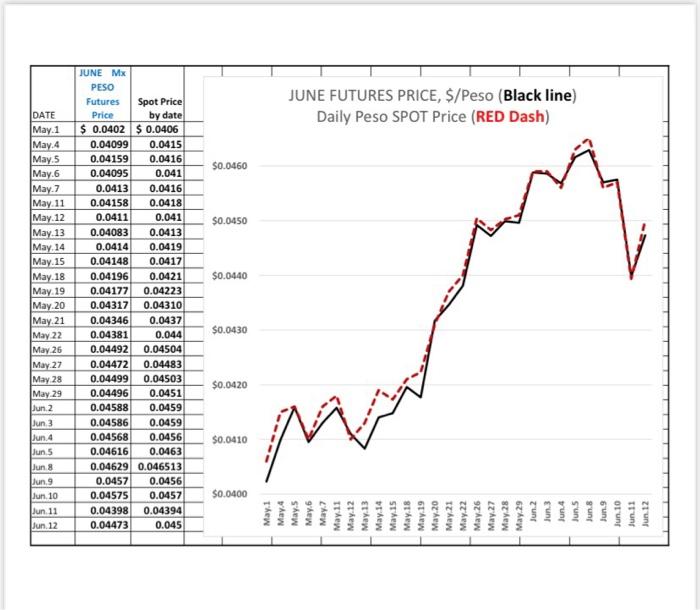

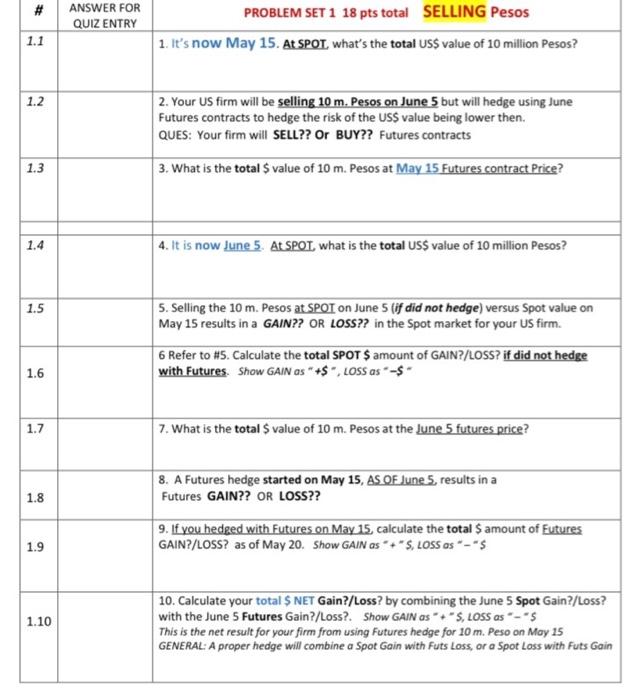

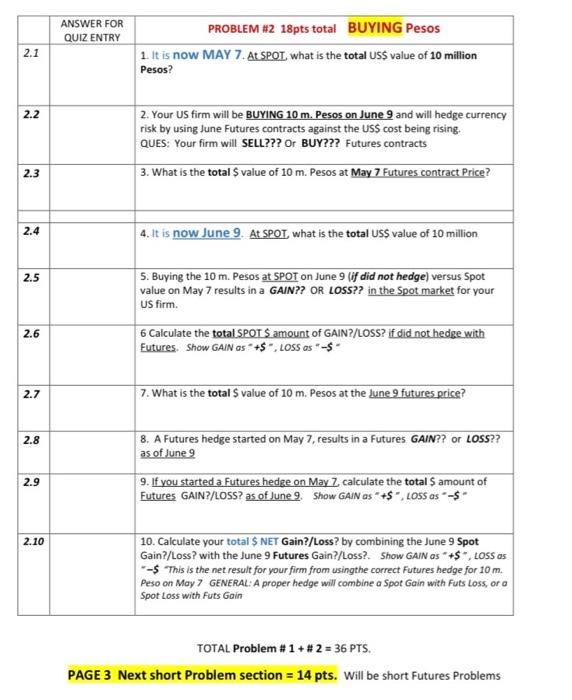

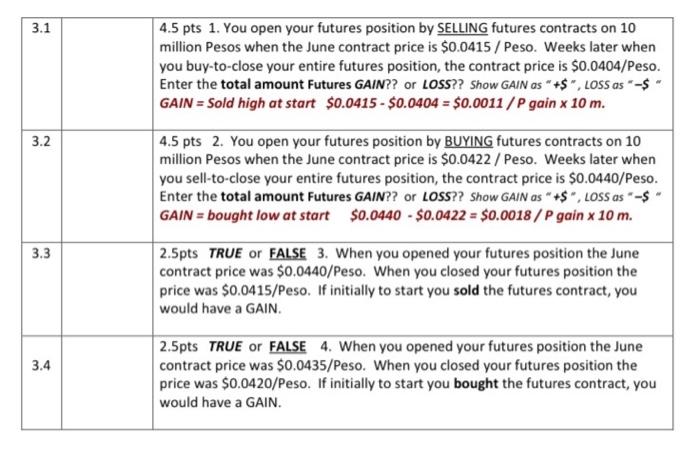

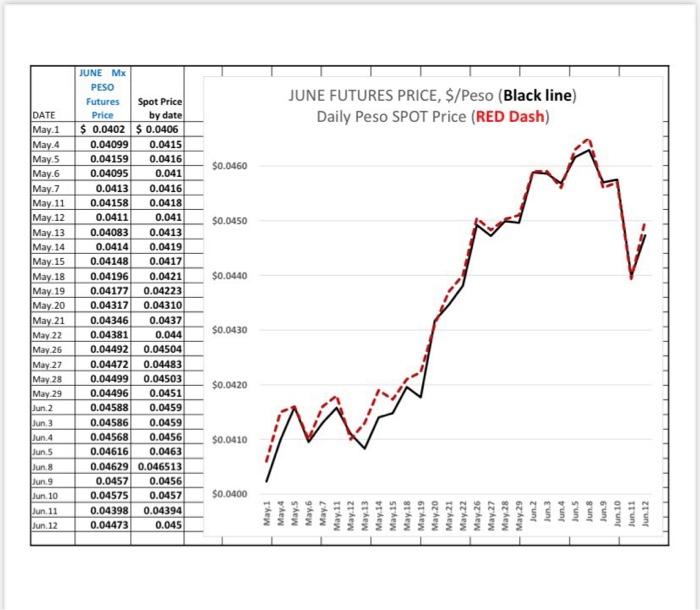

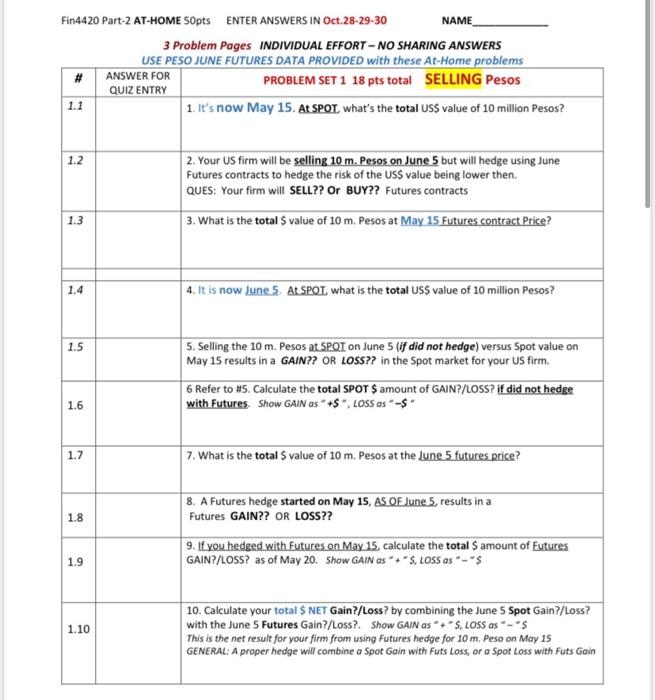

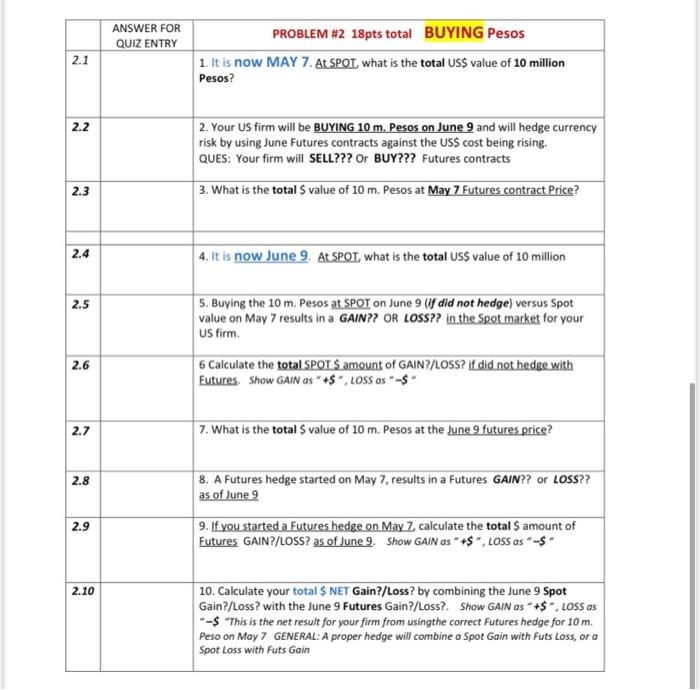

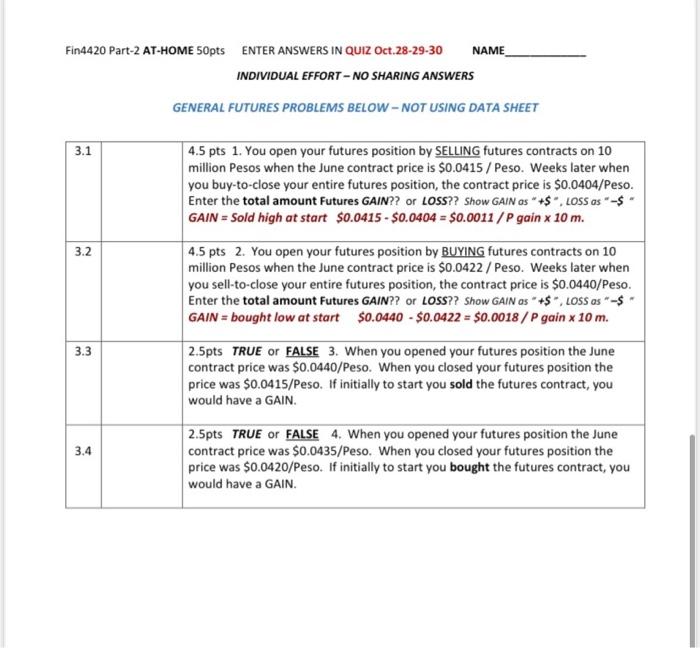

JUNE FUTURES PRICE, $/Peso (Black line) Daily Peso SPOT Price (RED Dash) $0.0460 $0.0450 $0.0440 DATE May 1 May 4 May 5 May. 6 May.7 May 11 May 12 May 13 May 14 May. 15 May 18 May 19 May 20 May 21 May 22 May 26 May 27 May 28 May 29 Jun 2 Jun 3 Lun. 4 Jun 5 Jun 8 Jun. 9 Lan 10 Jun 11 Jun. 12 JUNE Mx PESO Futures Spot Price Price by date $ 0.0402 $ 0.0406 0.04099 0.0415 0.04159 0.0416 0.04095 0.041 0.0413 0.0416 0.04158 0.0418 0.0411 0.041 0.04083 0.0413 0.0414 0.0419 0.04148 0.0417 0.04196 0.0421 0.04177 0.04223 0.04317 0.04310 0.04346 0.0437 0.04381 0.044 0.04492 0.04504 0.04472 0.04483 0.04499 0.04503 0.04496 0.0451 0.04588 0.0459 0.04586 0.0459 0.04568 0.0456 0.04616 0.0463 0.04629 0.046513 0.0457 0.0456 0.04575 0.0457 0.04398 0.04394 0.04473 0.045 $0.0430 $0.0420 $0.0410 $0.0400 Jun 3 Jun.4 Juns Jun 8 Jun. 9 Jun 10 Jun 11 Jun 12 # ANSWER FOR QUIZ ENTRY PROBLEM SET 1 18 pts total SELLING Pesos 1. It's now May 15. A SPOT what's the total US$ value of 10 million pesos? 1.1 1.2 2. Your US firm will be selling 10 m. Pesos on June 5 but will hedge using June Futures contracts to hedge the risk of the US$ value being lower then. QUES: Your firm will SELL?? Or BUY?? Futures contracts 3. What is the total value of 10 m. Pesos at May 15 Futures contract Price? 1.3 1.4 4. It is now June 5. A SPOL, what is the total US$ value of 10 million pesos? 1.5 5. Selling the 10 m. Pesos at SPOT on June 5 tif did not hedge) versus Spot value on May 15 results in a GAIN?? OR LOSS?? in the Spot market for your US firm. 6 Refer to #5. Calculate the total SPOT S amount of GAIN?/LOSS? if did not hedge with Futures. Show GAIN as " +$. LOSS as - 1.6 1.7 7. What is the total value of 10 m. Pesos at the June 5 futures price? 1.8 8. A Futures hedge started on May 15, AS OF June 5, results in a Futures GAIN?? OR LOSS?? 9. If you hedged with Futures on May 15 calculate the total amount of Futures GAIN?/LOSS? as of May 20. Show GAIN as ***S, LOSS OS - $ 1.9 1.10 10. Calculate your total $ NET Gain?/Loss? by combining the June 5 Spot Gain?/Loss? with the June 5 Futures Gain?/Loss?. Show GAIN as "S, LOSS as - 5 This is the net result for your firm from using Futures hedge for 10 m. Peso on May 15 GENERAL: A proper hedge will combine a Spot Gain with Futs Loss, or a Spot Loss with Futs Gain ANSWER FOR QUIZ ENTRY 2.1 PROBLEM #2 18pts total BUYING Pesos 1. It is now MAY 7. At SPOL what is the total US$ value of 10 million Pesos? 