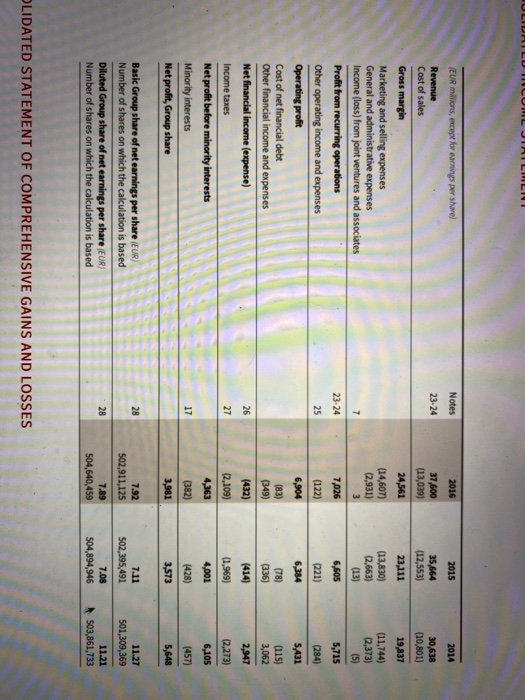

Junny, Help System Announcements CALCULATOR PRINTER VERSION IFRS 13-01 The financial statements of Louis Vuitton are presented in Appendix A. The complete annual report, including the notes to its financial statements, is available at the company's website. Click here to view Appendix E Use the company's 2016 annual report to answer the following questions. (a) What was the company's profit margin for 2016? (Round profit margin percentage to 1 decimal place, e.g. 15.2%) The company's profit margin for 2016 Has it increased or decreased from 2015? (b) What was the company's operating profit for 2016? The 2016 operating profit was (c) The company reported comprehensive income of 4,543 billion in 2016. What are the other comprehensive gains and losses recorded in 2016? Other comprehensive gains and losses was c million Click if you would like to Show Work for this question: Open Show Work LINK TO TEXT SAVE FOR LATER SUBMIT ANSW Question Attempts: 0 of 2 used ULIDHILD CUMIL JAILILII (EUR milions, except for earnings per share) Notes 2016 2015 2014 23-24 37.800 (13,039) 24,561 35,664 (12,553) 30,638 (10,801) 19,837 (14,607) (2,931) 3 23,111 (13,830) (2,663) (13) (11,744) 12,373) (5) 7 Revenue Cost of sales Gross margin Marketing and selling expenses General and administrative expenses Income (loss) from joint ventures and associates Profit from recurring operations Other operating income and expenses Operating profit Cost of net financial debt Other financial income and expenses Net financial income (expense) 23-24 5,715 7,026 (122) 6,904 6,505 0221) 25 (284) 6,384 (83) (349) (432) (78) (336) (414) 5,431 (115) 3,062 2,947 26 Income taxes 27 12,109) (1,969) 2,273) Net profit before minority interests Minority interests Net profit, Group share 4,363 (382) 17 4,001 (428) 3,573 6,105 (457) 5,648 3,981 28 7.92 502,911,125 7.11 502,395,491 11.27 501,309,369 Basic Group share of net earnings per share (EUR) Number of shares on which the calculation is based Diluted Group share of net earnings per share (EUR) Number of shares on which the calculation is based 28 7.89 504,640,459 7.08 504,894,946 11.21 503,861,733 OLIDATED STATEMENT OF COMPREHENSIVE GAINS AND LOSSES Junny, Help System Announcements CALCULATOR PRINTER VERSION IFRS 13-01 The financial statements of Louis Vuitton are presented in Appendix A. The complete annual report, including the notes to its financial statements, is available at the company's website. Click here to view Appendix E Use the company's 2016 annual report to answer the following questions. (a) What was the company's profit margin for 2016? (Round profit margin percentage to 1 decimal place, e.g. 15.2%) The company's profit margin for 2016 Has it increased or decreased from 2015? (b) What was the company's operating profit for 2016? The 2016 operating profit was (c) The company reported comprehensive income of 4,543 billion in 2016. What are the other comprehensive gains and losses recorded in 2016? Other comprehensive gains and losses was c million Click if you would like to Show Work for this question: Open Show Work LINK TO TEXT SAVE FOR LATER SUBMIT ANSW Question Attempts: 0 of 2 used ULIDHILD CUMIL JAILILII (EUR milions, except for earnings per share) Notes 2016 2015 2014 23-24 37.800 (13,039) 24,561 35,664 (12,553) 30,638 (10,801) 19,837 (14,607) (2,931) 3 23,111 (13,830) (2,663) (13) (11,744) 12,373) (5) 7 Revenue Cost of sales Gross margin Marketing and selling expenses General and administrative expenses Income (loss) from joint ventures and associates Profit from recurring operations Other operating income and expenses Operating profit Cost of net financial debt Other financial income and expenses Net financial income (expense) 23-24 5,715 7,026 (122) 6,904 6,505 0221) 25 (284) 6,384 (83) (349) (432) (78) (336) (414) 5,431 (115) 3,062 2,947 26 Income taxes 27 12,109) (1,969) 2,273) Net profit before minority interests Minority interests Net profit, Group share 4,363 (382) 17 4,001 (428) 3,573 6,105 (457) 5,648 3,981 28 7.92 502,911,125 7.11 502,395,491 11.27 501,309,369 Basic Group share of net earnings per share (EUR) Number of shares on which the calculation is based Diluted Group share of net earnings per share (EUR) Number of shares on which the calculation is based 28 7.89 504,640,459 7.08 504,894,946 11.21 503,861,733 OLIDATED STATEMENT OF COMPREHENSIVE GAINS AND LOSSES