's name is "The Nutheuse: The Nuthouse was founded during 2020. Julia's passion, longevity and wealth of knowledge in the ind ustry led to Thekuthouse exponding rapialy. creating a network of partners that spans farming pperations in the key erowing territories of South Africa, Australia, Kerya, Malswi Zimbabwe, Mosambique and Branil. During February, its first month of activity, The Futhouse made the following trancactions: Over and above these transactions, the company has had the following expenses: The company's accountant recommended that they should use the average cost method in order to determine the cost of the inventory sold but he is not sure about the consequences it may have on their financial situation. The GBSa Accounting cass of the 2021 fill semester decided to create a network of students that provide companies with a second opinion based on their technical kow-how in accounting. This company is called - Global Accountants inc. and was created to assist companys in understanding and accounting for their busines transactions accurately - the students are at the forefront of technical accounting concepts. especially after their recent studies in Inventory processesand valuaticn methods. Jela wanted a second opinion and has found your advisory services online. Aelyng on your accounting knowiedze Julia ask you the following questions: QUESION 1 a. Why in your opinion did Jula's accountant recommend the ayerses cost method? D. Name and explain the main characteristics of the 9 methods of valuation of me inventorv. c. Explain the consequences each valuation method may have on the valuation of the inventory in the above scenario and the determination of the net inconse in case of price fuctuation QUESION2 Prepare an income szatement of the company at the end of February for each one of the products sold by fula using the following methods of valuston of the inventory: You can ignore all tax consequences. i. The average cost method b. FFO method and Caloulate the balances of the inventory at the end of the month for each valuation method and provide explanations of the cakulations. Questions in order to compare with the records made by her accocintans, lulia asks you to prepare the journal entries for ail the purchases and sales of the products using the AFO mechod valuation