2.2 2. Your US firm will be BUYING 10 m. Pesos on June 9 and will hedge currency risk by using June Futures contracts against the US$ cost being rising, QUES: Your firm will SELL??? Or BUY??? Futures contracts 3. What is the total value of 10 m. Pesos at May 7 Futures contract Price? 2.3 2.4 4. It is now June 9. At SPOT, what is the total US$ value of 10 million 2.5 5. Buying the 10 m. Pesos at SPOT on June 9 (if did not hedge) versus Spot value on May 7 results in a GAIN?? OR LOSS?? in the Spot market for your US firm. 6 Calculate the total SPOT S amount of GAIN?/LOSS? if did not hedge with Futures. Show GAIN as +$. LOSS as - 2.6 2.7 7. What is the total $ value of 10 m. Pesos at the lune 9 futures price? 2.8 8. A Futures hedge started on May 7, results in a futures GAIN?? or LOSS?? as of June 9 9. If you started a futures hedge on May Z calculate the total amount of Futures GAIN?/LOSS? as of June 9. Show GAIN as * +$", LOSS as - 2.9 2.10 10. Calculate your total $ NET Gain?/Loss? by combining the June 9 Spot Gain?/Loss? with the June 9 Futures Gain?/Loss? Show GAIN as * +$. LOSS as -5 This is the net result for your firm from usingthe correct Futures hedge for 10 m. Peso on May 7 GENERAL: A proper hedge will combine a Spot Gain with Futs Loss, or a Spot Loss with Futs Gain TOTAL Problem #1 + #2 = 36 PTS. PAGE 3 Next short Problem section = 14 pts. Will be short Futures Problems 3.1 4.5 pts 1. You open your futures position by SELLING futures contracts on 10 million pesos when the June contract price is $0.0415 / Peso. Weeks later when you buy-to-close your entire futures position, the contract price is $0.0404/Peso. Enter the total amount Futures GAIN?? or LOSS?? Show GAIN as " +$", LOSS as -$ GAIN = Sold high at start $0.0415 - $0.0404 = $0.0011 /P gain x 10 m. 3.2 4.5 pts 2. You open your futures position by BUYING futures contracts on 10 million pesos when the June contract price is $0.0422 / Peso. Weeks later when you sell-to-close your entire futures position, the contract price is $0.0440/Peso. Enter the total amount Futures GAIN?? or LOSS?? Show GAIN as " +$", LOSS as -$ GAIN = bought low at start $0.0440 - $0.0422 = $0.0018/P gain x 10 m. 3.3 2.5pts TRUE or FALSE 3. When you opened your futures position the June contract price was $0.0440/Peso. When you closed your futures position the price was $0.0415/Peso. If initially to start you sold the futures contract, you would have a GAIN. 3.4 2.5pts TRUE or FALSE 4. When you opened your futures position the June contract price was $0.0435/Peso. When