Question

Julia Ltd. is a Canadian public corporation that engages in scientific development and experimental development (SR&ED) activities. In 2022, the corporations taxable income is calculated

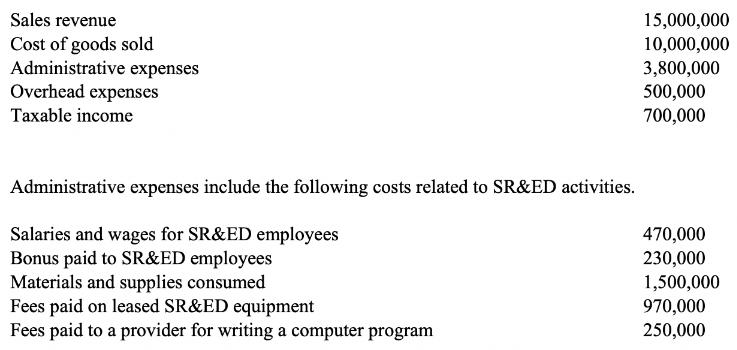

Julia Ltd. is a Canadian public corporation that engages in scientific development and experimental development (SR&ED) activities. In 2022, the corporation’s taxable income is calculated as follows.

In addition to the costs above, Mrs.X who owns 15% of the corporation, spent 50% of her time in SR&ED and her total salary was 120,000 in 2022 (also included in administrative expenses). The CPP year max pensionable earnings is 58,700 for 2020. Overhead expenses cannot be accurately attributed to SR&ED activities.

Required: Determine the minimum total tax payable with a 12% provincial rate, net of any investment credit available. Show all your details and provide explanations as necessary

Sales revenue Cost of goods sold Administrative expenses Overhead expenses Taxable income Administrative expenses include the following costs related to SR&ED activities. Salaries and wages for SR&ED employees Bonus paid to SR&ED employees Materials and supplies consumed Fees paid on leased SR&ED equipment Fees paid to a provider for writing a computer program 15,000,000 10,000,000 3,800,000 500,000 700,000 470,000 230,000 1,500,000 970,000 250,000

Step by Step Solution

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

The minimum total tax payable would be Federal corporate tax 15 of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started