Question

Julie turned 70 on February 15, 2021. She receives $1,144.23 per year ($59,500 per year). What will you enter in her T4 for box 16,

Julie turned 70 on February 15, 2021. She receives $1,144.23 per year ($59,500 per year). What will you enter in her T4 for box 16, Employee’s CPP contributions?

2) Jen is paid $80,000 per annum. Jen is paid every other week. What should Jen’s take-home pay per pay period if she contributes $50 to charity, assuming income taxes are at 7.65% and other mandatory deductions are at $300?

3. Create a payroll remittance journal for Jen for December 2022 showing the total remittance to be made to CRA.

4. Ron’s company’s withholdings per month are $80,000. As a payroll admin, you must advise Ron about when to remit the monthly withholdings to CRA. Please, assist Ron by preparing a remitting schedule and remittance due to the date scheduled for January 2021.

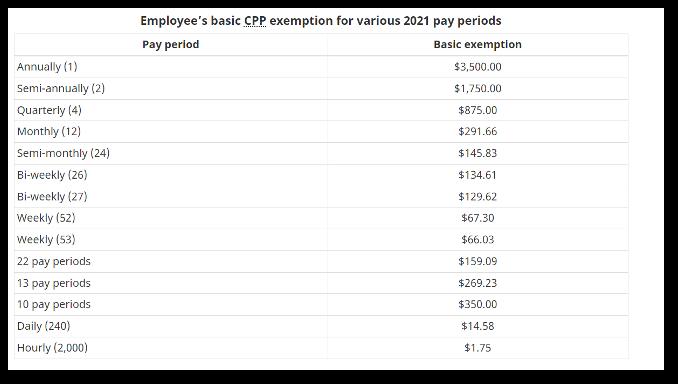

Annually (1) Semi-annually (2) Quarterly (4) Monthly (12) Semi-monthly (24) Bi-weekly (26) Bi-weekly (27) Weekly (52) Weekly (53) 22 pay periods 13 pay periods 10 pay periods Daily (240) Hourly (2,000) Employee's basic CPP exemption for various 2021 pay periods www Pay period Basic exemption $3,500.00 $1,750.00 $875.00 $291.66 $145.83 $134.61 $129.62 $67.30 $66.03 $159.09 $269.23 $350.00 $14.58 $1.75

Step by Step Solution

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

13500 Explanation What is the employees CPP contributions for the year The employees CPP contributio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started