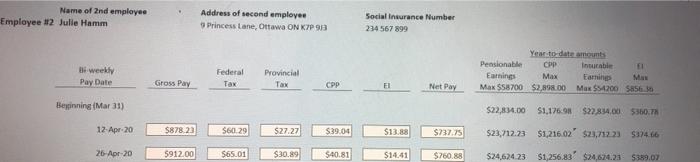

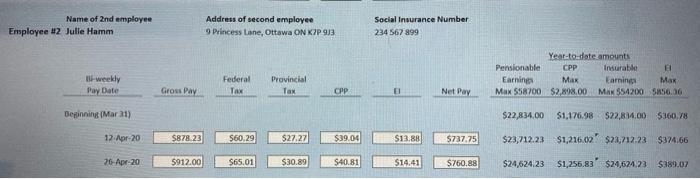

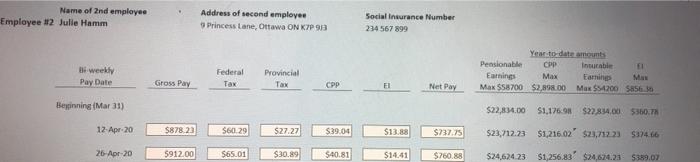

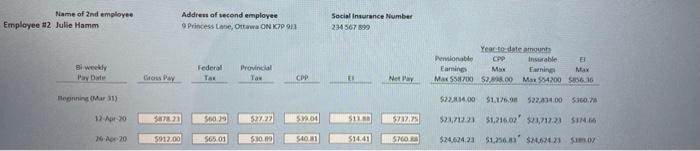

Julie Hamm works 40 hours a week/ gets paid bi-weekly, she elects $20 of additional federal income tax deducted per pay:

What is Julie Hamm's annual salary?

please zoom in the picture as it will look blurry if not

Name of 2nd employee Employee 2 Julie Hamm Address of second employee Princess Lane, Ottawa ON K7P98 Social Insurance Number 234 567 899 weekly Pay Date Federal Provincial Tax Pensionable Insurable FI Earnings Max Earning M Max $58700 $2,898.00 Max $120058560 Gross Pay Tax CPP EI Net Pay Beginning Mar 31) $22,834.00 $1,176 $22.834.00 $300.TH 12-Apr-20 $878.23 S60.29 $27.27 $39.04 $13. $737.75 $23,212.23 $1,216.02 $23,71223 37466 26-Apr-20 5912.00 $65.01 $30.89 $40.81 $14.41 $760.88 $24,624.23 $1,256,83' $24.674.23 $39.07 Name of 2nd employee Employee #2 Julie Hamm Address of second employee Princess Lane, Ottawa ON K7P Social Insurance Number 234567899 Bi weekly Pay Date Federal Tar Provincial Tau Year to date amount Pensionate CPP Insurable Earnings Ewing Max S5700 52.00 Max 954200 616 Cos Day CPP Netay Menningar) $23.84.00 $1.176.0 522.614.00 SO YA 12 00 S71 5009 52222 50.00 S11 52025 $21.12.21 $1,216.00 $2,71223 SIM -A20 5912.00 565.01 $10.00 54031 51441 SMO $24.624.23 $1,56' SHU SHOZ Name of 2nd employee Employee 2 Julie Hamm Address of second employee 9 Princess Lane, Ottawa ON KZP 93 Social Insurance Number 234 567 899 Year-to-date amounts Pensionable CPP Insurable Earnings Max Earnings Max Max 558700 $2,808,00 Mix $54200 S85636 3 weekly Pay Date Federal Tax Provincial Tax Gross Pay CPP Net Pay Beginning (Mar 31) $22,834.00 $1,176.98 $22.814.00 $360.78 12. Apr-20 $878 23 $60.29 $27.27 $39.04 $13.88 $737.75 $23,712.23 $1,216.02 $28,712.23 $37466 $24,624.23 $1,256.83' $24,624.23 $289.07 26-Apr-20 $912.00 $65.01 $30.89 $40.81 $14.41 $760.88 Name of 2nd employee Employee 2 Julie Hamm Address of second employee Princess Lane, Ottawa ON K7P98 Social Insurance Number 234 567 899 weekly Pay Date Federal Provincial Tax Pensionable Insurable FI Earnings Max Earning M Max $58700 $2,898.00 Max $120058560 Gross Pay Tax CPP EI Net Pay Beginning Mar 31) $22,834.00 $1,176 $22.834.00 $300.TH 12-Apr-20 $878.23 S60.29 $27.27 $39.04 $13. $737.75 $23,212.23 $1,216.02 $23,71223 37466 26-Apr-20 5912.00 $65.01 $30.89 $40.81 $14.41 $760.88 $24,624.23 $1,256,83' $24.674.23 $39.07 Name of 2nd employee Employee #2 Julie Hamm Address of second employee Princess Lane, Ottawa ON K7P Social Insurance Number 234567899 Bi weekly Pay Date Federal Tar Provincial Tau Year to date amount Pensionate CPP Insurable Earnings Ewing Max S5700 52.00 Max 954200 616 Cos Day CPP Netay Menningar) $23.84.00 $1.176.0 522.614.00 SO YA 12 00 S71 5009 52222 50.00 S11 52025 $21.12.21 $1,216.00 $2,71223 SIM -A20 5912.00 565.01 $10.00 54031 51441 SMO $24.624.23 $1,56' SHU SHOZ Name of 2nd employee Employee 2 Julie Hamm Address of second employee 9 Princess Lane, Ottawa ON KZP 93 Social Insurance Number 234 567 899 Year-to-date amounts Pensionable CPP Insurable Earnings Max Earnings Max Max 558700 $2,808,00 Mix $54200 S85636 3 weekly Pay Date Federal Tax Provincial Tax Gross Pay CPP Net Pay Beginning (Mar 31) $22,834.00 $1,176.98 $22.814.00 $360.78 12. Apr-20 $878 23 $60.29 $27.27 $39.04 $13.88 $737.75 $23,712.23 $1,216.02 $28,712.23 $37466 $24,624.23 $1,256.83' $24,624.23 $289.07 26-Apr-20 $912.00 $65.01 $30.89 $40.81 $14.41 $760.88