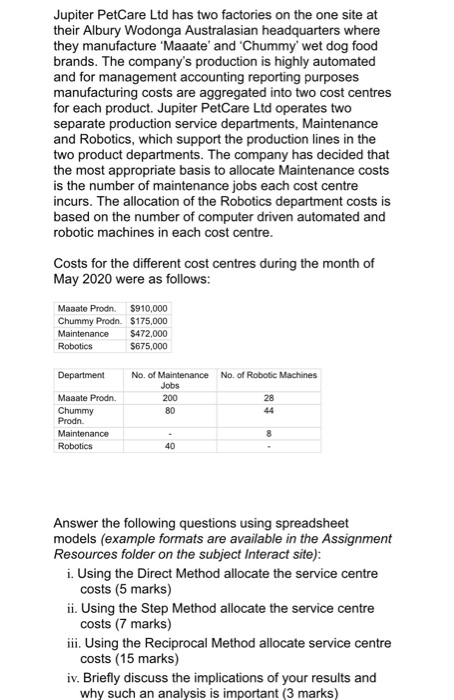

Jupiter PetCare Ltd has two factories on the one site at their Albury Wodonga Australasian headquarters where they manufacture 'Maaate' and 'Chummy' wet dog food brands. The company's production is highly automated and for management accounting reporting purposes manufacturing costs are aggregated into two cost centres for each product. Jupiter PetCare Ltd operates two separate production service departments, Maintenance and Robotics, which support the production lines in the two product departments. The company has decided that the most appropriate basis to allocate Maintenance costs is the number of maintenance jobs each cost centre incurs. The allocation of the Robotics department costs is based on the number of computer driven automated and robotic machines in each cost centre. Costs for the different cost centres during the month of May 2020 were as follows: Maaate Prodn. $910,000 Chummy Prodn. $175,000 Maintenance $472,000 Robotics $675,000 Department No. of Maintenance No. of Robotic Machines Jobs 200 28 80 Maaate Prodn. Chummy Prodn. Maintenance Robotics 8 40 Answer the following questions using spreadsheet models (example formats are available in the Assignment Resources folder on the subject Interact site): i. Using the Direct Method allocate the service centre costs (5 marks) ii. Using the Step Method allocate the service centre costs (7 marks) iii. Using the Reciprocal Method allocate service centre costs (15 marks) iv. Briefly discuss the implications of your results and why such an analysis is important (3 marks) Jupiter PetCare Ltd has two factories on the one site at their Albury Wodonga Australasian headquarters where they manufacture 'Maaate' and 'Chummy' wet dog food brands. The company's production is highly automated and for management accounting reporting purposes manufacturing costs are aggregated into two cost centres for each product. Jupiter PetCare Ltd operates two separate production service departments, Maintenance and Robotics, which support the production lines in the two product departments. The company has decided that the most appropriate basis to allocate Maintenance costs is the number of maintenance jobs each cost centre incurs. The allocation of the Robotics department costs is based on the number of computer driven automated and robotic machines in each cost centre. Costs for the different cost centres during the month of May 2020 were as follows: Maaate Prodn. $910,000 Chummy Prodn. $175,000 Maintenance $472,000 Robotics $675,000 Department No. of Maintenance No. of Robotic Machines Jobs 200 28 80 Maaate Prodn. Chummy Prodn. Maintenance Robotics 8 40 Answer the following questions using spreadsheet models (example formats are available in the Assignment Resources folder on the subject Interact site): i. Using the Direct Method allocate the service centre costs (5 marks) ii. Using the Step Method allocate the service centre costs (7 marks) iii. Using the Reciprocal Method allocate service centre costs (15 marks) iv. Briefly discuss the implications of your results and why such an analysis is important