Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Julia is paying off her student loan from 2 0 1 7 , when she completed her undergraduate degree. Julia is working towards her Master

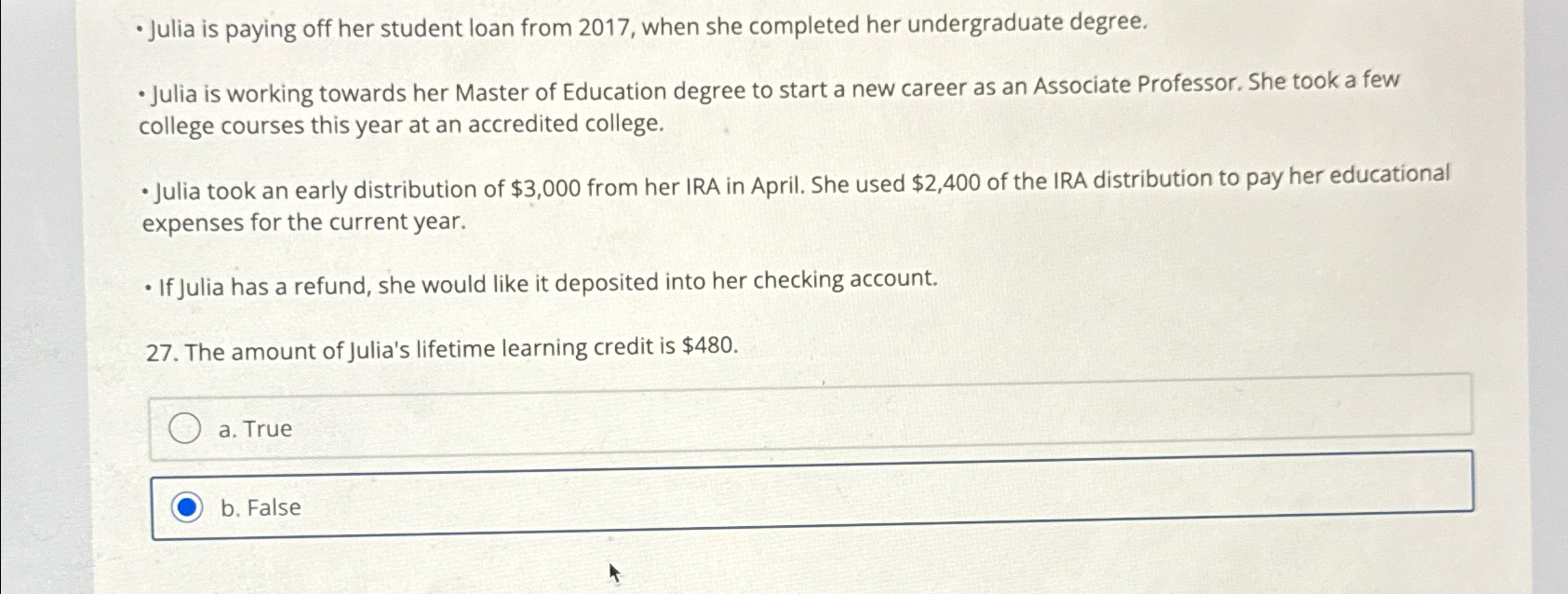

Julia is paying off her student loan from when she completed her undergraduate degree.

Julia is working towards her Master of Education degree to start a new career as an Associate Professor. She took a few college courses this year at an accredited college.

Julia took an early distribution of $ from her IRA in April. She used $ of the IRA distribution to pay her educational expenses for the current year.

If Julia has a refund, she would like it deposited into her checking account.

The amount of Julia's lifetime learning credit is $

a True

b False

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started