Question: Julie H. Hertenstein ABSTRACT: Component Technologies, Inc. (CTI) manufactures components used in electronic devices. CTI is considering adding manufacturing capacity for FlexConnex to meet increased

Julie H. Hertenstein

ABSTRACT: Component Technologies, Inc. (CTI) manufactures components used in electronic devices. CTI is considering adding manufacturing capacity for FlexConnex to meet increased future demand. CTI’s manufacturing planning staff identifies three options to meet this demand. The staff performs preliminary financial analyses to evaluate whether to conduct detailed planning for and evaluation of each of the three options. During their analysis, they consider which discount rate is more appropriate: the 20 percent rate, which the corporate finance manual states is the hurdle rate for capital investments, or 10 percent, which the staff believes is closer to the corporate cost of capital. They experiment with both discount rates, and two time horizons. This case requires you to calculate net present values (NPVs) and to analyze the effect of different dis- count rates and time horizons. It also asks you to consider the effect of other financial and nonfinancial issues on your analysis.

In 993, Component Technologies, Inc. (CTI)1 manufactured components, such as interconnect.

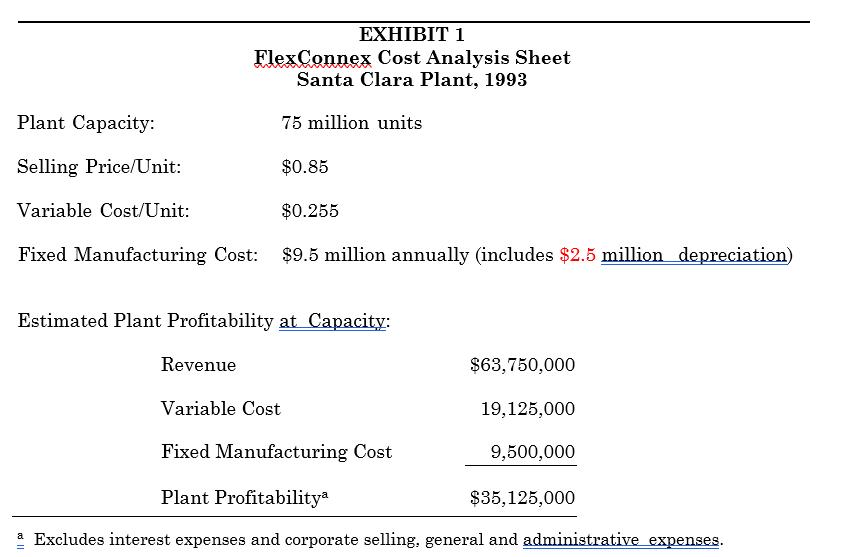

components, electronic connectors, fiber-optic connectors, flexible interconnects, coaxial cable, cable assemblies, and interconnect systems, used in computers and other electronic equipment. CTI’s global marketing strategy produced significant growth; CTI was now one of three major suppliers in its market segments. Major customers included other global companies, such as IBM, HP, Hitachi, and Siemens. These companies, in turn, manufactured and marketed their products worldwide. FlexConnex, one of CTI’s largest selling products, was very profitable (see Exhibit 1). The Santa Clara, Cali- fornia plant that manufactured the FlexConnex component was projected to reach its full capacity of 75 million units in 1994. With sufficient capacity to meet demand, CTI expected its sales of FlexConnex could continue to in- crease 10 percent per year as applications of computer technology extended into industrial products and consumer products such as automobiles and appliances.

Planning Meeting

At a meeting of his staff, Tom Richards, director of manufacturing planning, stated that they needed to plan to bring additional capacity for FlexConnex online in about two years

He suggested that they begin by proposing possible alternatives. The staff quickly identified three promising alternatives.

- The Santa Clara plant had been designed for future expansion. Additional space was available at the site, and new production capacity could be easily integrated into the existing production processes as long as compatible manufacturing technologies were employed.

- CTI owned a plant in Waltham, Massachusetts that manufactured a product line that was being phased out. Some existing equip ment in the Waltham plant was compatible with the Santa Clara plant’s manufacturing technology and could be converted to the pro- duction of FlexConnex. Half of the Waltham plant would be available in 1994, and the remainder in 1996.

