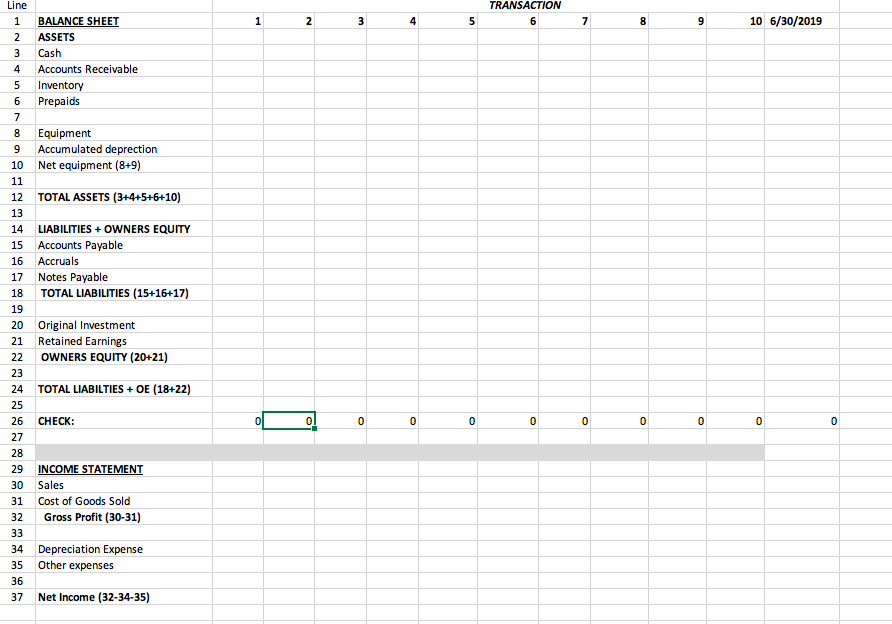

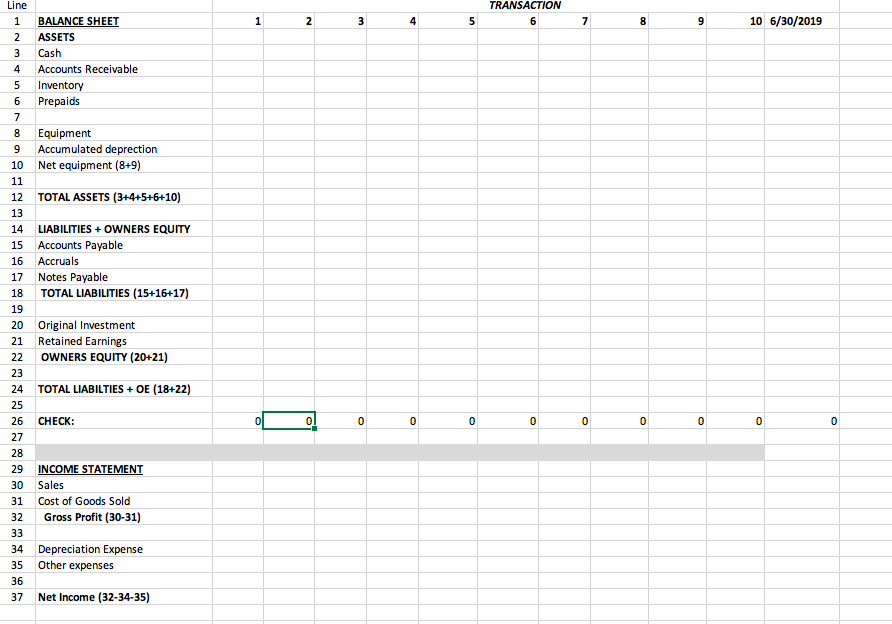

June 2, 2019 1. Invest $75,000 of your own cash in the business and take out a $60,000 five year loan. The loan features a "balloon" payment meaning you don't repay any principle until the end of the term. The annual interest rate is 10%. 2. Prepay $14,400 in cash for one year of rent. June 3, 2019 3. Pay $42,000 cash for an oven. The oven has a 7 year depreciable life. June 4, 2019 4. You pay $1,800 cash for inventory. a. You estimate that this amount of inventory can make 600 pizzas. 5. You pre-sell for cash 50 pizzas for a corporate party later in the month (this was before the pandemic). You are charging the customer $15 per pizza. June 5 - 29, 2019 6. During the month you sell 475 pizzas for $15 each, for cash. 7. As your inventory is running low you buy $1,800 more of inventory but this time you buy it on credit (you don't have to pay for 30 days) 8. You deliver the pizzas to the corporate party. June 30, 2019 9. Record rent and depreciation expenses for the month. 10. Make a cash payment for your monthly interest on the loan. 11. Prepare June 30 Balance Sheet and January Income Statements TRANSACTION 6 1 2 3 4 5 7 8 9 10 6/30/2019 Line 1 BALANCE SHEET 2 ASSETS 3 Cash 4 Accounts Receivable 5 Inventory 6 Prepaids 7 8 Equipment 9 Accumulated deprection 10 Net equipment (8+9) 11 12 TOTAL ASSETS (3+4+5+6+10) 13 14 LIABILITIES + OWNERS EQUITY 15 Accounts Payable 16 Accruals 17 Notes Payable 18 TOTAL LIABILITIES (15+16+17) 19 20 Original Investment 21 Retained Earnings 22 OWNERS EQUITY (20+21) 23 24 TOTAL LIABILTIES + OE (18+22) 25 26 CHECK: 27 28 29 INCOME STATEMENT 30 Sales 31 Cost of Goods Sold 32 Gross Profit (30-31) 33 34 Depreciation Expense 35 Other expenses 36 37 