Question

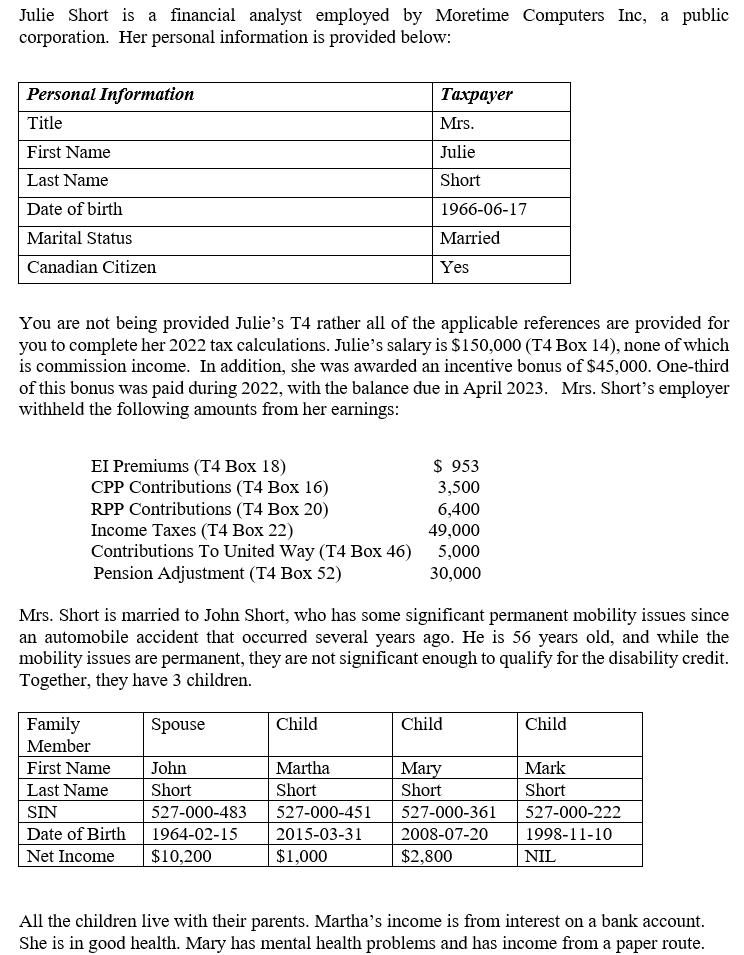

Julie Short is a financial analyst employed by Moretime Computers Inc, a public corporation. Her personal information is provided below: Personal Information Title First

