Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jupiter plc (Jupiter) owns a chain of pet shops in Geeland. As the economy in Geeland develops, pet ownership has increased and Jupiter now

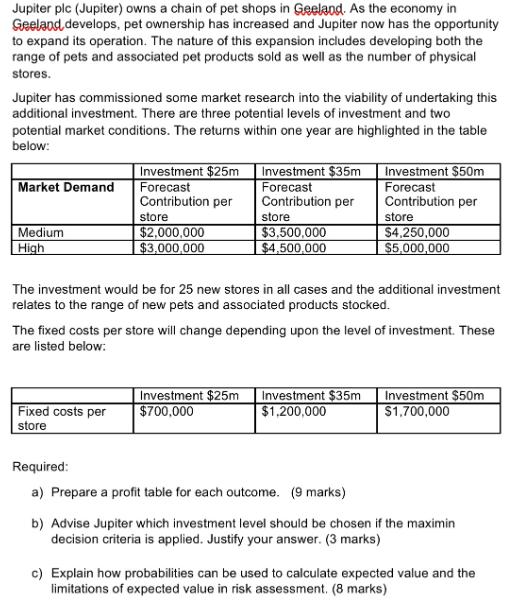

Jupiter plc (Jupiter) owns a chain of pet shops in Geeland. As the economy in Geeland develops, pet ownership has increased and Jupiter now has the opportunity to expand its operation. The nature of this expansion includes developing both the range of pets and associated pet products sold as well as the number of physical stores. Jupiter has commissioned some market research into the viability of undertaking this additional investment. There are three potential levels of investment and two potential market conditions. The returns within one year are highlighted in the table below: Market Demand Medium High Investment $25m Forecast Contribution per store $2,000,000 $3,000,000 Fixed costs per store Investment $35m Forecast Contribution per store $3,500,000 $4,500,000 Investment $25m $700,000 The investment would be for 25 new stores in all cases and the additional investment relates to the range of new pets and associated products stocked. The fixed costs per store will change depending upon the level of investment. These are listed below: Investment $50m Forecast Contribution per Investment $35m $1,200,000 store $4,250,000 $5,000,000 Required: a) Prepare a profit table for each outcome. (9 marks) Investment $50m $1,700,000 b) Advise Jupiter which investment level should be chosen if the maximin decision criteria is applied. Justify your answer. (3 marks) c) Explain how probabilities can be used to calculate expected value and the limitations of expected value in risk assessment. (8 marks)

Step by Step Solution

★★★★★

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started