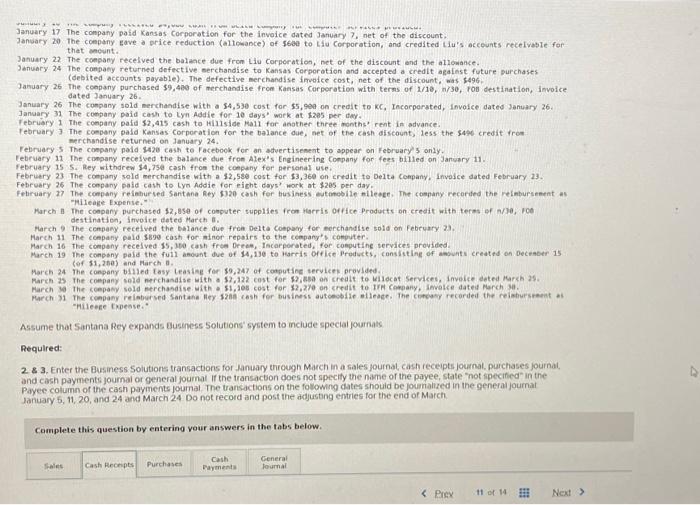

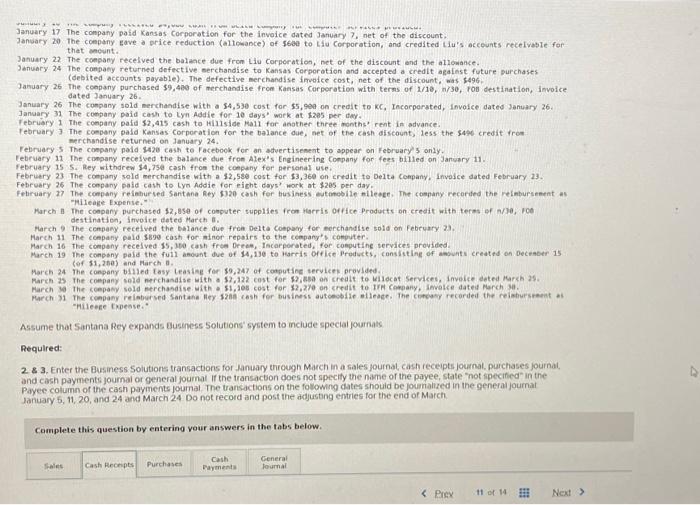

Julluut y JU The company ILLLIVLU *T, VOU LUCI ULILY LUMpuny IME CAMPULLI JLI VALLS POUVE January 17 The company paid Kansas Corporation for the invoice dated January 7, net of the discount. January 20 The company gave a price reduction (allowance) of $600 to Liu Corporation, and credited Liu's accounts receivable for that amount. January 22 The company received the balance due from Liu Corporation, net of the discount and the allowance. January 24 The company returned defective merchandise to Kansas Corporation and accepted a credit against future purchases (debited accounts payable). The defective merchandise invoice cost, net of the discount, was $496. January 26 The company purchased $9,400 of merchandise from Kansas Corporation with terms of 1/10, n/30, FOB destination, invoice dated January 26. January 26 The company sold merchandise with a $4,530 cost for $5,900 on credit to KC, Incorporated, invoice dated January 26. January 31 The company paid cash to Lyn Addie for 10 days' work at $205 per day. February 1 The company paid $2,415 cash to Hillside Mall for another three months' rent in advance. February 3 The company paid Kansas Corporation for the balance due, net of the cash discount, less the $496 credit from merchandise returned on January 24. February 5 The company paid $420 cash to Facebook for an advertisement to appear on February 5 only. February 11 The company received the balance due from Alex's Engineering Company for fees billed on January 11. February 15 S. Rey withdrew $4,750 cash from the company for personal use. February 23 The company sold merchandise with a $2,580 cost for $3,360 on credit to Delta Company, invoice dated February 23. February 26 The company paid cash to Lyn Addie for eight days' work at $205 per day. February 27 The company reimbursed Santana Rey $320 cash for business automobile mileage. The company recorded the reimbursement as "Mileage Expense."** March 8 The company purchased $2,850 of computer supplies from Harris Office Products on credit with terms of n/30, FOB destination, invoice dated March 8. March 9 The company received the balance due from Delta Company for merchandise sold on February 23. March 11 The company paid $890 cash for minor repairs to the company's computer. March 16 The company received $5,380 cash from Dream, Incorporated, for computing services provided. March 19 The company paid the full amount (of $1,280) and March 8. March 24 The company billed Easy Leasing for $9,247 of computing services provided. March 25 The company sold merchandise with a $2,122 cost for $2,880 on credit to Wildcat Services, invoice dated March 25. March 30 The company sold merchandise with a $1,108 cost for $2,270 on credit to IFM Company, invoice dated March 30. March 31 The company reimbursed Santana Rey $288 cash for business automobile mileage. The company recorded the reimbursement as "Mileage Expense." Assume that Santana Rey expands Business Solutions' system to include special Journals. Required: 2. & 3. Enter the Business Solutions transactions for January through March In a sales Journal, cash receipts Journal, purchases Journal, and cash payments Journal or general Journal. If the transaction does not specify the name of the payee, state "not specified" in the Payee column of the cash payments Journal. The transactions on the following dates should be Journalized in the general Journal: January 5, 11, 20, and 24 and March 24. Do not record and post the adjusting entries for the end of March. Complete this question by entering your answers in the tabs below. Sales due of $4,13 due of $4,130 to Harris Office Products, consisting of amounts created on December 15 Cash Receipts Purchases Cash Payments General Journal