- CTI could build a greenfield plant2 in Ireland, close to its major Euro- pean customers. To attract such industries, the Irish government would make a site available at low cost. A new technology currently being Beta-tested3 by an equip- ment manufacturer could be used to equip this plant..

Tom believed that these three were promising proposals. To ensure CTI could bring additional, profitable, FlexConnex capacity online in two years, Tom felt that they should begin developing plans for these alterna- tives. Nonetheless, he wanted the staff to keep an open mind to additional al- ternatives even as they evaluated these three. As the discussion started to wind down, Gracie Stanton, an engineer, said that she had a suggestion.

Gracie: Before we spend our time developing these three alternatives in detail, I’d like to get a rough feel for the potential profitability of each alternative. We shouldn’t waste our time developing de- tailed plans for an alternative if there is no chance it will ever show a positive NPV.

Tom: Good point, Gracie. Let’s break up into three groups, and do back-of-the-envelope calculations based on what we currently know about each alternative. Gracie, would you head up the Santa Clara group, since you were part of the engineering team for that plant? Edward Lodge, how about Waltham? Ian Townsley, could you and your folks take a look at Ireland? To start, what are the facts and assumptions about each facility?

Gracie: Well, there’s enough space at the Santa Clara site to produce an additional 30 million units annually. I expect it would cost about $23 million to expand this plant, and bring its total capacity to 105 million units. Of the $23 million, we would spend $5 million to expand the building, and $18 million for additional equipment compatible with Santa Clara’s existing manufacturing process. All $23 million would probably be spent in 1994, and the plant would be ready for production in 1995.

I assume that the selling price per unit will remain at its current level; further, since the same manufacturing technology will continue to be used, the variable manufacturing cost will remain the same as we show on the 1993 Santa Clara Cost Analysis Sheet [Exhibit 1]. Expanding the existing plant would allow some fixed manufacturing costs, like the plant manager’s salary, to be shared with the existing facility, so I estimate that the additional fixed manufacturing costs, excluding depreciation, will be $2.1 million annually beginning in 1995. In 1997, these fixed costs will rise to $2.4 million and remain at that level for the foreseeable future.

Edward: Well, the Waltham plant is smaller than the space available in Santa Clara, so I think its capacity will be about 25 million units. It will require renovations to adapt the plant to manufacture FlexConnex, say, about $2 million, and approximately $12 million for equipment. Half of this would be spent in 1994, and half in 1996. Initial production would be- gin in 1995; half of the 25-million-unit capacity should be available in 1995; two- thirds in 1996; the remainder in 1997.

Since the Waltham plant will use the same technology as Santa Clara, we can assume that the variable manufacturing costs will be the same as Santa Clara’s. Selling prices will also be the same. How- ever, since Waltham will be a stand-alone faculty, its fixed manufacturing costs, excluding depreciation, would be somewhat higher: $2.4 million annually beginning in 1995. In 1997, however, fixed costs will increase to $2.6 million annually, where I expect them to remain for the foresee- able future.

Ian: I just visited the Beta-test site for the manufacturing equipment using the new technology that I propose we use for the greenfield plant. There I learned that the economic size for a plant using this technology to manufacture a product such as FlexConnex is about 70 million units, so I propose that we prepare our estimates for Ireland based on a 70-mil- lion-unit capacity plant. Of course, this will cost more, since it is much larger than other sites. With the help of the Irish government, an appropriate site can be obtained for about $1 million. A building large enough to produce 70 million units can probably be built for about $10 mil- lion, and equipping the facility with the new technology equipment will cost about $50 million. Most of this would be spent in 1994, although as much as 10 percent might be spent before the end of 1993 to acquire and prepare the site. The plant would begin production in 1995; some areas of the plant would not be complete, however, and as much as 20–25 percent of the investment would remain to be spent during 1995.