you closed your futures position the price was $0.0420/Peso. If initially to start you bought the futures contract, you would have a GAIN. JUNE FUTURES PRICE, $/Peso (Black line) Daily Peso SPOT Price (RED Dash) $0.0460 $0.0450 $0.0440 DATE May 1 May 4 May 5 May.6 May 7 May 11 May 12 May 13 May 14 May 15 May 18 May 19 May 20 May 21 May 22 May 26 May 27 May 28 May 29 Jun 2 Jun 3 Jun 4 Jun 5 Jun Jun. 9 an 10 Jun 11 Jun. 12 JUNE Mx PESO Futures Spot Price Price by date $ 0.0402 $ 0.0406 0.04099 0.0415 0.04159 0.0416 0.04095 0.041 0.0413 0.0416 0.04158 0.0418 0.0411 0.041 0.04083 0.0413 0.0414 0.0419 0.04148 0.0417 0.04196 0.0421 0.04177 0.04223 0.04317 0.04310 0.04346 0.0437 0.04381 0.044 0.04492 0.04504 0.04472 0.04483 0.04499 0.04503 0.04496 0.0451 0.04588 0.0459 0.04586 0.0459 0.04568 0.0456 0.04616 0.0463 0.04629 0.046513 0.0457 0.0456 0.04575 0.0457 0.04398 0.04394 0.04473 0.045 $0.0430 $0.0420 $0.0410 $0.0400 Eur Jun.4 Juns Jun 8 Jung Jun. 10 un 11 Jun 12 Fin4420 Part-2 AT-HOME 5Opts ENTER ANSWERS IN Oct.28-29-30 NAME 3 Problem Pages INDIVIDUAL EFFORT - NO SHARING ANSWERS USE PESO JUNE FUTURES DATA PROVIDED with these At-Home problems # ANSWER FOR PROBLEM SET 1 18 pts total SELLING Pesos QUIZ ENTRY 1.1 1. It's now May 15. At SPOT what's the total US$ value of 10 million pesos? 1.2 2. Your US firm will be selling 10 m. Pesos on June 5 but will hedge using lune Futures contracts to hedge the risk of the US$ value being lower then. QUES: Your firm will SELL?? Or BUY?? Futures contracts 3. What is the total value of 10 m. Pesos at May 15 Futures contract Price? 1.3 1.4 4. It is now June 5. AL.SPOL what is the total US$ value of 10 million pesos? 1.5 5. Selling the 10 m. Pesos at SPOT on June 5 (if did not hedge) versus Spot value on May 15 results in a GAIN?? OR LOSS?? in the Spot market for your US firm. 6 Refer to #5. Calculate the total SPOT S amount of GAIN?/LOSS? if did not hedge with Futures Show GAIN as " +$", LOSS as - 1.6 1.7 7. What is the total value of 10 m. Pesos at the June 5 futures price? 8. A Futures hedge started on May 15, AS OF June 5, results in a Futures GAIN?? OR LOSS?? 1.8 9. If you hedged with Futures on May 15, calculate the total amount of Futures GAIN?/LOSS? as of May 20. Show GAIN as ***, LOSS as *-* 1.9 1.10 10. Calculate your total $ NET Gain?/Loss? by combining the June 5 Spot Gain?/Loss? with the June 5 Futures Gain?/Loss? Show GAIN as "S, LOSS as - 5 This is the net result for your firm from using Futures hedge for 10 m. Peso on May 15 GENERAL: A proper hedge will combine a Spot Gain with Futs Loss, or a Spot Loss with Futs Gain ANSWER FOR QUIZ ENTRY 2.1 PROBLEM #2 18pts total BUYING Pesos 1. It is now MAY 7. At SPOT what is the total US$ value of 10 million Pesos? 