Answered step by step

Verified Expert Solution

Question

1 Approved Answer

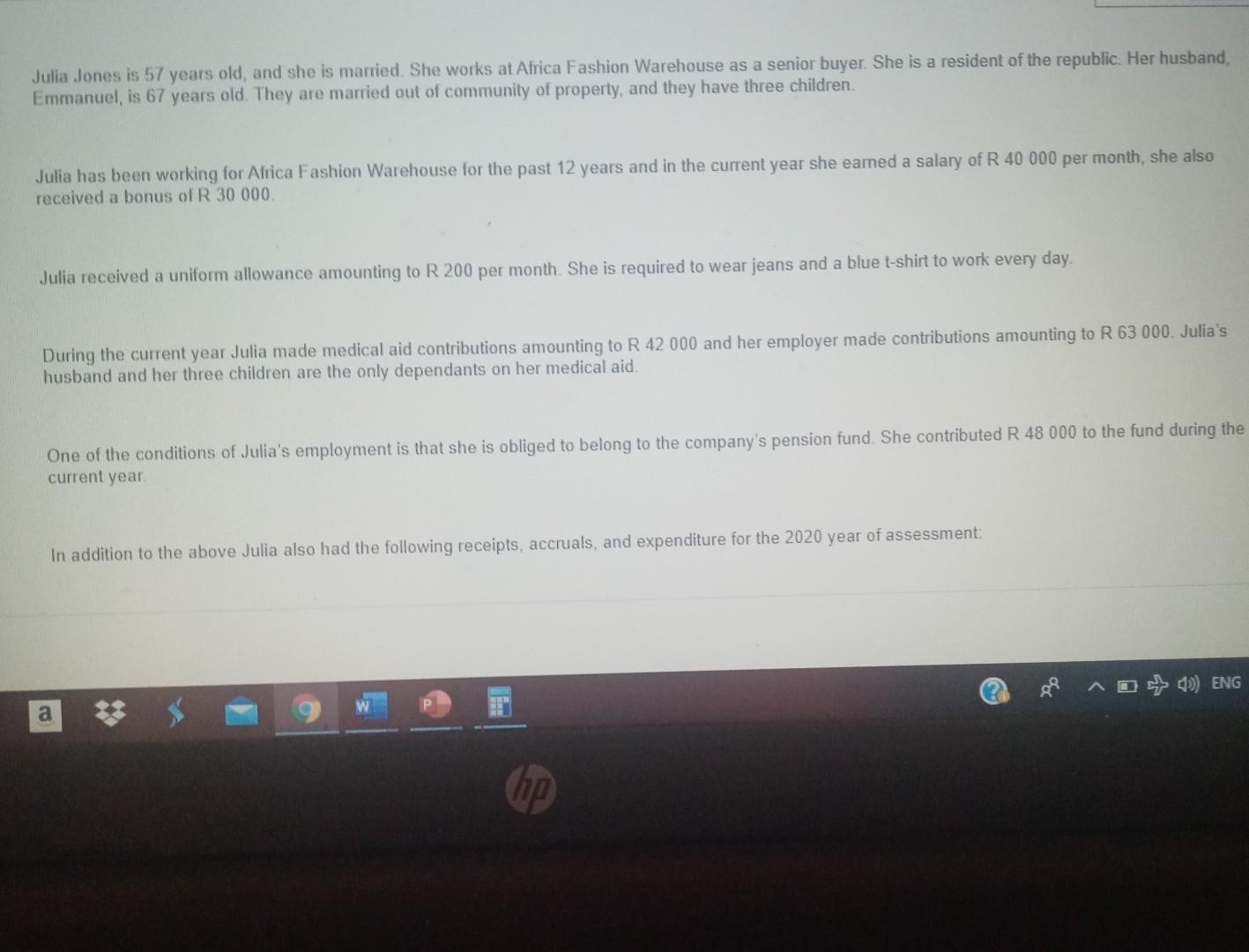

Julia Jones is 57 years old, and she is married. She works at Africa Fashion Warehouse as a senior buyer. She is a resident of

