Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Douglas Crane is the owner of Get'er Doug Excavating Co. (Get'er Doug) - a company that specializes in landscaping, rock walls, block walls and

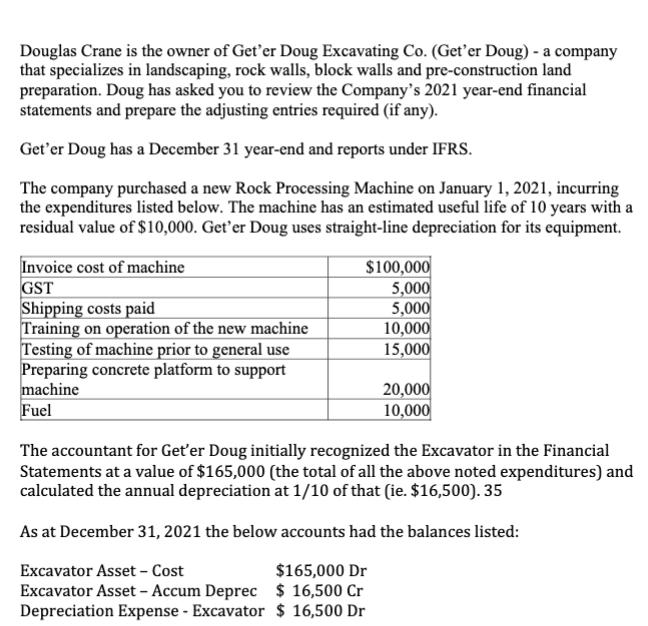

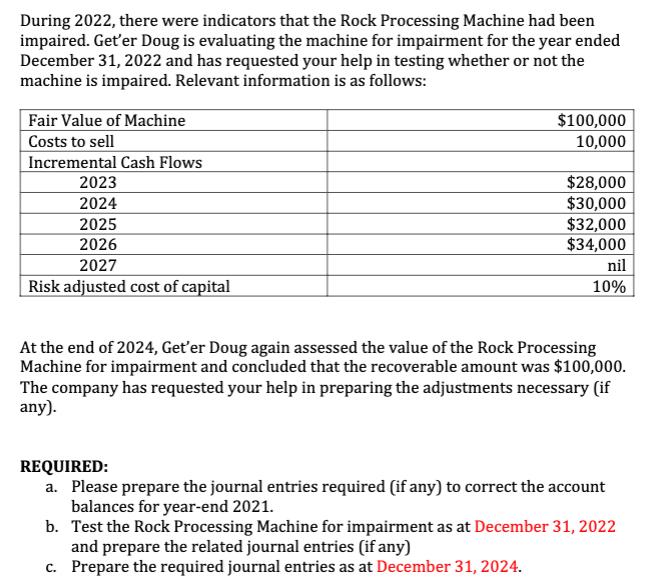

Douglas Crane is the owner of Get'er Doug Excavating Co. (Get'er Doug) - a company that specializes in landscaping, rock walls, block walls and pre-construction land preparation. Doug has asked you to review the Company's 2021 year-end financial statements and prepare the adjusting entries required (if any). Get'er Doug has a December 31 year-end and reports under IFRS. The company purchased a new Rock Processing Machine on January 1, 2021, incurring the expenditures listed below. The machine has an estimated useful life of 10 years with a residual value of $10,000. Get'er Doug uses straight-line depreciation for its equipment. Invoice cost of machine GST Shipping costs paid Training on operation of the new machine Testing of machine prior to general use Preparing concrete platform to support machine Fuel $100,000 5,000 5,000 10,000 15,000 20,000 10,000 The accountant for Get'er Doug initially recognized the Excavator in the Financial Statements at a value of $165,000 (the total of all the above noted expenditures) and calculated the annual depreciation at 1/10 of that (ie. $16,500). 35 As at December 31, 2021 the below accounts had the balances listed: Excavator Asset - Cost $165,000 Dr $ 16,500 Cr Excavator Asset - Accum Deprec Depreciation Expense - Excavator $ 16,500 Dr During 2022, there were indicators that the Rock Processing Machine had been impaired. Get'er Doug is evaluating the machine for impairment for the year ended December 31, 2022 and has requested your help in testing whether or not the machine is impaired. Relevant information is as follows: Fair Value of Machine Costs to sell Incremental Cash Flows 2023 2024 2025 2026 2027 Risk adjusted cost of capital $100,000 10,000 $28,000 $30,000 $32,000 $34,000 nil 10% At the end of 2024, Get'er Doug again assessed the value of the Rock Processing Machine for impairment and concluded that the recoverable amount was $100,000. The company has requested your help in preparing the adjustments necessary (if any). REQUIRED: a. Please prepare the journal entries required (if any) to correct the account balances for year-end 2021. b. Test the Rock Processing Machine for impairment as at December 31, 2022 and prepare the related journal entries (if any) c. Prepare the required journal entries as at December 31, 2024.

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a Total Cost 165000 Salvage Value 10000 Depreciation 1650001000010 15500 Correction Entry Excavator ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started