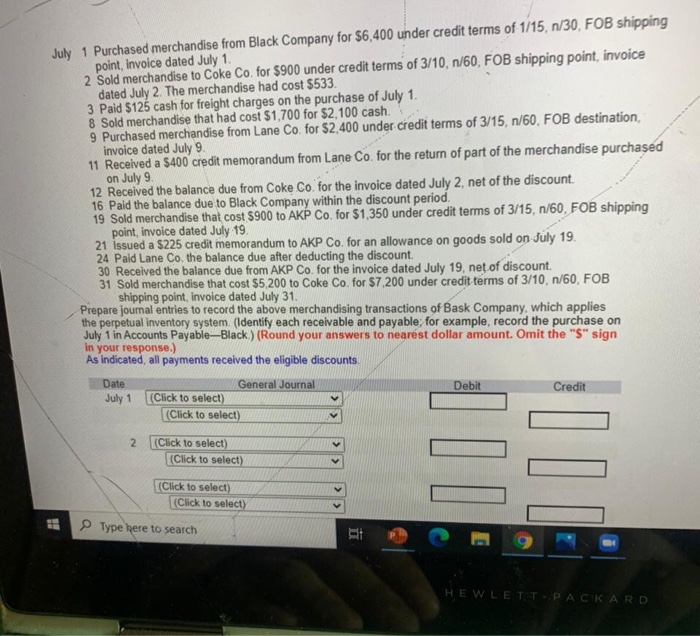

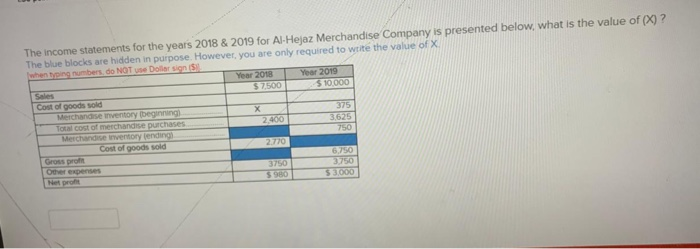

July 1 Purchased merchandise from Black Company for $6,400 under credit terms of 1/15, n/30, FOB shipping point, invoice dated July 1. 2 Sold merchandise to Coke Co. for $900 under credit terms of 3/10, 1/60, FOB shipping point, invoice dated July 2. The merchandise had cost $533. 3 Paid $125 cash for freight charges on the purchase of July 1. 8 Sold merchandise that had cost $1,700 for $2,100 cash. 9 Purchased merchandise from Lane Co. for $2,400 under credit terms of 3/15, n/60, FOB destination, invoice dated July 9. 11 Received a $400 credit memorandum from Lane Co. for the return of part of the merchandise purchased on July 9. 12 Received the balance due from Coke Co. for the invoice dated July 2, net of the discount. 16 Paid the balance due to Black Company within the discount period. 19 Sold merchandise that cost $900 to AKP Co. for $1,350 under credit terms of 3/15, 1/60. FOB shipping point, invoice dated July 19 21 issued a 5225 credit memorandum to AKP Co. for an allowance on goods sold on July 19. 24 Paid Lane Co the balance due after deducting the discount 30 Received the balance due from AKP Co. for the invoice dated July 19, net of discount. 31 Sold merchandise that cost $5,200 to Coke Co. for $7.200 under credit terms of 3/10, 1/60, FOB shipping point, invoice dated July 31. Prepare journal entries to record the above merchandising transactions of Bask Company, which applies the perpetual inventory system (Identify each receivable and payable, for example, record the purchase on July 1 in Accounts PayableBlack) (Round your answers to nearest dollar amount. Omit the "S" sign in your response.) As indicated, all payments received the eligible discounts General Journal July 1 (Click to select) Credit Click to select) Date Debit 2 (Click to select) (Click to select) (Click to select) (Click to select) Type here to search BE HEWLETT-PACKARD The income statements for the years 2018 & 2019 for Al Hejaz Merchandise Company is presented below, what is the value of (x)? The blue blocks are hidden in purpose. However, you are only required to write the value of X when ping numbers do NOT US Dollar sign 15 Year 2018 Year 2019 Sales $7500 $10.000 Cost of goods sold Merchandise inventory beginning X Total cost of merchandise purchases 37625 Merchandise inventory ending 750 Cost of goods sold 2770 Gross proti 690 Other expenses 3750 3750 Netpro S90 53000