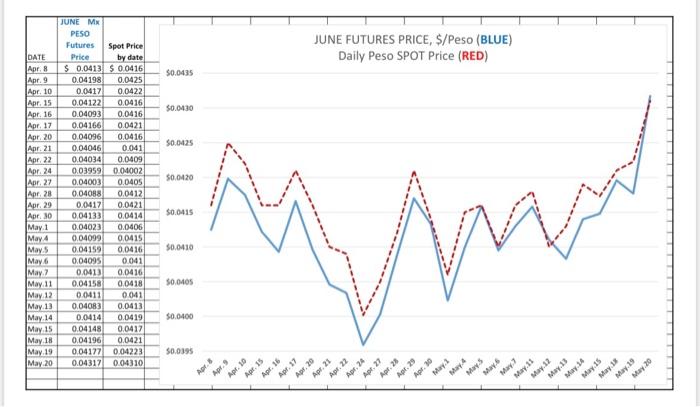

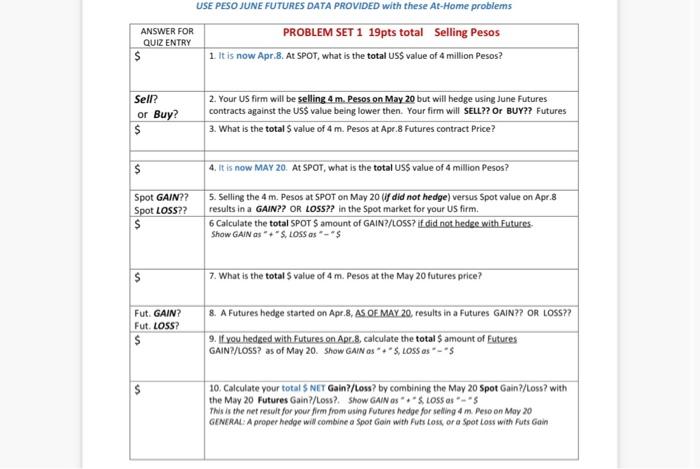

JUNE FUTURES PRICE, S/Peso (BLUE) Daily Peso SPOT Price (RED) $0.0435 $0.0130 Apr. 20 $0.0425 50.0120 JUNE M PESO Futures Spot Price DATE Price by date Apr 8 $ 0.0413 $ 0.0416 Apr. 9 0.04198 0.0425 Apr. 10 0.0417 00422 Apr. 15 0.04122 0.0416 Apr 16 0.04093 0.0416 Apr. 17 0.04166 0.0421 0.04096 0.0416 Apr. 21 0.04046 0.041 Apr 22 0.04034 0.0409 Apr. 24 0.03959 0.04002 Apr. 27 0.04003 0.0405 Apr 28 0.04088 0.0412 Apr 29 0.0412 0.0421 Apr. 30 0.04133 May 1 0.04023 0.0406 May 4 0.04099 0,0415 May 0.04159 0.0416 May 6 0.04095 0.041 May 0.0413 0.0416 May 11 0.04158 0.0418 May 12 0.0411 0041 May 13 0.04083 0.0413 May 14 0.0414 0.0419 May 15 0.04148 0.0417 May 18 0.04196 0.0421 May 19 0.04177 0.04223 May 20 0.04317 0.04310 0.0414 $0.0415 $0.0410 my 50.0405 $0.0400 $0.0395 Apr. 10 Apr 15 Apr Apr May 2 Apr. 20 Agr. 29 Apr. 20 May 12 May 11 May May May 5 May 19 May 20 May May 15 May 14 May May 13 USE PESO JUNE FUTURES DATA PROVIDED with these At-Home problems ANSWER FOR QUIZ ENTRY $ PROBLEM SET 1 19pts total Selling Pesos 1. It is now Apr.8. At SPOT, what is the total USS value of 4 million pesos? Sell? or Buy? $ 2. Your US firm will be selling 4 m. Pesos on May 20 but will hedge using June Futures contracts against the US$value being lower then Your firm will SELL?? Or BUY?? Futures 3. What is the total 5 value of 4 m. Pesos at Apr.8 Futures contract Price? $ 4. It is now MAY 20. AT SPOT, what is the total US$ value of 4 million Pesos? Spot GAIN?? Spot LOSS?? $ 5. Selling the 4 m. Pesos at SPOT on May 20 uf did not hedge) versus Spot value on Apr.8 results in a GAIN?? OR LOSS?? in the spot market for your US firm. 6 Calculate the total SPOT S amount of GAIN?/LOSS? if did not hedge with Futures. Show GAIN as S, LOSS as *-$ $ 7. What is the total value of 4 m. Pesos at the May 20 futures price? Fut. GAIN? Fut. LOSS? $ 8. A Futures hedge started on Apt.8, AS.DE MAY 20 results in a futures GAIN?? OR LOSS?? 9. If you hedged with Futures on Apr 8 calculate the total amount of Futures GAIN?/LOSS? as of May 20 Show GAIN. S. LOSS as $ $ 10. Calculate your total $ NET Gain?/Loss? by combining the May 20 Spot Gain?/Loss? with the May 20 Futures Gain?/Loss?. Show GAIN *** LOSS oss This is the net result for your firm from using Futures hedge for selling 4 m. Peso on May 20 GENERAL: A proper hedge will combine a Spot Goin with Futstone or a Spot Loss with Puts Goin