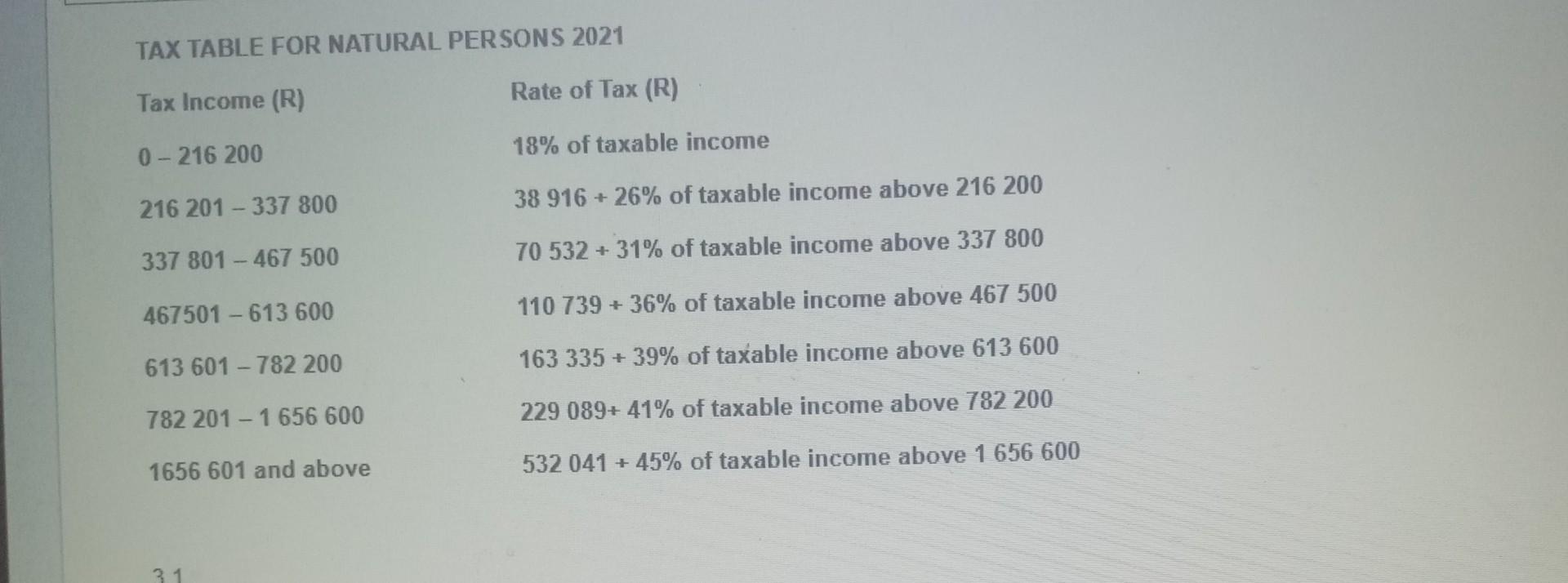

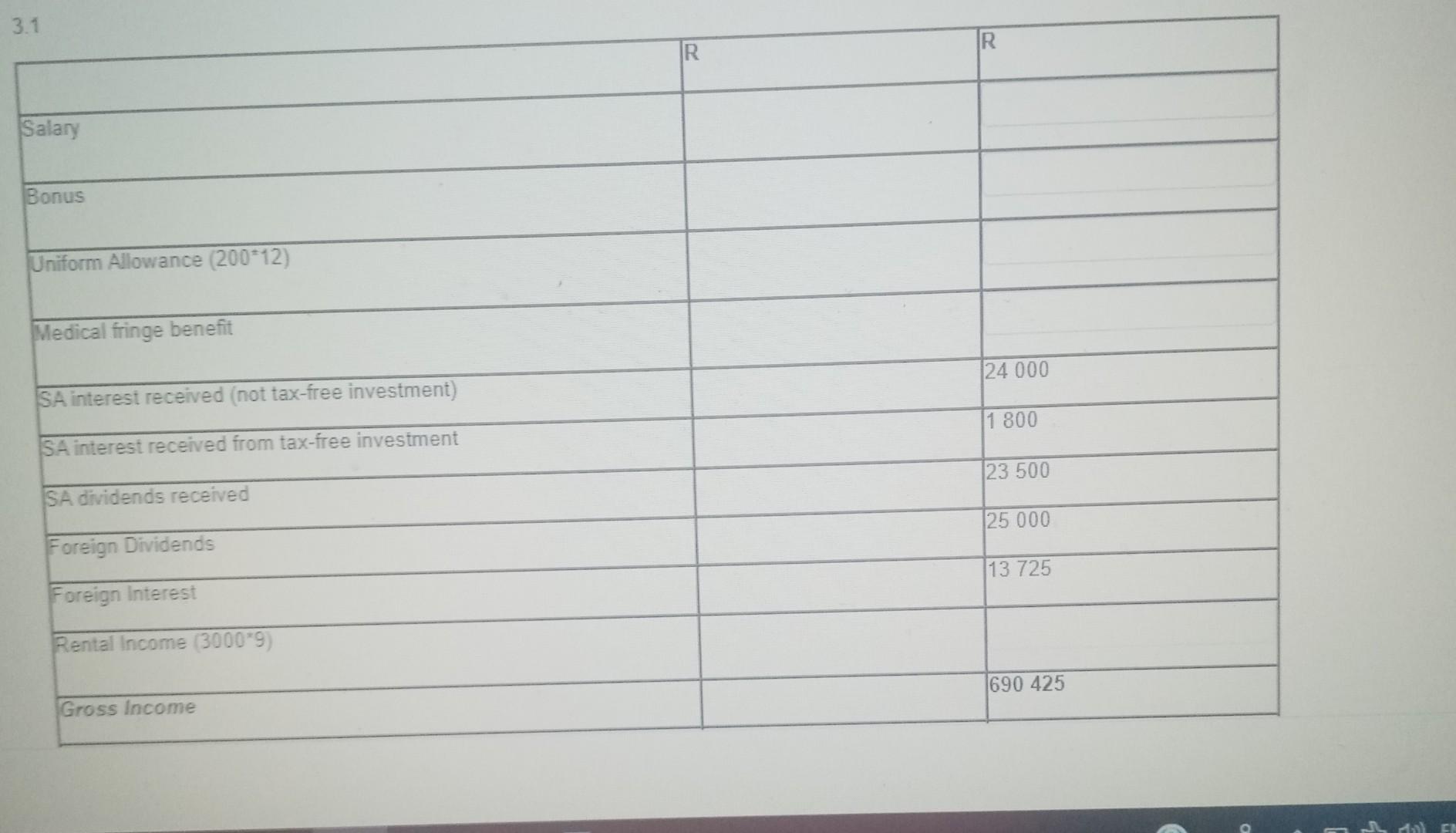

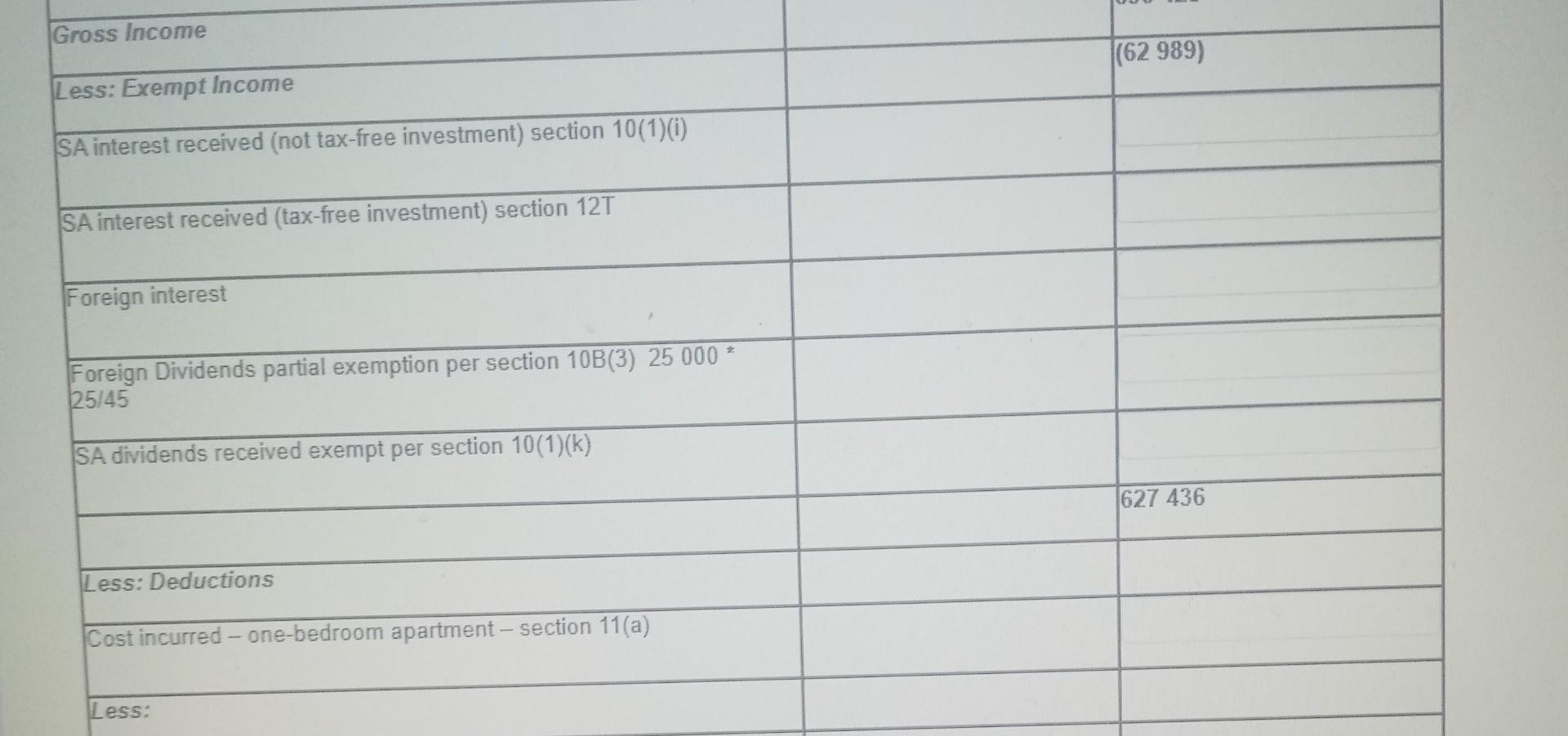

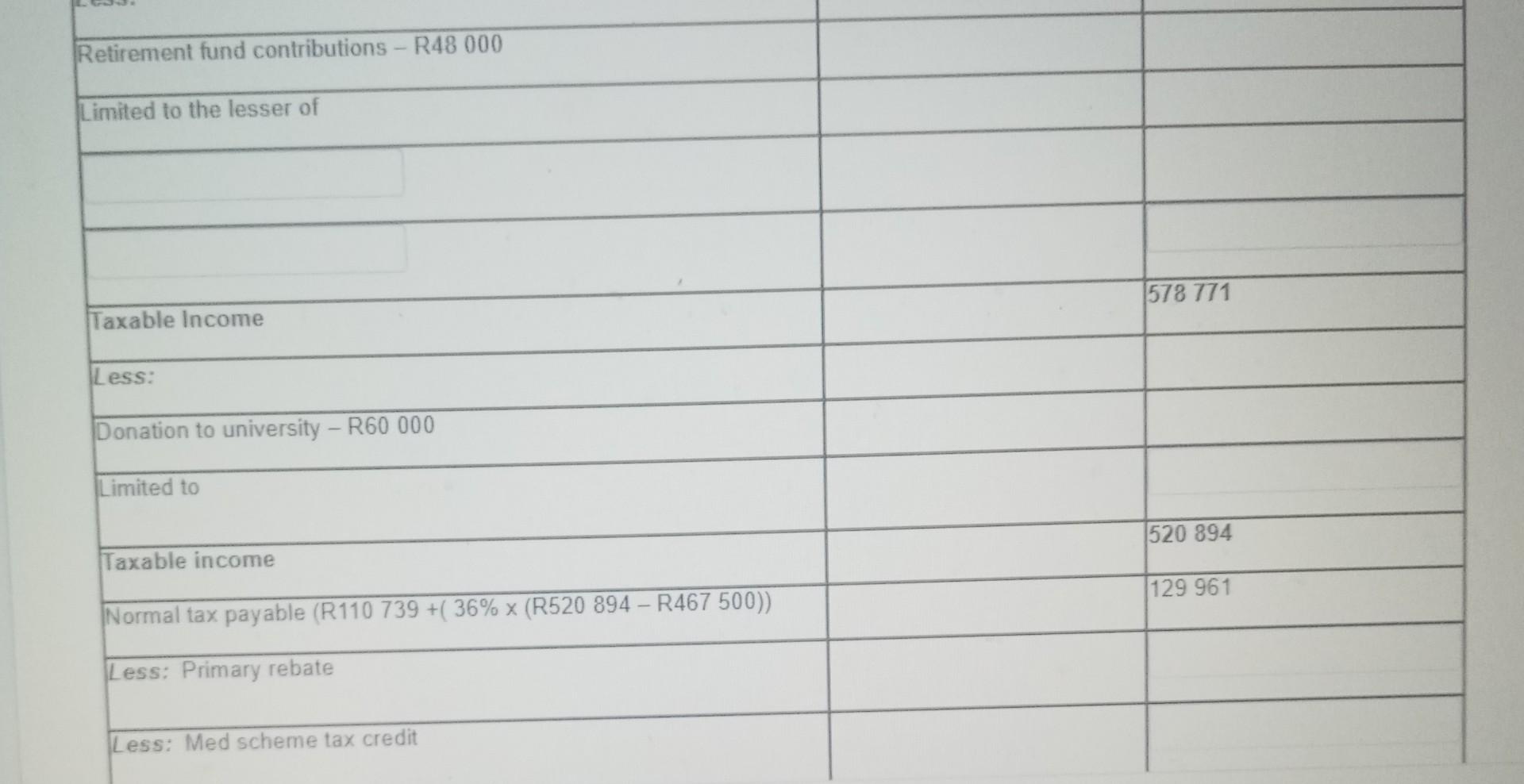

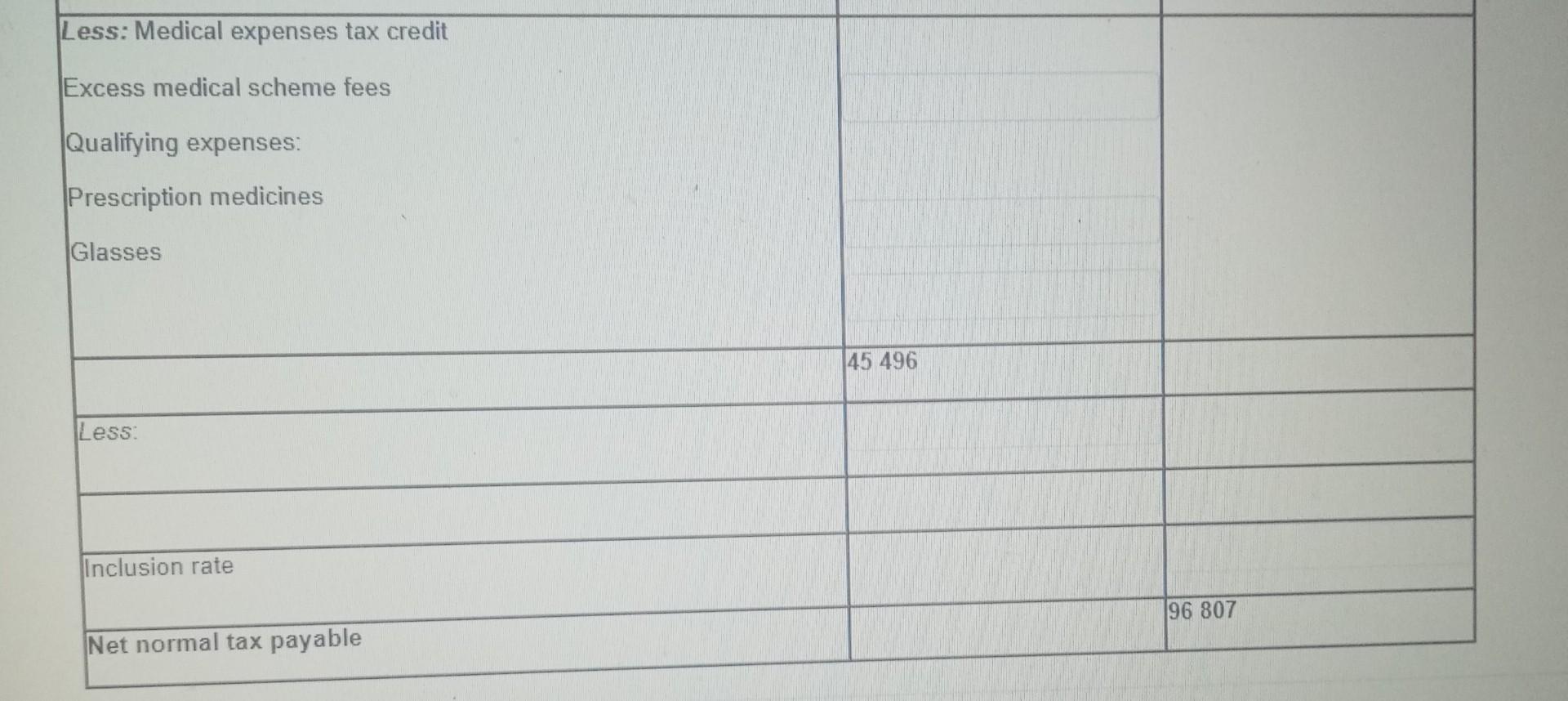

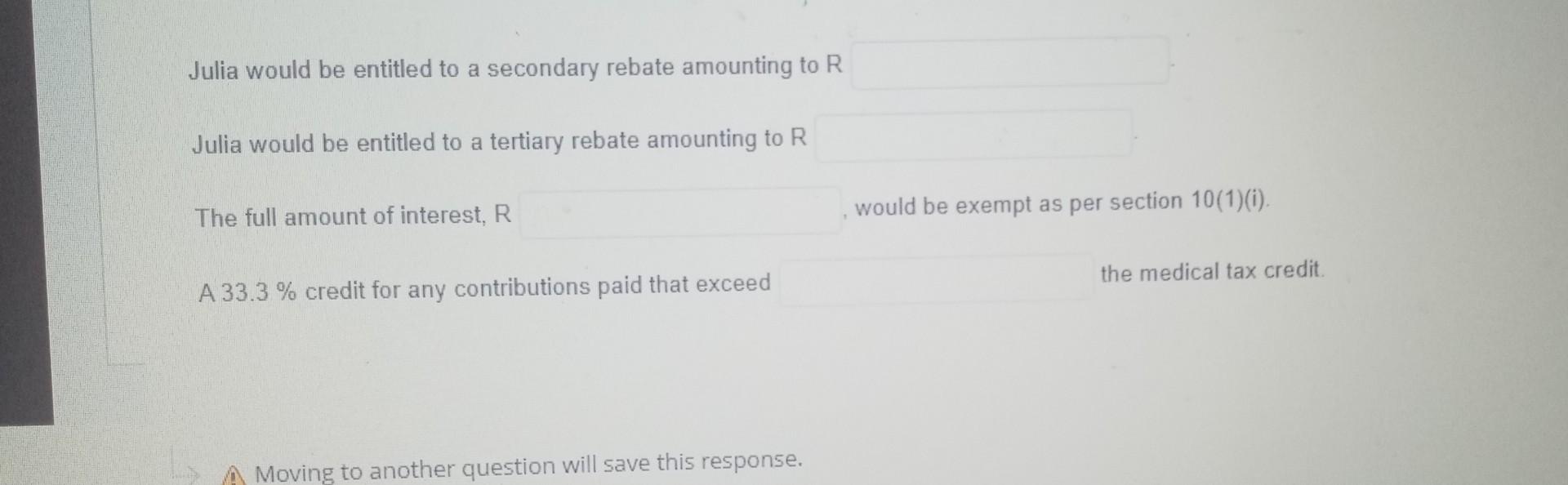

Julia Jones is 57 years old, and she is married. She works at Africa Fashion Warehouse as a senior buyer. She is a resident of the republic. Her husband, Emmanuel, is 67 years old. They are married out of community of property, and they have three children. Julia has been working for Africa Fashion Warehouse for the past 12 years and in the current year she earned a salary of R 40 000 per month, she also received a bonus of R 30 000 Julia received a uniform allowance amounting to R 200 per month. She is required to wear jeans and a blue t-shirt to work every day. During the current year Julia made medical aid contributions amounting to R 42000 and her employer made contributions amounting to R63 000. Julia's husband and her three children are the only dependants on her medical aid One of the conditions