Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Just a few multiple choice question, please give me the answer as soon as possible. Thank you. Will give you a positive rating without hesitance.

Just a few multiple choice question, please give me the answer as soon as possible. Thank you. Will give you a positive rating without hesitance.

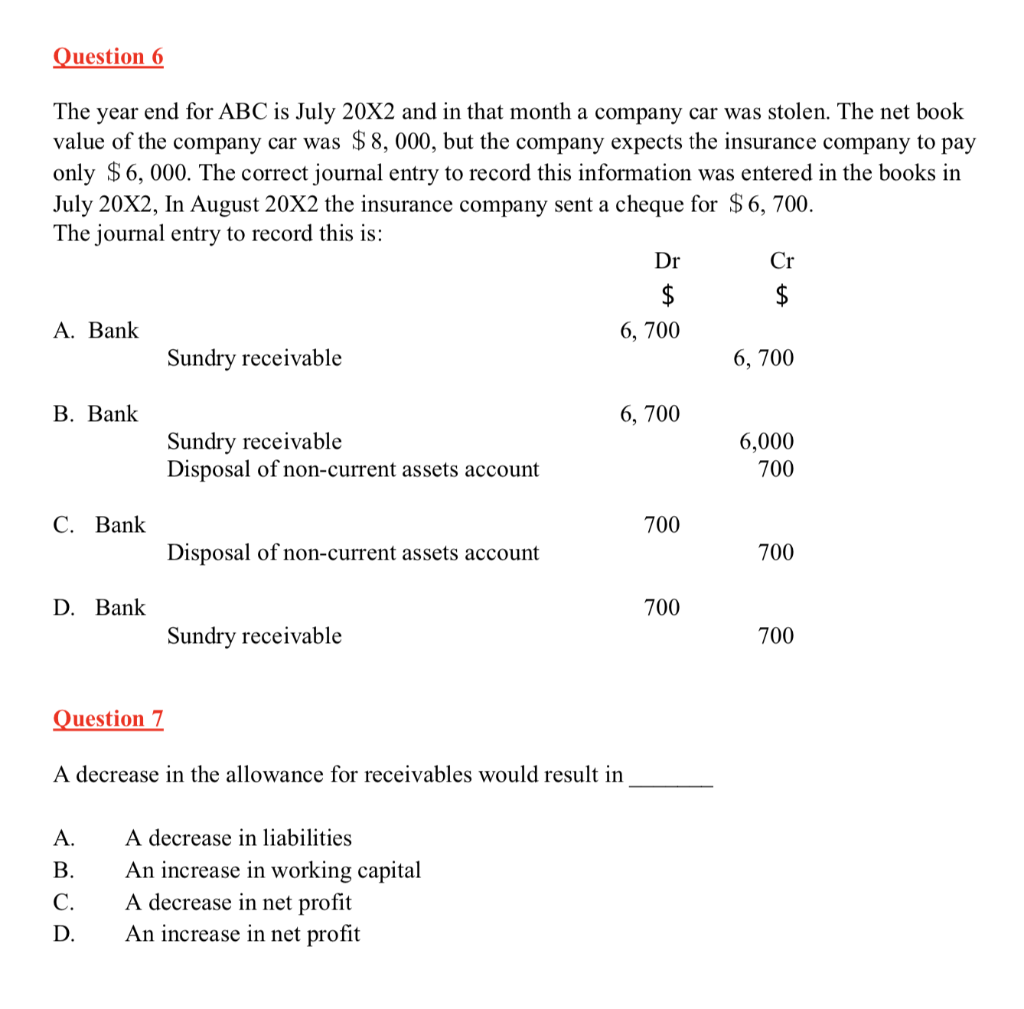

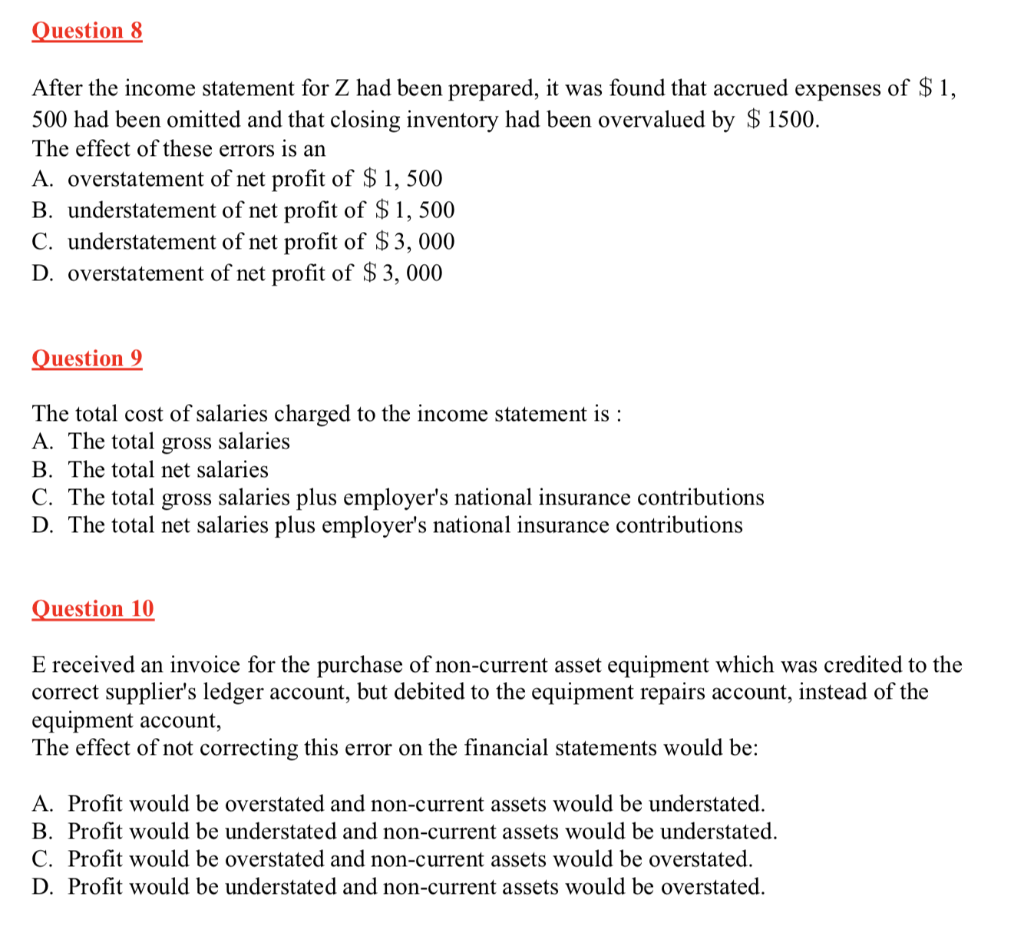

Question 6 The year end for ABC is July 20X2 and in that month a company car was stolen. The net book value of the company car was $8,000, but the company expects the insurance company to pay only $6,000. The correct journal entry to record this information was entered in the books in July 20X2, In August 20X2 the insurance company sent a cheque for $6, 700. The journal entry to record this is: Dr Cr $ $ A. Bank 6, 700 Sundry receivable 6, 700 B. Bank 6, 700 Sundry receivable Disposal of non-current assets account 6,000 700 C. Bank 700 Disposal of non-current assets account 700 D. Bank 700 Sundry receivable 700 Question 7 A decrease in the allowance for receivables would result in A. B. C. D. A decrease in liabilities An increase in working capital A decrease in net profit An increase in net profit Question 8 After the income statement for Z had been prepared, it was found that accrued expenses of $1, 500 had been omitted and that closing inventory had been overvalued by $ 1500. The effect of these errors is an A. overstatement of net profit of $1,500 B. understatement of net profit of $ 1,500 C. understatement of net profit of $3,000 D. overstatement of net profit of $3,000 Question 9 The total cost of salaries charged to the income statement is : A. The total gross salaries B. The total net salaries C. The total gross salaries plus employer's national insurance contributions D. The total net salaries plus employer's national insurance contributions Question 10 E received an invoice for the purchase of non-current asset equipment which was credited to the correct supplier's ledger account, but debited to the equipment repairs account, instead of the equipment account, The effect of not correcting this error on the financial statements would be: A. Profit would be overstated and non-current assets would be understated. B. Profit would be understated and non-current assets would be understated. C. Profit would be overstated and non-current assets would be overstated. D. Profit would be understated and non-current assets would be overstated

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started