Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Juliana purchased land three years ago for $119,800. She made a gift of the land to Tom, her brother, in the current year, when the

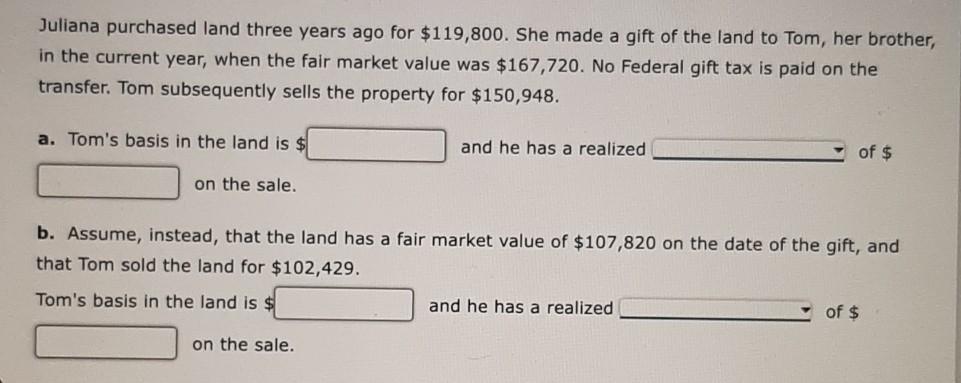

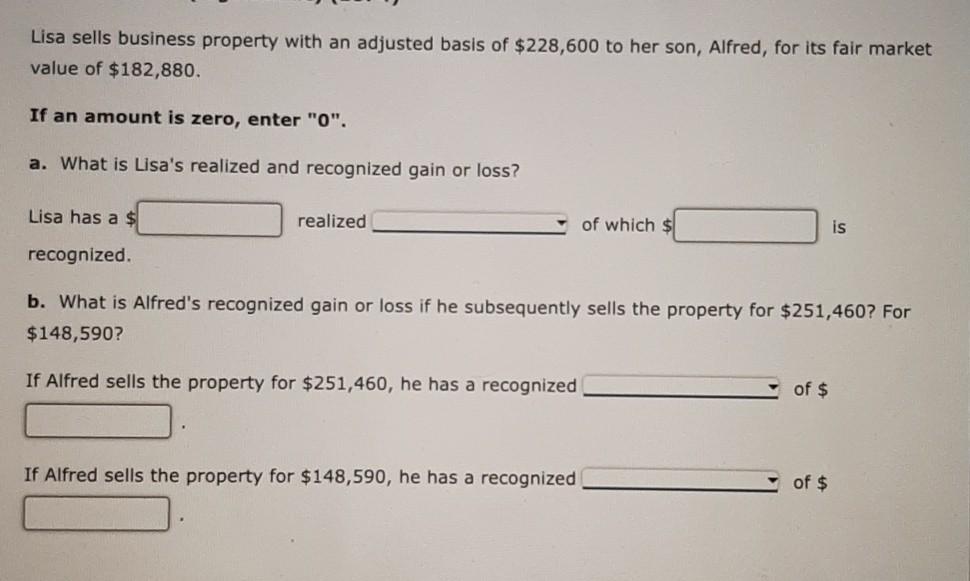

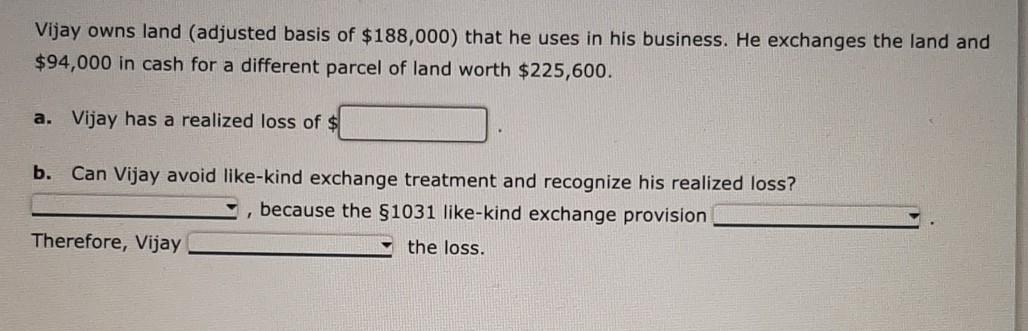

Juliana purchased land three years ago for $119,800. She made a gift of the land to Tom, her brother, in the current year, when the fair market value was $167,720. No Federal gift tax is paid on the transfer. Tom subsequently sells the property for $150,948. a. Tom's basis in the land is and he has a realized of $ on the sale. b. Assume, instead, that the land has a fair market value of $107,820 on the date of the gift, and that Tom sold the land for $102,429. Tom's basis in the land is $ and he has a realized of $ on the sale. Lisa sells business property with an adjusted basis of $228,600 to her son, Alfred, for its fair market value of $182,880. If an amount is zero, enter "O". a. What is Lisa's realized and recognized gain or loss? Lisa has a $ realized of which $ is recognized b. What is Alfred's recognized gain or loss if he subsequently sells the property for $251,460? For $148,590? If Alfred sells the property for $251,460, he has a recognized of $ If Alfred sells the property for $148,590, he has a recognized of $ Vijay owns land (adjusted basis of $188,000) that he uses in his business. He exchanges the land and $94,000 in cash for a different parcel of land worth $225,600. a. Vijay has a realized loss of $ b. Can Vijay avoid like-kind exchange treatment and recognize his realized loss? , because the $1031 like-kind exchange provision Therefore, Vijay the loss

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started