January 17 The company paid Kansas Corporation for the invoice dated January 7 , net of the discount. Jansary 20 the conpany gave a price reduction (allowance) of s6ae to Liu Corporation, and credited ilu's acceunts recelvable foe that anownt. January 22 The compacy recelved the balance due fron liu Corporation, net of the discount and the allowance. January 24 The conpaey returned defective nerchandise to Kansas Corporation and accepted a credit against. future purchases (delited accounts payable). The defective serchandise imudce cost, net of the discount, was s496. January 26 The coepany purchased $9,400 of menchandise fron Kansas Corporation with terns of 1/10, nis30, ros destination, invoice dated January 26. January 26 The conpany sold merchandise with a 54,530 cost for 55 , 9ea on credit to kC, Incorporated, Involee dated 3anuary 26 . January 31 The conpany paid cash to Lyn Addie for 10 days" work at 1205 per dwy. Tebriaty 1 The coepany paid 52 ,415 cash to Minside Nall for another three months' rent in advance. Vebruary 3 The coepany pald Kansas Corporation for the balance due, net of the cash discount, less the 3490 credit from merchandise returned on lanuary 24 . rebruary 5 . The coepany pald 3420 cash to Facebook for an aduertisenent to appear on February' 3 only. Rebruary 11 the conpany recelved the balance due from Alex's Engineering Conpany for fees billed on Jartuary 11. february 15 5. Rey withdrew 34,75 cash fron the coepaby for perianal use. Febriery 23 The conpany sold merchandise with a 12,550 cost for $3,360 on credit to Delta company. Involce dated February 23 . February 26 The coepany paid cath to Lyn Addie for eicht days? work at 3205 per day. February 27 The company reinburued Santana Rey 5120 cash for business eutonebile nlieoge, The coepany: recorded the reinbursement as "aileage Expense." March B The coepany purchased 12, Bse of computer supplies fron harris office Products on creait with terns bf alle, roe destination, invoice deted March i. Parch 9 The company recelved the balance due fron Delte comphy for ecrchandise sold on febcuary 23. Harch 11 the conpany pald 3890 cash for minor repairs to the coepary's conputer. March 16 the conpony recelyed 15 , Me0 cash free orece, Incarporated, for conputine services provided. March 19 The compeny paid the full anount due of 14,130 to larris orfice Products, consintling of anownts created on Deceaber 15 (ef 31,260) and Farch 1. March 24 the conpany billed lasy leasiae for 59,247 of cotputine services provided. Mares 25 the coepany sold merchanaise with a 57,122 cost for 97 , wea on crealt to kilocat Services, inveice deted Markb a9. March sa the coepany sold nerchasdise. With o 51,108 cost for $2,27, on credit to lrh Company, invelie dated Parch.3a. "hileere Erpease." Assume that Santana Rey expands Busthess Solutions' sybtem to meiude speciai foumats Requlred: 2. \& 3. Enter the Business Solutions transactions for January through March in a fiales journat, cash receipts journal, purchases journal, and cash payments joumal or general joumal If the transacbon does not specify the name of the payee, state "not ipecified" in the Payee column of the cash payments joumal. The transactions on the fotowne dates shouid be jouiralized in the general journat January 5,11,20, and 24 and March 24 . Do not