Just a short answer for letters a,b,c,d please.

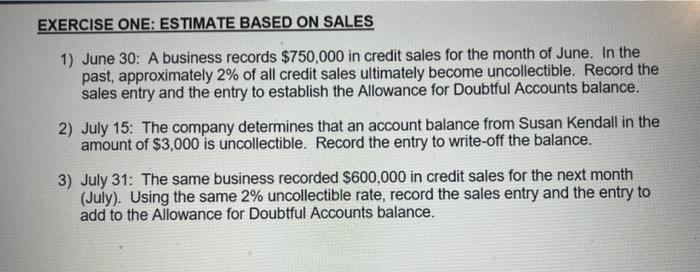

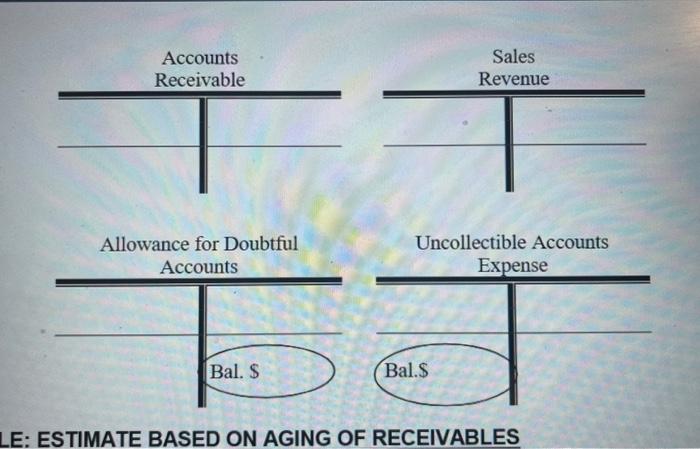

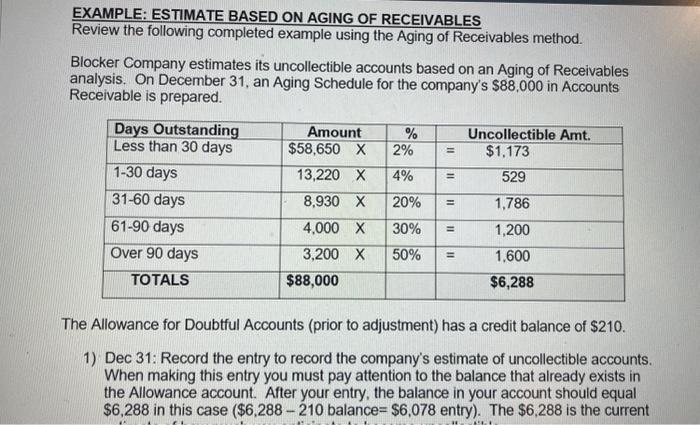

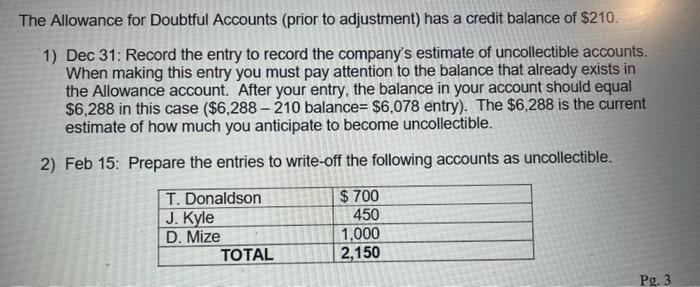

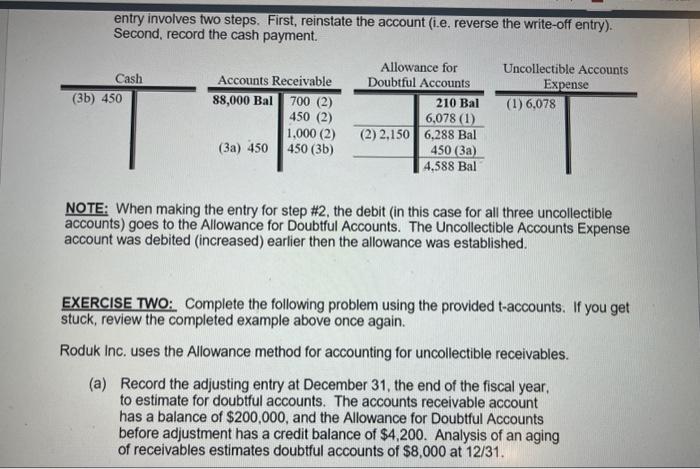

