Answered step by step

Verified Expert Solution

Question

1 Approved Answer

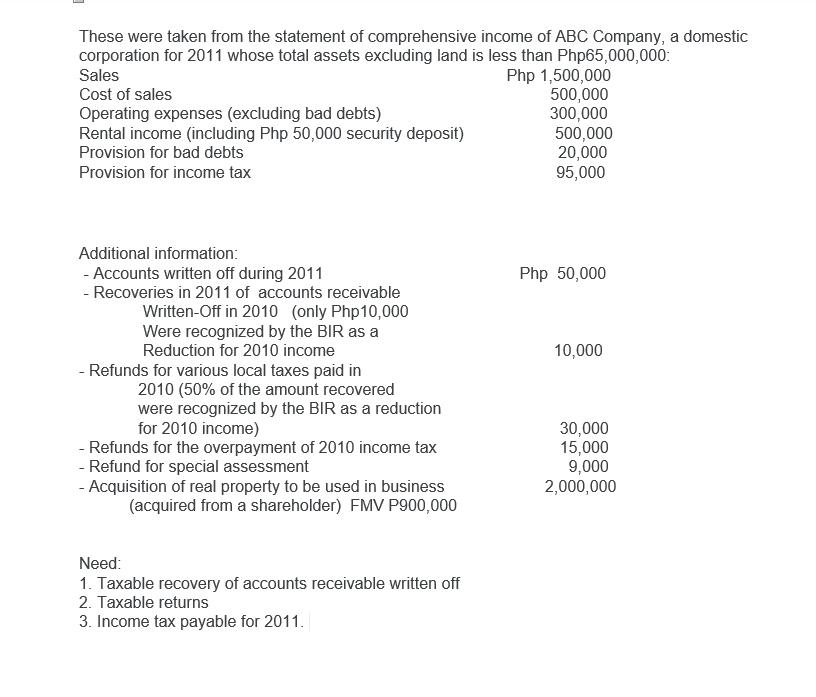

These were taken from the statement of comprehensive income of ABC Company, a domestic corporation for 2011 whose total assets excluding land is less

These were taken from the statement of comprehensive income of ABC Company, a domestic corporation for 2011 whose total assets excluding land is less than Php65,000,000: Sales Cost of sales Operating expenses (excluding bad debts) Rental income (including Php 50,000 security deposit) Provision for bad debts Provision for income tax Additional information: - Accounts written off during 2011 - Recoveries in 2011 of accounts receivable Written-Off in 2010 (only Php10,000 Were recognized by the BIR as a Reduction for 2010 income - Refunds for various local taxes paid in 2010 (50% of the amount recovered were recognized by the BIR as a reduction for 2010 income) - Refunds for the overpayment of 2010 income tax - Refund for special assessment - Acquisition of real property to be used in business (acquired from a shareholder) FMV P900,000 Need: 1. Taxable recovery of accounts receivable written off 2. Taxable returns 3. Income tax payable for 2011. Php 1,500,000 500,000 300,000 500,000 20,000 95,000 Php 50,000 10,000 30,000 15,000 9,000 2,000,000

Step by Step Solution

★★★★★

3.33 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 Bad debt recovered shall be taxable only to the extent deducted earlier In the given case P...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started