2.2 2. Your US firm will be BUYING 10 m. Pesos on June 9 and will hedge currency risk by using June Futures contracts against the US$ cost being rising. QUES: Your firm will SELL??? Or BUY??? Futures contracts 2.3 3. What is the total value of 10 m. Pesos at May 7 Futures contract Price? 2.4 4. It is now June 9. At SPOT what is the total US$ value of 10 million 2.5 5. Buying the 10 m. Pesos at SPOT on June 9 Uf did not hedge) versus Spot value on May 7 results in a GAIN?? OR LOSS?? in the spot market for your us firm. 6 Calculate the total SPOT S amount of GAIN?/LOSS? I did not hedge with Futures. Show GAIN as "+$, LOSS as - 2.6 2.7 7. What is the total value of 10 m. Pesos at the June 9 futures price? 2.8 8. A Futures hedge started on May 7, results in a futures GAIN?? or LOSS?? as of June 2 9. If you started a Futures hedge on May Zcalculate the total amount of Futures GAIN?/LOSS? as of June 9. Show GAIN as **$*, LOSS as - 2.9 2.10 10. Calculate your total $ NET Gain?/Loss? by combining the June 9 Spot Gain?/Loss? with the June 9 Futures Gain?/Loss?. Show GAIN as * +$", LOSS as -- "This is the net result for your firm from usingthe correct Futures hedge for 10 m Peso on May 7 GENERAL: A proper hedge will combine a Spot Gain with Futs Loss, or a Spot Loss with Futs Gain Fin4420 Part-2 AT-HOME 50pts ENTER ANSWERS IN QUIZ Oct.28-29-30 NAME INDIVIDUAL EFFORT - NO SHARING ANSWERS GENERAL FUTURES PROBLEMS BELOW - NOT USING DATA SHEET 3.1 4.5 pts 1. You open your futures position by SELLING futures contracts on 10 million pesos when the June contract price is $0.0415 / Peso. Weeks later when you buy-to-close your entire futures position, the contract price is $0.0404/Peso. Enter the total amount Futures GAIN?? or LOSS?? Show GAIN as " +$", LOSS as "-$ GAIN = Sold high at start $0.0415 - $0.0404 = $0.0011 /P gain x 10 m. 3.2 4.5 pts 2. You open your futures position by BUYING futures contracts on 10 million pesos when the June contract price is $0.0422 / Peso. Weeks later when you sell-to-close your entire futures position, the contract price is $0.0440/Peso. Enter the total amount Futures GAIN?? or LOSS?? Show GAIN as " +5, LOSS as - GAIN = bought low at start $0.0440 - $0.0422 = $0.0018 /P gain x 10 m. 2.5pts TRUE or FALSE 3. When you opened your futures position the June contract price was $0.0440/Peso. When you closed your futures position the price was $0.0415/Peso. If initially to start you sold the futures contract, you would have a GAIN 3.3 3.4 2.5pts TRUE or FALSE 4. When you opened your futures position the June contract