Although FlexConnex’s worldwide selling price will be the same as for the other facilities, the new equipment will lower the variable manufacturing cost to

$0.195 per unit. The efficiency of this new plant will help keep fixed manufacturing costs down, as well, but since the facility will be so large, fixed manufacturing costs, excluding depreciation, would be higher than the other two facilities: $2.8 million annually beginning in 1995, rising to $2.9 million annually beginning in 1999.

Tom: These assumptions sound like rea- sonable first cuts to me. Let’s just start with a five-year analysis, 1994 through 1998, using the discount rate of 20 percent, which the corporate finance manual states is the hurdle rate for capital in- vestments. For simplicity, let’s assume all cash flows occur at the end of the respective year. Discount everything to today’s dollars, that is, as of the end of 1993. And, consistent with corporate policy, we’ll do a pretax analysis; we’ll ask the corporate finance staff to evaluate the tax implications later.

A few minutes later, the buzzing of the small groups died down, and the tapping on the laptop keyboards had ceased.

Tom: Well, what have you learned from this first glance

Edward: The Waltham site looks promising.

Ian: Not Ireland.

Gracie: This is odd. The Santa Clara plant is right on the margin, and that surprises me since the existing manufacturing facility is one of CTI’s most profitable, and we get further economies of scale by expanding that plant. I wonder if the discount rate we are using is too high. At the “Finance for Manufacturing Engineers” seminar I attended recently, we discussed the problems associated with using a discount rate that was too high. The professor stated that there was a sound theoretical basis for using a dis- count rate that approximated the company’s cost of capital, but many companies “added on” estimates for risk, corporate charges, and other factors that were less well grounded. Based on what I learned in that seminar, I tried to estimate CTI’s actual cost of capital; it was about 10 percent. I wonder what would happen if we used 10 percent instead?

Tom: With these laptops and spread- sheet programs, that’s easy enough; let’s check it out. A few seconds later....

Gracie: Now, that’s better!

Edward: Ours too.

Ian: Well, at least we’re moving in the right direction. But it doesn’t make sense to me that a facility with lower variable cost per unit, and lower average fixed cost per unit at capacity, shows a negative NPV when the others are positive. We checked our calculations; what’s the story? Could it be that Ireland would not even be up to capacity production in five years because the plant is so big?

Gracie: Maybe, but our plants are being penalized, too; after all, even though they reach capacity in the first five years, they will presumably continue to produce FlexConnex. Although there is constant technological change in this industry, there is a reasonable probability that demand for FlexConnex will remain strong for at least 10 years.

Ian: Well, then, let’s look at each of the three plants over a ten-year period, us- ing Gracie’s 10 percent discount rate.

Later....

Edward: Aha! Waltham continues to improve.

Gracie: However, Santa Clara has you beat now!

Ian: I’ve got bad news for both of you!

Questions

- In addition to reducing costs, the new technology proposed for the greenfield plant would increase manufacturing flexibility, which would enable CTI to respond more quickly to customers and to provide them more custom features. Should these factors be considered in the analysis? If so, how would you in- corporate them?

- Should other factors be taken into consideration in choosing the loca- tion of the FlexConnex plant? If so, what are they?

- Should Tom Richards continue to develop more detailed plans for these three alternatives? If not, which should be eliminated? Are there other alternatives that his staff should consider? If so, what are they?

EXHIBIT 1 FlexConnex Cost Analysis Sheet Santa Clara Plant, 1993 75 million units Plant Capacity: Selling Price/Unit: $0.85 Variable Cost/Unit: $0.255 Fixed Manufacturing Cost: $9.5 million annually (includes $2.5 million depreciation) Estimated Plant Profitability at Capacity: Revenue Variable Cost $63,750,000 19,125,000 Fixed Manufacturing Cost Plant Profitabilitya $35,125,000 Excludes interest expenses and corporate selling, general and administrative expenses. 9,500,000

Step by Step Solution

3.40 Rating (166 Votes )

There are 3 Steps involved in it

In addition to reducing costs the new technology proposed for the greenfield plant would increase manufacturing flexibility which would enable CTI to respond more quickly to customers and to provide t... View full answer

Get step-by-step solutions from verified subject matter experts