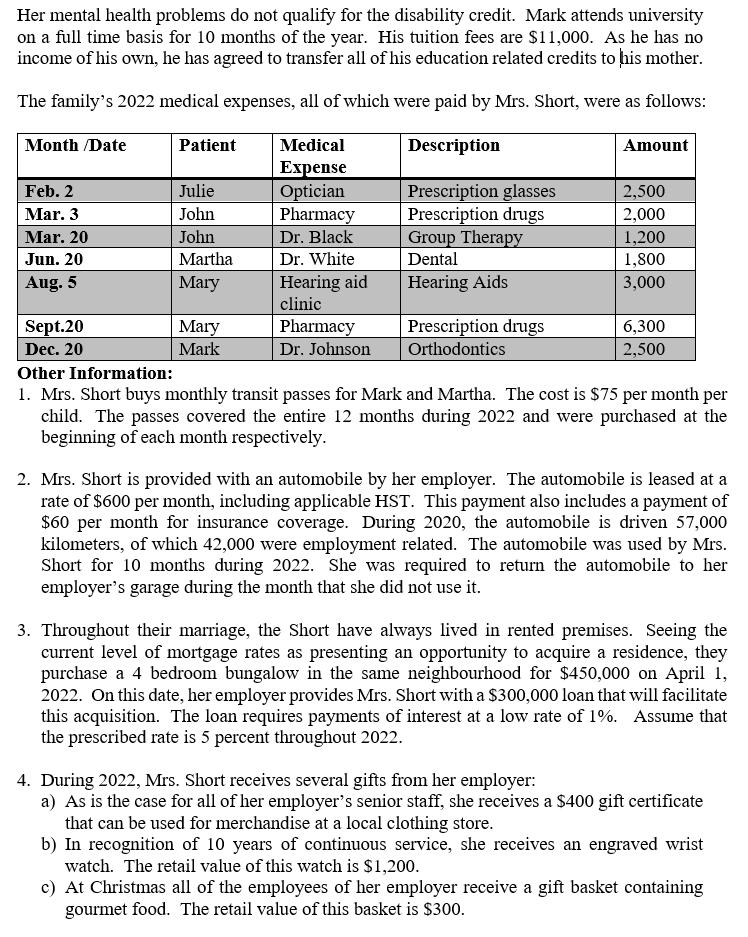

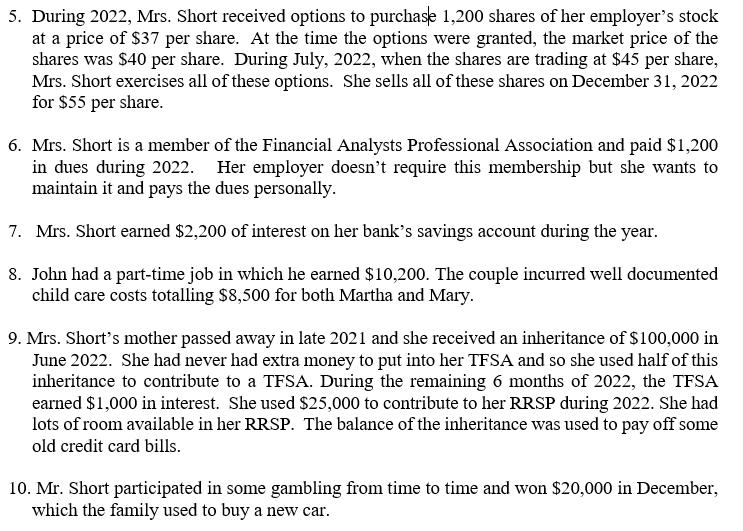

Julie Short is a financial analyst employed by Moretime Computers Inc, a public corporation. Her personal information is provided below: Personal Information Title First Name Last Name Date of birth Marital Status Canadian Citizen EI Premiums (T4 Box 18) CPP Contributions (T4 Box 16) RPP Contributions (T4 Box 20) Income Taxes (T4 Box 22) Contributions To United Way (T4 Box 46) Pension Adjustment (T4 Box 52) You are not being provided Julie's T4 rather all of the applicable references are provided for you to complete her 2022 tax calculations. Julie's salary is $150,000 (T4 Box 14), none of which is commission income. In addition, she was awarded an incentive bonus of $45,000. One-third of this bonus was paid during 2022, with the balance due in April 2023. Mrs. Short's employer withheld the following amounts from her earnings: Family Member First Name Last Name SIN Date of Birth Net Income Mrs. Short is married to John Short, who has some significant permanent mobility issues since an automobile accident that occurred several years ago. He is 56 years old, and while the mobility issues are permanent, they are not significant enough to qualify for the disability credit. Together, they have 3 children. Spouse John Short 527-000-483 1964-02-15 $10,200 Child Taxpayer Mrs. Julie Short Martha Short 1966-06-17 Married Yes 527-000-451 2015-03-31 $1,000 $ 953 3,500 6,400 49,000 5,000 30,000 Child Mary Short 527-000-361 2008-07-20 $2,800 Child Mark Short 527-000-222 1998-11-10 NIL All the children live with their parents. Martha's income is from interest on a bank account. She is in good health. Mary has mental health problems and has income from a paper route. Her mental health problems do not qualify for the disability credit. Mark attends university on a full time basis for 10 months of the year. His tuition fees are $11,000. As he has no income of his own, he has agreed to transfer all of his education related credits to his mother. The family's 2022 medical expenses, all of which were paid by Mrs. Short, were as follows: Description Prescription glasses Prescription drugs Month /Date Feb. 2 Mar. 3 Mar. 20 Jun. 20 Aug. 5 Sept.20 Dec. 20 Other Information: Patient Julie John John Martha Mary Mary Mark Medical Expense Optician Pharmacy Dr. Black Dr. White Hearing aid clinic Pharmacy Dr. Johnson Group Therapy Dental Hearing Aids Prescription drugs Orthodontics Amount 2,500 2,000 1,200 1,800 3,000 6,300 2,500 1. Mrs. Short buys monthly transit passes for Mark and Martha. The cost is $75 per month per child. The passes covered the entire 12 months during 2022 and were purchased at the beginning of each month respectively. 2. Mrs. Short is provided with an automobile by her employer. The automobile is leased at a rate of $600 per month, including applicable HST. This payment also includes a payment of $60 per month for insurance coverage. During 2020, the automobile is driven 57,000 kilometers, of which 42,000 were employment related. The automobile was used by Mrs. Short for 10 months during 2022. She was required to return the automobile to her employer's garage during the month that she did not use it. 3. Throughout their marriage, the Short have always lived in rented premises. Seeing the current level of mortgage rates as presenting an opportunity to acquire a residence, they purchase a 4 bedroom bungalow in the same neighbourhood for $450,000 on April 1, 2022. On this date, her employer provides Mrs. Short with a $300,000 loan that will facilitate this acquisition. The loan requires payments of interest at a low rate of 1%. Assume that the prescribed rate is 5 percent throughout 2022. 4. During 2022, Mrs. Short receives several gifts from her employer: a) As is the case for all of her employer's senior staff, she receives a $400 gift certificate that can be used for merchandise at a local clothing store. b) In recognition of 10 years of continuous service, she receives an engraved wrist watch. The retail value of this watch is $1,200. c) At Christmas all of the employees of her employer receive a gift basket containing gourmet food. The retail value of this basket is $300. 5. During 2022, Mrs. Short received options to purchase 1,200 shares of her employer's stock at a price of $37 per share. At the time the options were granted, the market price of the shares was $40 per share. During July, 2022, when the shares are trading at $45 per share, Mrs. Short exercises all of these options. She sells all of these shares on December 31, 2022 for $55 per share. 6. Mrs. Short is a member of the Financial Analysts Professional Association and paid $1,200 in dues during 2022. Her employer doesn't require this membership but she wants to maintain it and pays the dues personally. 7. Mrs. Short earned $2,200 of interest on her bank's savings account during the year. 8. John had a part-time job in which he earned $10,200. The couple incurred well documented child care costs totalling $8,500 for both Martha and Mary. 9. Mrs. Short's mother passed away in late 2021 and she received an inheritance of $100,000 in June 2022. She had never had extra money to put into her TFSA and so she used half of this inheritance to contribute to a TFSA. During the remaining 6 months of 2022, the TFSA earned $1,000 in interest. She used $25,000 to contribute to her RRSP during 2022. She had lots of room available in her RRSP. The balance of the inheritance was used to pay off some old credit card bills. 10. Mr. Short participated in some gambling from time to time and won $20,000 in December, which the family used to buy a new car.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets calculate Julie Shorts tax liability for the year 2022 using the information provided First wel...

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started