Answered step by step

Verified Expert Solution

Question

1 Approved Answer

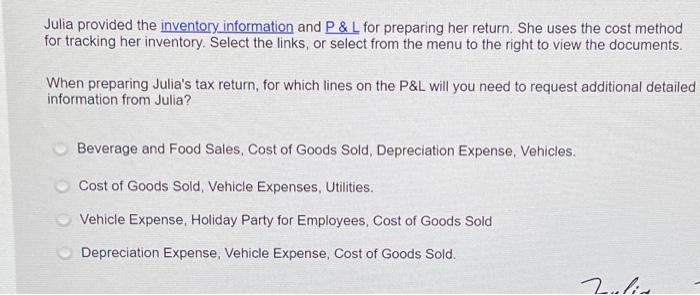

Julia provided the inventory information and P & L for preparing her return. She uses the cost method for tracking her inventory. Select the links,

Julia provided the inventory information and P & L for preparing her return. She uses the cost method for tracking her inventory. Select the links, or select from the menu to the right to view the documents. When preparing Julia's tax return, for which lines on the P&L will you need to request additional detailed information from Julia? Beverage and Food Sales, Cost of Goods Sold, Depreciation Expense, Vehicles. Cost of Goods Sold, Vehicle Expenses, Utilities. Vehicle Expense, Holiday Party for Employees, Cost of Goods Sold Depreciation Expense, Vehicle Expense, Cost of Goods Sold. Zulia

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started