price was $0.0435/Peso. When you closed your futures position the price was $0.0420/Peso. If initially to start you bought the futures contract, you would have a GAIN JUNE FUTURES PRICE, $/Peso (Black line) Daily Peso SPOT Price (RED Dash) $0.0460 $0.0450 $0.0440 DATE May 1 May 4 May 5 May. 6 May.7 May 11 May 12 May 13 May 14 May. 15 May 18 May 19 May 20 May 21 May 22 May 26 May 27 May 28 May 29 Jun 2 Jun 3 Lun. 4 Jun 5 Jun 8 Jun. 9 Lan 10 Jun 11 Jun. 12 JUNE Mx PESO Futures Spot Price Price by date $ 0.0402 $ 0.0406 0.04099 0.0415 0.04159 0.0416 0.04095 0.041 0.0413 0.0416 0.04158 0.0418 0.0411 0.041 0.04083 0.0413 0.0414 0.0419 0.04148 0.0417 0.04196 0.0421 0.04177 0.04223 0.04317 0.04310 0.04346 0.0437 0.04381 0.044 0.04492 0.04504 0.04472 0.04483 0.04499 0.04503 0.04496 0.0451 0.04588 0.0459 0.04586 0.0459 0.04568 0.0456 0.04616 0.0463 0.04629 0.046513 0.0457 0.0456 0.04575 0.0457 0.04398 0.04394 0.04473 0.045 $0.0430 $0.0420 $0.0410 $0.0400 Jun 3 Jun.4 Juns Jun 8 Jun. 9 Jun 10 Jun 11 Jun 12 # ANSWER FOR QUIZ ENTRY PROBLEM SET 1 18 pts total SELLING Pesos 1. It's now May 15. A SPOT what's the total US$ value of 10 million pesos? 1.1 1.2 2. Your US firm will be selling 10 m. Pesos on June 5 but will hedge using June Futures contracts to hedge the risk of the US$ value being lower then. QUES: Your firm will SELL?? Or BUY?? Futures contracts 3. What is the total value of 10 m. Pesos at May 15 Futures contract Price? 1.3 1.4 4. It is now June 5. A SPOL, what is the total US$ value of 10 million pesos? 1.5 5. Selling the 10 m. Pesos at SPOT on June 5 tif did not hedge) versus Spot value on May 15 results in a GAIN?? OR LOSS?? in the Spot market for your US firm. 6 Refer to #5. Calculate the total SPOT S amount of GAIN?/LOSS? if did not hedge with Futures. Show GAIN as " +$. LOSS as - 1.6 1.7 7. What is the total value of 10 m. Pesos at the June 5 futures price? 1.8 8. A Futures hedge started on May 15, AS OF June 5, results in a Futures GAIN?? OR LOSS?? 9. If you hedged with Futures on May 15 calculate the total amount of Futures GAIN?/LOSS? as of May 20. Show GAIN as ***S, LOSS OS - $ 1.9 1.10 10. Calculate your total $ NET Gain?/Loss? by combining the June 5 Spot Gain?/Loss? with the June 5 Futures Gain?/Loss?. Show GAIN as "S, LOSS as - 5 This is the net result for your firm from using Futures hedge for 10 m. Peso on May 15 GENERAL: A proper hedge will combine a Spot Gain with Futs Loss, or a Spot Loss with Futs Gain ANSWER FOR QUIZ ENTRY 2.1 PROBLEM #2 18pts total BUYING Pesos 1. It is now MAY 7. At SPOL what is the total US$ value of 10 million Pesos? 