Answered step by step

Verified Expert Solution

Question

1 Approved Answer

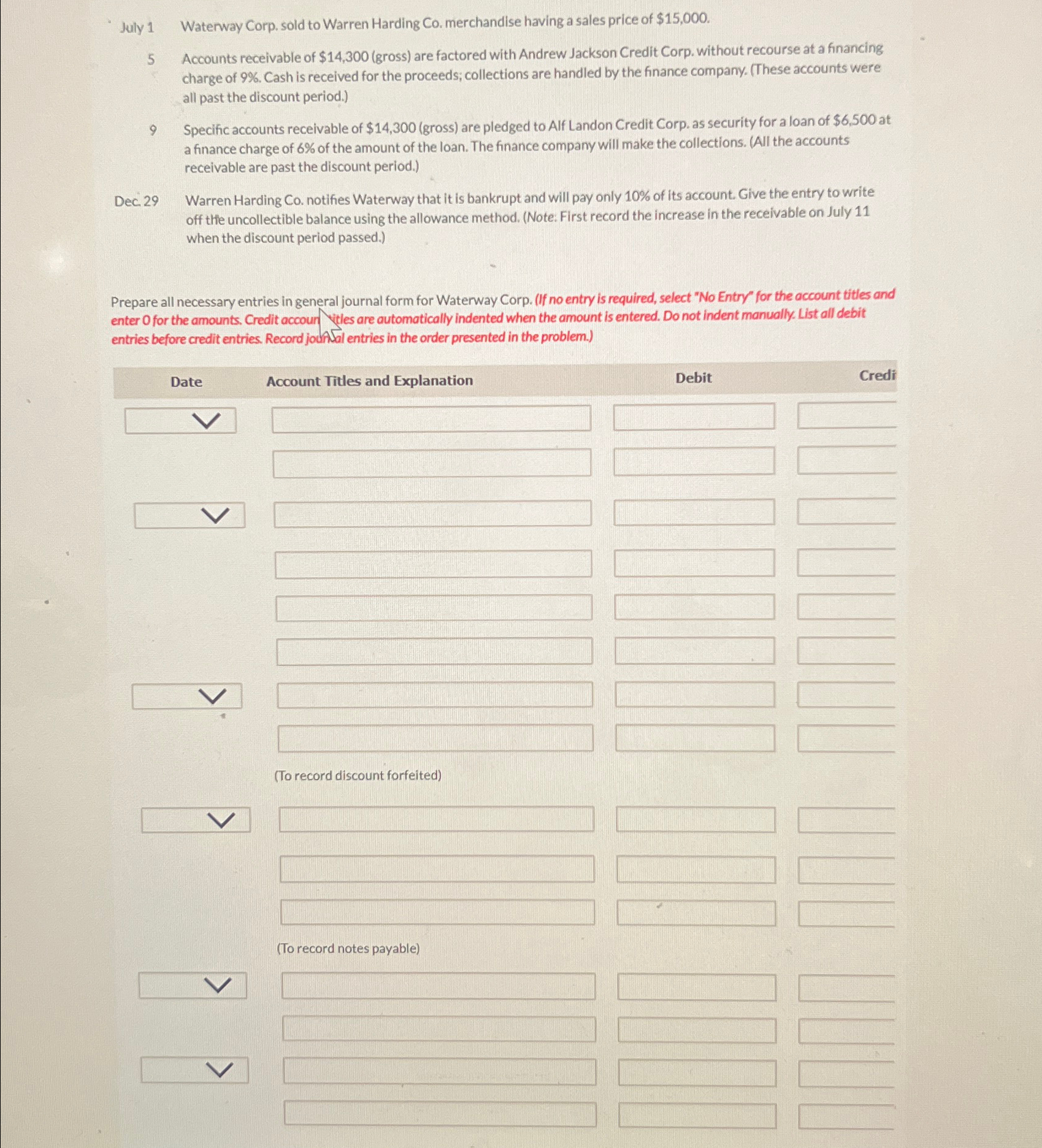

July 1 Waterway Corp. sold to Warren Harding Co . merchandise having a sales price of $ 1 5 , 0 0 0 . 5

July Waterway Corp. sold to Warren Harding Co merchandise having a sales price of $

Accounts receivable of $gross are factored with Andrew Jackson Credit Corp. without recourse at a financing charge of Cash is received for the proceeds; collections are handled by the finance company. These accounts were all past the discount period.

Specific accounts receivable of $gross are pledged to Alf Landon Credit Corp. as security for a loan of $ at a finance charge of of the amount of the loan. The finance company will make the collections. All the accounts receivable are past the discount period.

Dec. Warren Harding Co notifies Waterway that it is bankrupt and will pay only of its account. Give the entry to write off the uncollectible balance using the allowance method. Note: First record the increase in the receivable on July when the discount period passed.

Prepare all necessary entries in general journal form for Waterway Corp. If no entry is required, select No Entry" for the account titles and enter for the amounts. Credit accour yitles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. Record jodalal entries in the order presented in the problem.

Date

Account Titles and Explanation

Debit

Credi

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started