of Julia's employment is that she is obliged to belong to the company's pension fund. She contributed R 48 000 to the fund during the current year In addition to the above Julia also had the following receipts, accruals, and expenditure for the 2020 year of assessment: ^5 + 1) ENG a hip TAX TABLE FOR NATURAL PERSONS 2021 Tax Income (R) Rate of Tax (R) 0-216 200 18% of taxable income 216 201 - 337 800 38 916 +26% of taxable income above 216 200 337 801 - 467 500 70 532 + 31% of taxable income above 337 800 467501 - 613 600 110 739 + 36% of taxable income above 467 500 613 601 - 782 200 163 335 + 39% of taxable income above 613 600 782 201 -1 656 600 229 089+ 41% of taxable income above 782 200 1656 601 and above 532 041 +45% of taxable income above 1 656 600 31 3.1 IR IR Salary Bonus Uniform Allowance (200-12) Medical fringe benefit 24 000 SA interesi received (not tax-free investment) 1 800 SA interest received from tax-free investment 23 500 SA dividends received 25 000 Foreign Dividends 13 725 Foreign interest Rental Income 3000"9) 690 425 Gross Income Gross Income (62 989) Less: Exempt Income SA interest received (not tax-free investment) section 10(1)(0) SA interest received (tax-free investment) section 12T Foreign interest 2 Foreign Dividends partial exemption per section 10B(3) 25 000 * 225/45 SA dividends received exempt per section 10(1)(k) 1627 436 Less: Deductions Cost incurred - one-bedroom apartment section 11(a) Less: Retirement fund contributions - R48 000 Limited to the lesser of 578 771 Taxable income Less: Donation to university - R60 000 Limited to 520 894 Taxable income 129 961 Normal tax payable (R110 739 + 36% x (R520 894 R467 500)) Less: Primary rebate Less: Med scheme tax credit Less: Medical expenses tax credit Excess medical scheme fees Qualifying expenses: Prescription medicines Glasses 45 496 Less: Inclusion rate 196 807 Net normal tax payable Julia would be entitled to a secondary rebate amounting to R Julia would be entitled to a tertiary rebate amounting to R The full amount of interest, R would be exempt as per section 10(1)(i). the medical tax credit. A 33.3 % credit