Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Just 6 and 7 :) Many people often have strong opinions with regards to paying federal income taxes. Additionally, many of the same individuals who

Just 6 and 7 :)

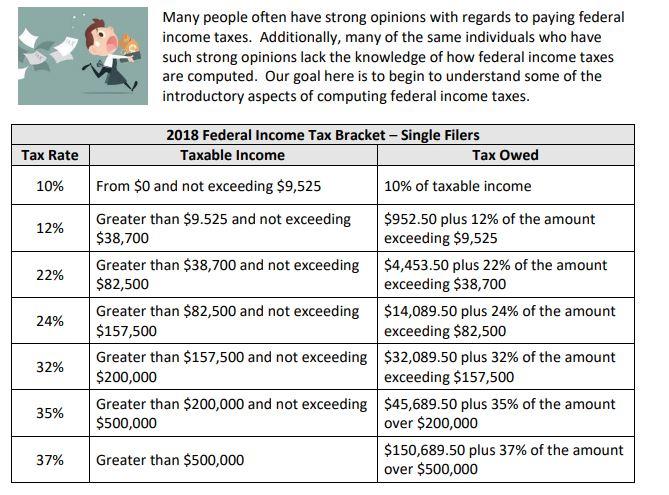

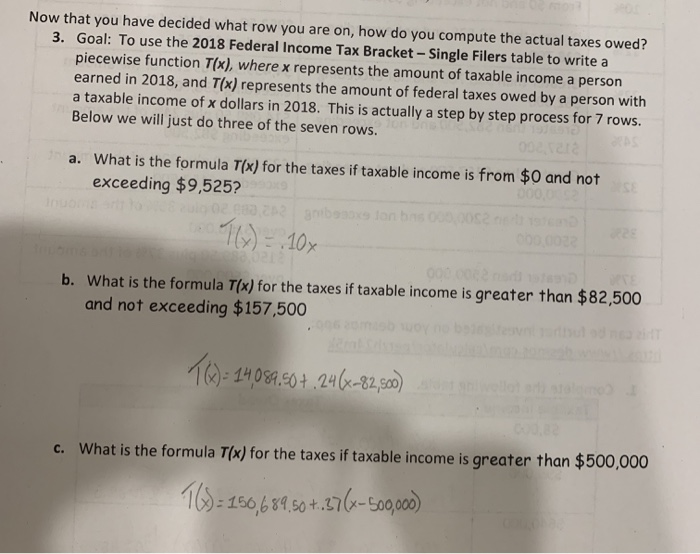

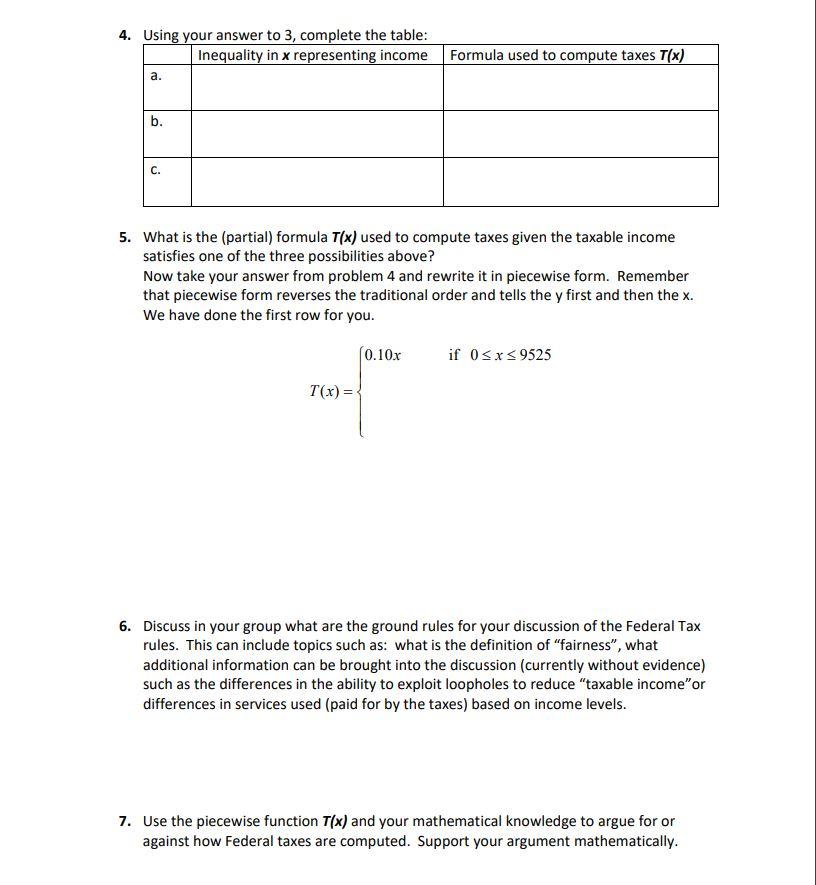

Many people often have strong opinions with regards to paying federal income taxes. Additionally, many of the same individuals who have such strong opinions lack the knowledge of how federal income taxes are computed. Our goal here is to begin to understand some of the introductory aspects of computing federal income taxes. Tax Rate 10% 12% 22% 2018 Federal Income Tax Bracket - Single Filers Taxable income Tax Owed From $0 and not exceeding $9,525 10% of taxable income Greater than $9.525 and not exceeding $952.50 plus 12% of the amount $38,700 exceeding $9,525 Greater than $38,700 and not exceeding $4,453.50 plus 22% of the amount $82,500 exceeding $38,700 Greater than $82,500 and not exceeding $14,089.50 plus 24% of the amount $157,500 exceeding $82,500 Greater than $157,500 and not exceeding $32,089.50 plus 32% of the amount $200,000 exceeding $157,500 Greater than $200,000 and not exceeding $45,689.50 plus 35% of the amount $500,000 over $200,000 $150,689.50 plus 37% of the amount Greater than $500,000 over $500,000 24% 32% 35% 37% Now that you have decided what row you are on, how do you compute the actual taxes owed? 3. Goal: To use the 2018 Federal Income Tax Bracket - Single Filers table to write a piecewise function T(x), where x represents the amount of taxable income a person earned in 2018, and T(x) represents the amount of federal taxes owed by a person with a taxable income of x dollars in 2018. This is actually a step by step process for 7 rows. Below we will just do three of the seven rows. a. What is the formula T(x) for the taxes if taxable income is from $0 and not exceeding $9,525? 000 blonb52 1(x) = 10x Oo b. What is the formula T(x) for the taxes if taxable income is greater than $82,500 and not exceeding $157,500 16) = - 14089.50 7.24(x-82,500) 14 c. What is the formula T(x) for the taxes if taxable income is greater than $500,000 16): 156,689.50+.276-500,000) 4. Using your answer to 3, complete the table: Inequality in x representing income a. Formula used to compute taxes T(x) b. 5. What is the (partial) formula T(x) used to compute taxes given the taxable income satisfies one of the three possibilities above? Now take your answer from problem 4 and rewrite it in piecewise form. Remember that piecewise form reverses the traditional order and tells the y first and then the x. We have done the first row for you. 0.10x if 0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started