Answered step by step

Verified Expert Solution

Question

1 Approved Answer

June 1,2018 Mr. Tee deposited P 500, 000 in BDO in the name of the business Tee Supply Company. 2 Bought a computer on account

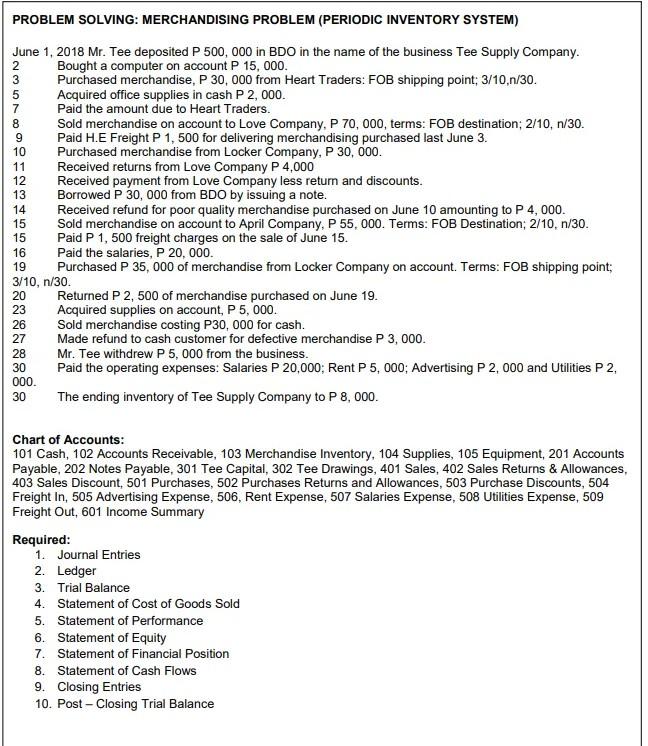

June 1,2018 Mr. Tee deposited P 500, 000 in BDO in the name of the business Tee Supply Company. 2 Bought a computer on account P 15, 000. Purchased merchandise, P 30, 000 from Heart Traders: FOB shipping point; 3/10,n/30. Acquired office supplies in cash P 2, 000 . Paid the amount due to Heart Traders. Sold merchandise on account to Love Company, P 70, 000, terms: FOB destination; 2/10, n/30. Paid H.E Freight P 1, 500 for delivering merchandising purchased last June 3. Purchased merchandise from Locker Company, P 30, 000. Received returns from Love Company P 4,000 Received payment from Love Company less retum and discounts. Borrowed \\( \\mathrm{P} 30,000 \\) from BDO by issuing a note. Received refund for poor quality merchandise purchased on June 10 amounting to \\( P 4,000 \\). Sold merchandise on account to April Company, P 55, 000. Terms: FOB Destination; 2/10, n/30. Paid P 1, 500 freight charges on the sale of June 15. Paid the salaries, P 20, 000 . Purchased P 35, 000 of merchandise from Locker Company on account. Terms: FOB shipping point; 19 Pur \\( 3 / 10, \\mathrm{n} / 30 \\). 20 Returned P 2, 500 of merchandise purchased on June 19. 23 Acquired supplies on account, P 5, 000. 26 Sold merchandise costing P30, 000 for cash. 27 Made refund to cash customer for defective merchandise P 3,000. 28 Mr. Tee withdrew P 5, 000 from the business. 30 Paid the operating expenses: Salaries P 20,000; Rent P 5,000; Advertising P 2, 000 and Utilities P 2, 000 . 30 The ending inventory of Tee Supply Company to \\( P 8,000 \\). Chart of Accounts: 101 Cash, 102 Accounts Receivable, 103 Merchandise Inventory, 104 Supplies, 105 Equipment, 201 Accounts Payable, 202 Notes Payable, 301 Tee Capital, 302 Tee Drawings, 401 Sales, 402 Sales Returns \\& Allowances, 403 Sales Discount, 501 Purchases, 502 Purchases Returns and Allowances, 503 Purchase Discounts, 504 Freight In, 505 Advertising Expense, 506, Rent Expense, 507 Salaries Expense, 508 Utilities Expense, 509 Freight Out, 601 Income Summary Required: 1. Journal Entries 2. Ledger 3. Trial Balance 4. Statement of Cost of Goods Sold 5. Statement of Performance 6. Statement of Equity 7. Statement of Financial Position 8. Statement of Cash Flows 9. Closing Entries 10. Post - Closing Trial Balance June 1,2018 Mr. Tee deposited P 500, 000 in BDO in the name of the business Tee Supply Company. 2 Bought a computer on account P 15, 000. Purchased merchandise, P 30, 000 from Heart Traders: FOB shipping point; 3/10,n/30. Acquired office supplies in cash P 2, 000 . Paid the amount due to Heart Traders. Sold merchandise on account to Love Company, P 70, 000, terms: FOB destination; 2/10, n/30. Paid H.E Freight P 1, 500 for delivering merchandising purchased last June 3. Purchased merchandise from Locker Company, P 30, 000. Received returns from Love Company P 4,000 Received payment from Love Company less retum and discounts. Borrowed \\( \\mathrm{P} 30,000 \\) from BDO by issuing a note. Received refund for poor quality merchandise purchased on June 10 amounting to \\( P 4,000 \\). Sold merchandise on account to April Company, P 55, 000. Terms: FOB Destination; 2/10, n/30. Paid P 1, 500 freight charges on the sale of June 15. Paid the salaries, P 20, 000 . Purchased P 35, 000 of merchandise from Locker Company on account. Terms: FOB shipping point; 19 Pur \\( 3 / 10, \\mathrm{n} / 30 \\). 20 Returned P 2, 500 of merchandise purchased on June 19. 23 Acquired supplies on account, P 5, 000. 26 Sold merchandise costing P30, 000 for cash. 27 Made refund to cash customer for defective merchandise P 3,000. 28 Mr. Tee withdrew P 5, 000 from the business. 30 Paid the operating expenses: Salaries P 20,000; Rent P 5,000; Advertising P 2, 000 and Utilities P 2, 000 . 30 The ending inventory of Tee Supply Company to \\( P 8,000 \\). Chart of Accounts: 101 Cash, 102 Accounts Receivable, 103 Merchandise Inventory, 104 Supplies, 105 Equipment, 201 Accounts Payable, 202 Notes Payable, 301 Tee Capital, 302 Tee Drawings, 401 Sales, 402 Sales Returns \\& Allowances, 403 Sales Discount, 501 Purchases, 502 Purchases Returns and Allowances, 503 Purchase Discounts, 504 Freight In, 505 Advertising Expense, 506, Rent Expense, 507 Salaries Expense, 508 Utilities Expense, 509 Freight Out, 601 Income Summary Required: 1. Journal Entries 2. Ledger 3. Trial Balance 4. Statement of Cost of Goods Sold 5. Statement of Performance 6. Statement of Equity 7. Statement of Financial Position 8. Statement of Cash Flows 9. Closing Entries 10. Post - Closing Trial Balance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started