record and post the adjusteng entries for the end of March. Complete this question by entering vour answers in the tabs below. January 17 The company paid Kansas Corporation for the invoice dated January 7 , net of the discount. Jansary 20 the conpany gave a price reduction (allowance) of s6ae to Liu Corporation, and credited ilu's acceunts recelvable foe that anownt. January 22 The compacy recelved the balance due fron liu Corporation, net of the discount and the allowance. January 24 The conpaey returned defective nerchandise to Kansas Corporation and accepted a credit against. future purchases (delited accounts payable). The defective serchandise imudce cost, net of the discount, was s496. January 26 The coepany purchased $9,400 of menchandise fron Kansas Corporation with terns of 1/10, nis30, ros destination, invoice dated January 26. January 26 The conpany sold merchandise with a 54,530 cost for 55 , 9ea on credit to kC, Incorporated, Involee dated 3anuary 26 . January 31 The conpany paid cash to Lyn Addie for 10 days" work at 1205 per dwy. Tebriaty 1 The coepany paid 52 ,415 cash to Minside Nall for another three months' rent in advance. Vebruary 3 The coepany pald Kansas Corporation for the balance due, net of the cash discount, less the 3490 credit from merchandise returned on lanuary 24 . rebruary 5 . The coepany pald 3420 cash to Facebook for an aduertisenent to appear on February' 3 only. Rebruary 11 the conpany recelved the balance due from Alex's Engineering Conpany for fees billed on Jartuary 11. february 15 5. Rey withdrew 34,75 cash fron the coepaby for perianal use. Febriery 23 The conpany sold merchandise with a 12,550 cost for $3,360 on credit to Delta company. Involce dated February 23 . February 26 The coepany paid cath to Lyn Addie for eicht days? work at 3205 per day. February 27 The company reinburued Santana Rey 5120 cash for business eutonebile nlieoge, The coepany: recorded the reinbursement as "aileage Expense." March B The coepany purchased 12, Bse of computer supplies fron harris office Products on creait with terns bf alle, roe destination, invoice deted March i. Parch 9 The company recelved the balance due fron Delte comphy for ecrchandise sold on febcuary 23. Harch 11 the conpany pald 3890 cash for minor repairs to the coepary's conputer. March 16 the conpony recelyed 15 , Me0 cash free orece, Incarporated, for conputine services provided. March 19 The compeny paid the full anount due of 14,130 to larris orfice Products, consintling of anownts created on Deceaber 15 (ef 31,260) and Farch 1. March 24 the conpany billed lasy leasiae for 59,247 of cotputine services provided. Mares 25 the coepany sold merchanaise with a 57,122 cost for 97 , wea on crealt to kilocat Services, inveice deted Markb a9. March sa the coepany sold nerchasdise. With o 51,108 cost for $2,27, on credit to lrh Company, invelie dated Parch.3a. "hileere Erpease." Assume that Santana Rey expands Busthess Solutions' sybtem to meiude speciai foumats Requlred: 2. \& 3. Enter the Business Solutions transactions for January through March in a fiales journat, cash receipts journal, purchases journal, and cash payments joumal or general joumal If the transacbon does not specify the name of the payee, state "not ipecified" in the Payee column of the cash payments joumal. The transactions on the fotowne dates shouid be jouiralized in the general journat January 5,11,20, and 24 and March 24 . Do not record and post the adjusteng entries for the end of March. Complete this question by entering vour answers in the tabs below