for any contributions paid that exceed A Moving to another question will save this response. Julia Jones is 57 years old, and she is married. She works at Africa Fashion Warehouse as a senior buyer. She is a resident of the republic. Her husband, Emmanuel, is 67 years old. They are married out of community of property, and they have three children. Julia has been working for Africa Fashion Warehouse for the past 12 years and in the current year she earned a salary of R 40 000 per month, she also received a bonus of R 30 000 Julia received a uniform allowance amounting to R 200 per month. She is required to wear jeans and a blue t-shirt to work every day. During the current year Julia made medical aid contributions amounting to R 42000 and her employer made contributions amounting to R63 000. Julia's husband and her three children are the only dependants on her medical aid One of the conditions of Julia's employment is that she is obliged to belong to the company's pension fund. She contributed R 48 000 to the fund during the current year In addition to the above Julia also had the following receipts, accruals, and expenditure for the 2020 year of assessment: ^5 + 1) ENG a hip TAX TABLE FOR NATURAL PERSONS 2021 Tax Income (R) Rate of Tax (R) 0-216 200 18% of taxable income 216 201 - 337 800 38 916 +26% of taxable income above 216 200 337 801 - 467 500 70 532 + 31% of taxable income above 337 800 467501 - 613 600 110 739 + 36% of taxable income above 467 500 613 601 - 782 200 163 335 + 39% of taxable income above 613 600 782 201 -1 656 600 229 089+ 41% of taxable income above 782 200 1656 601 and above 532 041 +45% of taxable income above 1 656 600 31 3.1 IR IR Salary Bonus Uniform Allowance (200-12) Medical fringe benefit 24 000 SA interesi received (not tax-free investment) 1 800 SA interest received from tax-free investment 23 500 SA dividends received 25 000 Foreign Dividends 13 725 Foreign interest Rental Income 3000"9) 690 425 Gross Income Gross Income (62 989) Less: Exempt Income SA interest received (not tax-free investment) section 10(1)(0) SA interest received (tax-free investment) section 12T Foreign interest 2 Foreign Dividends partial exemption per section 10B(3) 25 000 * 225/45 SA dividends received exempt per section 10(1)(k) 1627 436 Less: Deductions Cost incurred - one-bedroom apartment section 11(a) Less: Retirement fund contributions - R48 000 Limited to the lesser of 578 771 Taxable income Less: Donation to university - R60 000 Limited to 520 894 Taxable income 129 961 Normal tax payable (R110 739 + 36% x (R520 894 R467 500)) Less: Primary rebate Less: Med scheme tax credit Less: Medical expenses tax credit Excess medical scheme fees Qualifying expenses: Prescription medicines Glasses 45 496 Less: Inclusion rate 196 807 Net normal tax payable Julia would be entitled to a secondary rebate amounting to R Julia would be entitled to a tertiary rebate amounting to R The full amount of interest, R would be exempt as per section 10(1)(i). the medical tax credit. A 33.3 % credit for any contributions paid that exceed A Moving to another question will save this response

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started