Answered step by step

Verified Expert Solution

Question

1 Approved Answer

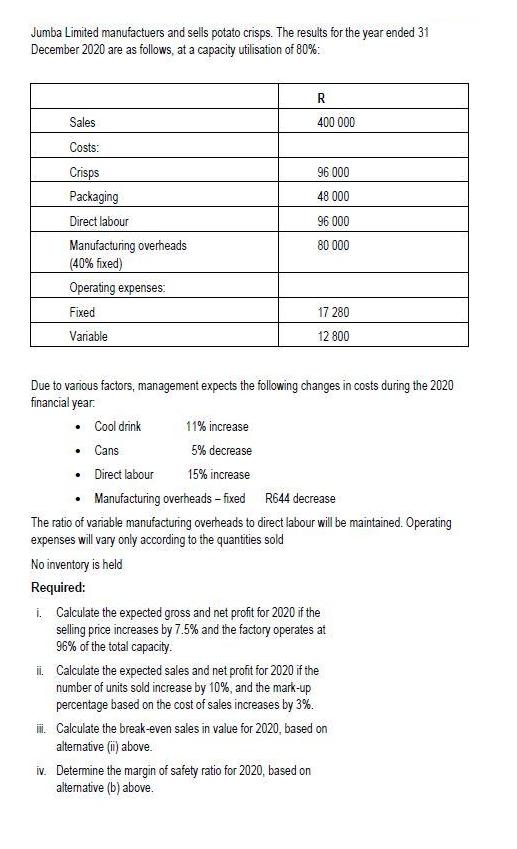

Jumba Limited manufactuers and sells potato crisps. The results for the year ended 31 December 2020 are as follows, at a capacity utilisation of

Jumba Limited manufactuers and sells potato crisps. The results for the year ended 31 December 2020 are as follows, at a capacity utilisation of 80%: R Sales 400 000 Costs: Crisps 96.000 Packaging 48 000 Direct labour 96 000 Manufacturing overheads 80 000 (40% fixed) Operating expenses: Fixed 17 280 Variable 12 800 Due to various factors, management expects the following changes in costs during the 2020 financial year. Cool drink 11% increase Cans 5% decrease Direct labour 15% increase Manufacturing overheads - fixed R644 decrease The ratio of variable manufacturing overheads to direct labour will be maintained. Operating expenses will vary only according to the quantities sold No inventory is held Required: i. Calculate the expected gross and net profit for 2020 if the selling price increases by 7.5% and the factory operates at 96% of the total capacity. ii. Calculate the expected sales and net profit for 2020 if the number of units sold increase by 10%, and the mark-up percentage based on the cost of sales increases by 3%. iii. Calculate the break-even sales in value for 2020, based on alternative (ii) above. iv. Determine the margin of safety ratio for 2020, based on alternative (b) above.

Step by Step Solution

★★★★★

3.28 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

1 Sales Costs Crisps Packaging Direct labour Manufa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started