Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Juns first term at Concordia was in the Winter 2023. After having taken a Personal Finance course, he knew that he would be the target

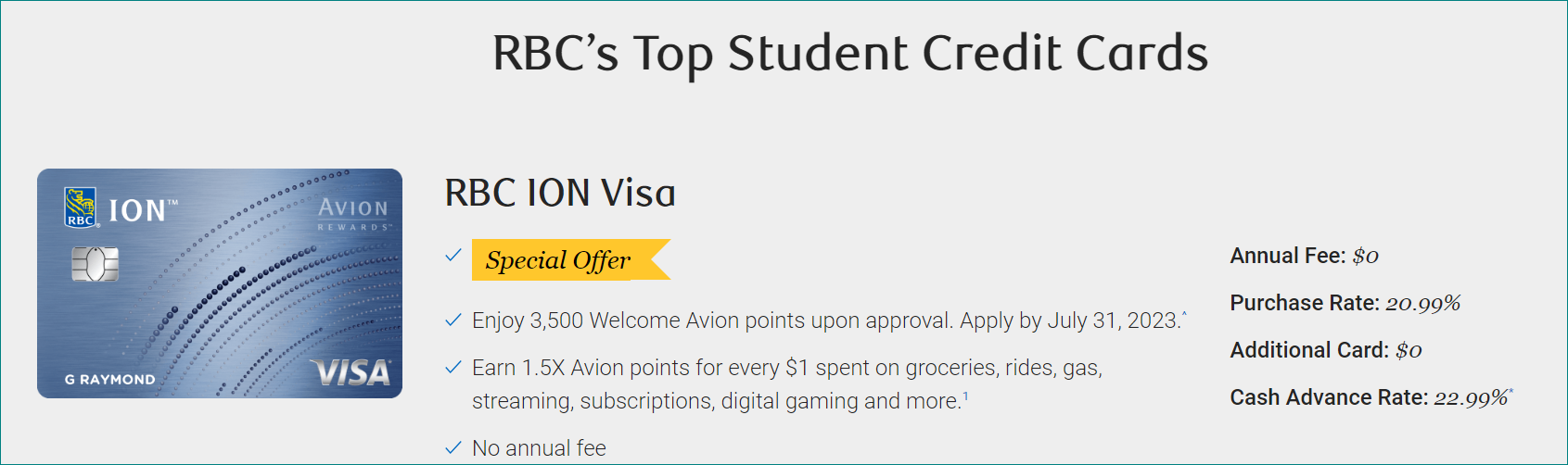

- Juns first term at Concordia was in the Winter 2023. After having taken a Personal Finance course, he knew that he would be the target of credit card companies approaching him for his business. As he also had a bank account with RBC, he thought it best to build credit history with them and accepted RBCs student credit card offer for his first credit card https://www.rbcroyalbank.com/credit-cards/rewards/rbc-ion-visa.html

- Jun knew from the course that it was not wise to use his credit card for cash advances, however he found himself with some cashflow issues and felt that he had no choice. What would be Juns effective interest rate on his credit card for having taken a cash advance? Hint: use the credit card details below as well as 365 days for compounding.

- 22.59%

- 23.35%

- 24.47%

- 25.84%

- 26.32%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started