Net Income (32-34-35) 0 0 0 0 0 0 0 0 0 0 0 June 2, 2019 1. Invest $75,000 of your own cash in the business and take out a $60,000 five year loan. The loan features a "balloon" payment meaning you don't repay any principle until the end of the term. The annual interest rate is 10%. 2. Prepay $14,400 in cash for one year of rent. June 3, 2019 3. Pay $42,000 cash for an oven. The oven has a 7 year depreciable life. June 4, 2019 4. You pay $1,800 cash for inventory. a. You estimate that this amount of inventory can make 600 pizzas. 5. You pre-sell for cash 50 pizzas for a corporate party later in the month (this was before the pandemic). You are charging the customer $15 per pizza. June 5 - 29, 2019 6. During the month you sell 475 pizzas for $15 each, for cash. 7. As your inventory is running low you buy $1,800 more of inventory but this time you buy it on credit (you don't have to pay for 30 days) 8. You deliver the pizzas to the corporate party. June 30, 2019 9. Record rent and depreciation expenses for the month. 10. Make a cash payment for your monthly interest on the loan. 11. Prepare June 30 Balance Sheet and January Income Statements TRANSACTION 6 1 2 3 4 5 7 8 9 10 6/30/2019 Line 1 BALANCE SHEET 2 ASSETS 3 Cash 4 Accounts Receivable 5 Inventory 6 Prepaids 7 8 Equipment 9 Accumulated deprection 10 Net equipment (8+9) 11 12 TOTAL ASSETS (3+4+5+6+10) 13 14 LIABILITIES + OWNERS EQUITY 15 Accounts Payable 16 Accruals 17 Notes Payable 18 TOTAL LIABILITIES (15+16+17) 19 20 Original Investment 21 Retained Earnings 22 OWNERS EQUITY (20+21) 23 24 TOTAL LIABILTIES + OE (18+22) 25 26 CHECK: 27 28 29 INCOME STATEMENT 30 Sales 31 Cost of Goods Sold 32 Gross Profit (30-31) 33 34 Depreciation Expense 35 Other expenses 36 37 Net Income (32-34-35) 0 0 0 0 0 0 0 0 0 0 0