2.2 2. Your US firm will be BUYING 10 m. Pesos on June 9 and will hedge currency risk by using June Futures contracts against the US$ cost being rising, QUES: Your firm will SELL??? Or BUY??? Futures contracts 3. What is the total value of 10 m. Pesos at May 7 Futures contract Price? 2.3 2.4 4. It is now June 9. At SPOT, what is the total US$ value of 10 million 2.5 5. Buying the 10 m. Pesos at SPOT on June 9 (if did not hedge) versus Spot value on May 7 results in a GAIN?? OR LOSS?? in the Spot market for your US firm. 6 Calculate the total SPOT S amount of GAIN?/LOSS? if did not hedge with Futures. Show GAIN as +$. LOSS as - 2.6 2.7 7. What is the total $ value of 10 m. Pesos at the lune 9 futures price? 2.8 8. A Futures hedge started on May 7, results in a futures GAIN?? or LOSS?? as of June 9 9. If you started a futures hedge on May Z calculate the total amount of Futures GAIN?/LOSS? as of June 9. Show GAIN as * +$", LOSS as - 2.9 2.10 10. Calculate your total $ NET Gain?/Loss? by combining the June 9 Spot Gain?/Loss? with the June 9 Futures Gain?/Loss? Show GAIN as * +$. LOSS as -5 This is the net result for your firm from usingthe correct Futures hedge for 10 m. Peso on May 7 GENERAL: A proper hedge will combine a Spot Gain with Futs Loss, or a Spot Loss with Futs Gain TOTAL Problem #1 + #2 = 36 PTS. PAGE 3 Next short Problem section = 14 pts. Will be short Futures Problems 3.1 4.5 pts 1. You open your futures position by SELLING futures contracts on 10 million pesos when the June contract price is $0.0415 / Peso. Weeks later when you buy-to-close your entire futures position, the contract price is $0.0404/Peso. Enter the total amount Futures GAIN?? or LOSS?? Show GAIN as " +$", LOSS as -$ GAIN = Sold high at start $0.0415 - $0.0404 = $0.0011 /P gain x 10 m. 3.2 4.5 pts 2. You open your futures position by BUYING futures contracts on 10 million pesos when the June contract price is $0.0422 / Peso. Weeks later when you sell-to-close your entire futures position, the contract price is $0.0440/Peso. Enter the total amount Futures GAIN?? or LOSS?? Show GAIN as " +$", LOSS as -$ GAIN = bought low at start $0.0440 - $0.0422 = $0.0018/P gain x 10 m. 3.3 2.5pts TRUE or FALSE 3. When you opened your futures position the June contract price was $0.0440/Peso. When you closed your futures position the price was $0.0415/Peso. If initially to start you sold the futures contract, you would have a GAIN. 3.4 2.5pts TRUE or FALSE 4. When you opened your futures position the June contract price was $0.0435/Peso. When you closed your futures position the price was $0.0420/Peso. If initially to start you bought the futures contract, you would have a GAIN. JUNE FUTURES PRICE, $/Peso (Black line) Daily Peso SPOT Price (RED Dash) $0.0460 $0.0450 $0.0440 DATE May 1 May 4 May 5 May.6 May 7 May 11 May 12 May 13 May 14 May 15 May 18 May 19 May 20 May 21 May 22 May 26 May 27 May 28 May 29 Jun 2 Jun 3 Jun 4 Jun 5 Jun Jun. 9 an 10 Jun 11 Jun. 12 JUNE Mx PESO Futures Spot Price Price by date $ 0.0402 $ 0.0406 0.04099 0.0415 0.04159 0.0416 0.04095 0.041 0.0413 0.0416 0.04158 0.0418 0.0411 0.041 0.04083 0.0413 0.0414 0.0419 0.04148 0.0417 0.04196 0.0421 0.04177 0.04223 0.04317 0.04310 0.04346 0.0437 0.04381 0.044 0.04492 0.04504 0.04472 0.04483 0.04499 0.04503 0.04496 0.0451 0.04588 0.0459 0.04586 0.0459 0.04568 0.0456 0.04616 0.0463 0.04629 0.046513 0.0457 0.0456 0.04575 0.0457 0.04398 0.04394 0.04473 0.045 $0.0430 $0.0420 $0.0410 $0.0400 Eur Jun.4 Juns Jun 8 Jung Jun. 10 un 11 Jun 12 Fin4420 Part-2 AT-HOME 5Opts ENTER ANSWERS IN Oct.28-29-30 NAME 3 Problem Pages INDIVIDUAL EFFORT - NO SHARING ANSWERS USE PESO JUNE FUTURES DATA PROVIDED with these At-Home problems # ANSWER FOR PROBLEM SET 1 18 pts total SELLING Pesos QUIZ ENTRY 1.1 1. It's now May 15. At SPOT what's the total US$ value of 10 million pesos? 1.2 2. Your US firm will be selling 10 m. Pesos on June 5 but will hedge using lune Futures contracts to hedge the risk of the US$ value being lower then. QUES: Your firm will SELL?? Or BUY?? Futures contracts 3. What is the total value of 10 m. Pesos at May 15 Futures contract Price? 1.3 1.4 4. It is now June 5. AL.SPOL what is the total US$ value of 10 million pesos? 1.5 5. Selling the 10 m. Pesos at SPOT on June 5 (if did not hedge) versus Spot value on May 15 results in a GAIN?? OR LOSS?? in the Spot market for your US firm. 6 Refer to #5. Calculate the total SPOT S amount of GAIN?/LOSS? if did not hedge with Futures Show GAIN as " +$", LOSS as - 1.6 1.7 7. What is the total value of 10 m. Pesos at the June 5 futures price? 8. A Futures hedge started on May 15, AS OF June 5, results in a Futures GAIN?? OR LOSS?? 1.8 9. If you hedged with Futures on May 15, calculate the total amount of Futures GAIN?/LOSS? as of May 20. Show GAIN as ***, LOSS as *-* 1.9 1.10 10. Calculate your total $ NET Gain?/Loss? by combining the June 5 Spot Gain?/Loss? with the June 5 Futures Gain?/Loss? Show GAIN as "S, LOSS as - 5 This is the net result for your firm from using Futures hedge for 10 m. Peso on May 15 GENERAL: A proper hedge will combine a Spot Gain with Futs Loss, or a Spot Loss with Futs Gain ANSWER FOR QUIZ ENTRY 2.1 PROBLEM #2 18pts total BUYING Pesos 1. It is now MAY 7. At SPOT what is the total US$ value of 10 million Pesos? 