Answered step by step

Verified Expert Solution

Question

1 Approved Answer

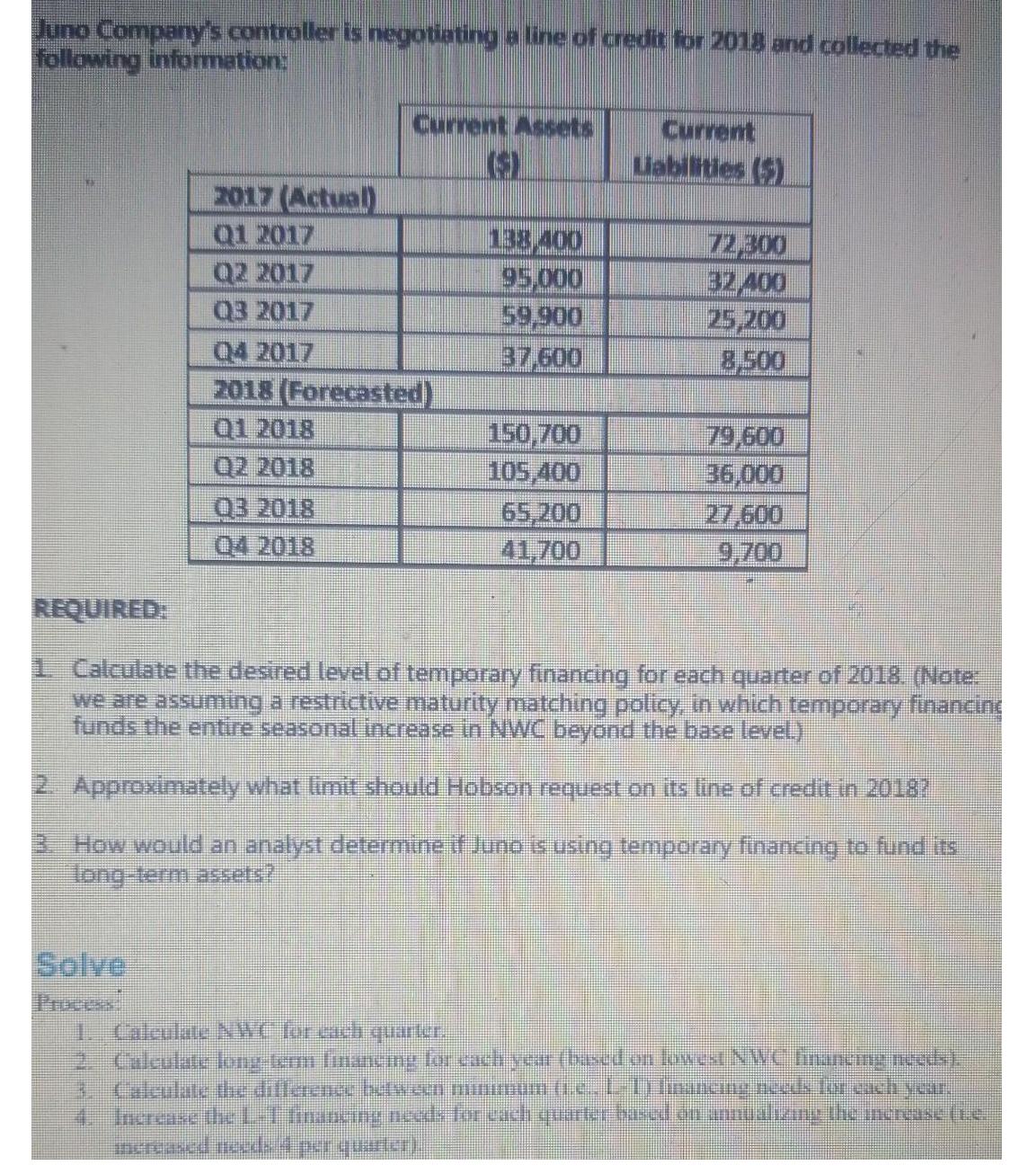

Juno Company's controller is negotiating a line of credit for 2018 and collected the following information: 2017 (Actual) Q1 2017 Q2 2017 Q3 2017

Juno Company's controller is negotiating a line of credit for 2018 and collected the following information: 2017 (Actual) Q1 2017 Q2 2017 Q3 2017 Current Assets ($) 04 2017 2018 (Forecasted) Q1 2018 02 2018 03 2018 04 2018 138,400 95,000 59,900 37,600 150,700 105,400 65,200 41,700 Current Liabilities (5) 72.300 32,400 25,200 8,500 79,600 36,000 27,600 9,700 REQUIRED: 1. Calculate the desired level of temporary financing for each quarter of 2018. (Note: we are assuming a restrictive maturity matching policy, in which temporary financing funds the entire seasonal increase in NWC beyond the base level) 2. Approximately what limit should Hobson request on its line of credit in 2018? 3. How would an analyst determine if Juno is using temporary financing to fund its long-term assets? 1. Calculate NWC for each quarter. 2. Calculate long-term financing for each year (based on lowest NWC financing needs). 3. Calculate the difference between minimum (1.e.. L-1) Imancing needs for each year. 4. Increase the L-1 financing needs for each quarter based on annualizing the increase (i.e. increased needs 4 per quarter)

Step by Step Solution

★★★★★

3.38 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the desired level of temporary financing for each quarter ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started