2.2 2. Your US firm will be BUYING 10 m. Pesos on June 9 and will hedge currency risk by using June Futures contracts against the US$ cost being rising. QUES: Your firm will SELL??? Or BUY??? Futures contracts 2.3 3. What is the total value of 10 m. Pesos at May 7 Futures contract Price? 2.4 4. It is now June 9. At SPOT what is the total US$ value of 10 million 2.5 5. Buying the 10 m. Pesos at SPOT on June 9 Uf did not hedge) versus Spot value on May 7 results in a GAIN?? OR LOSS?? in the spot market for your us firm. 6 Calculate the total SPOT S amount of GAIN?/LOSS? I did not hedge with Futures. Show GAIN as "+$, LOSS as - 2.6 2.7 7. What is the total value of 10 m. Pesos at the June 9 futures price? 2.8 8. A Futures hedge started on May 7, results in a futures GAIN?? or LOSS?? as of June 2 9. If you started a Futures hedge on May Zcalculate the total amount of Futures GAIN?/LOSS? as of June 9. Show GAIN as **$*, LOSS as - 2.9 2.10 10. Calculate your total $ NET Gain?/Loss? by combining the June 9 Spot Gain?/Loss? with the June 9 Futures Gain?/Loss?. Show GAIN as * +$", LOSS as -- "This is the net result for your firm from usingthe correct Futures hedge for 10 m Peso on May 7 GENERAL: A proper hedge will combine a Spot Gain with Futs Loss, or a Spot Loss with Futs Gain Fin4420 Part-2 AT-HOME 50pts ENTER ANSWERS IN QUIZ Oct.28-29-30 NAME INDIVIDUAL EFFORT - NO SHARING ANSWERS GENERAL FUTURES PROBLEMS BELOW - NOT USING DATA SHEET 3.1 4.5 pts 1. You open your futures position by SELLING futures contracts on 10 million pesos when the June contract price is $0.0415 / Peso. Weeks later when you buy-to-close your entire futures position, the contract price is $0.0404/Peso. Enter the total amount Futures GAIN?? or LOSS?? Show GAIN as " +$", LOSS as "-$ GAIN = Sold high at start $0.0415 - $0.0404 = $0.0011 /P gain x 10 m. 3.2 4.5 pts 2. You open your futures position by BUYING futures contracts on 10 million pesos when the June contract price is $0.0422 / Peso. Weeks later when you sell-to-close your entire futures position, the contract price is $0.0440/Peso. Enter the total amount Futures GAIN?? or LOSS?? Show GAIN as " +5, LOSS as - GAIN = bought low at start $0.0440 - $0.0422 = $0.0018 /P gain x 10 m. 2.5pts TRUE or FALSE 3. When you opened your futures position the June contract price was $0.0440/Peso. When you closed your futures position the price was $0.0415/Peso. If initially to start you sold the futures contract, you would have a GAIN 3.3 3.4 2.5pts TRUE or FALSE 4. When you opened your futures position the June contract price was $0.0435/Peso. When you closed your futures position the price was $0.0420/Peso. If initially to start you bought the futures contract, you would have a GAIN