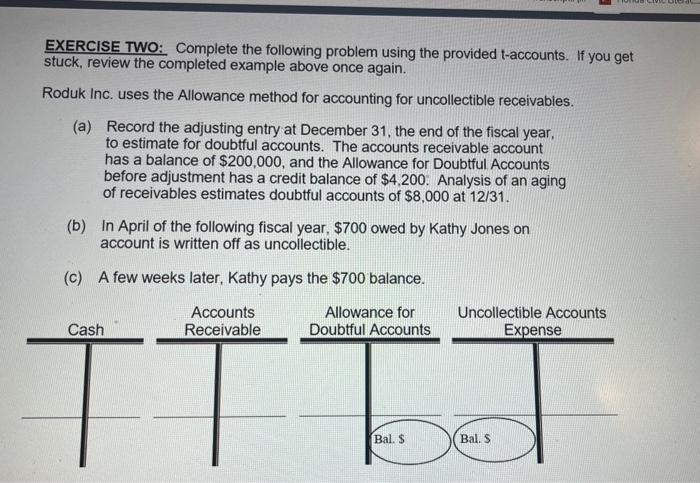

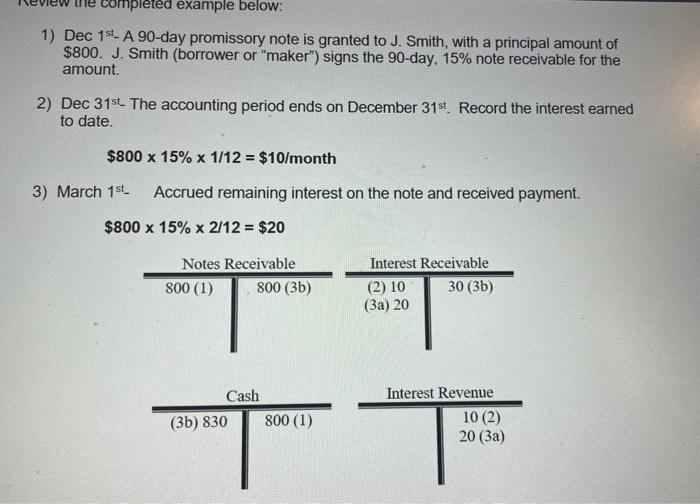

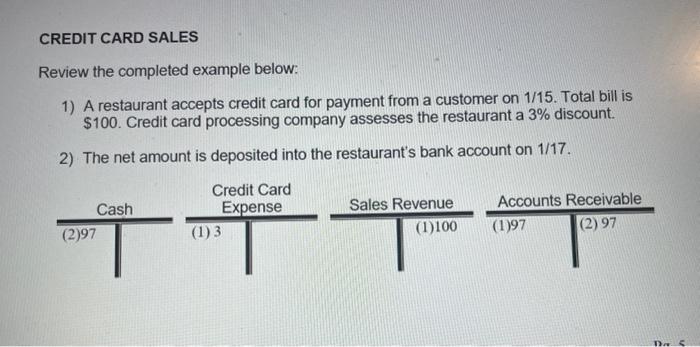

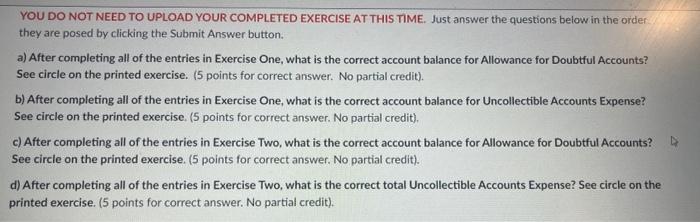

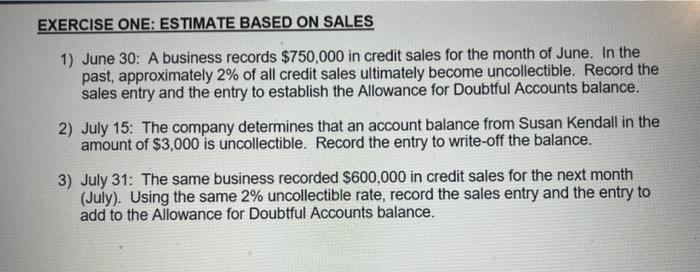

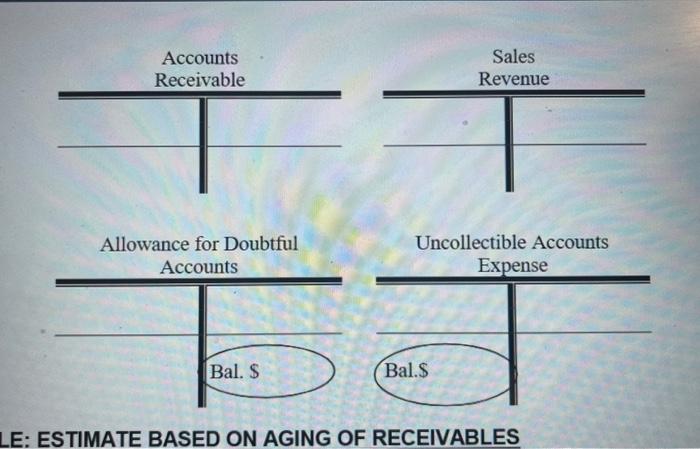

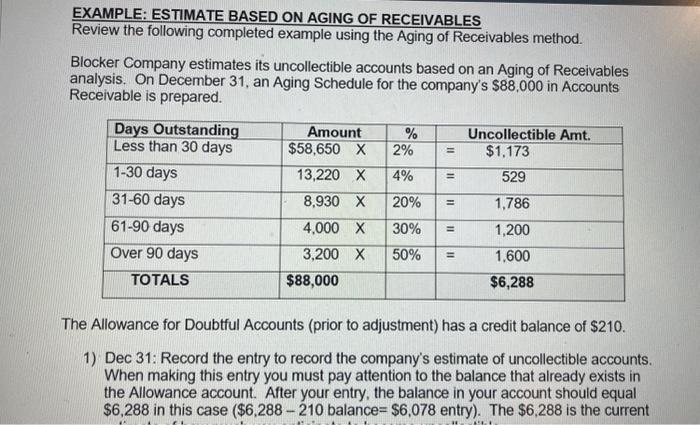

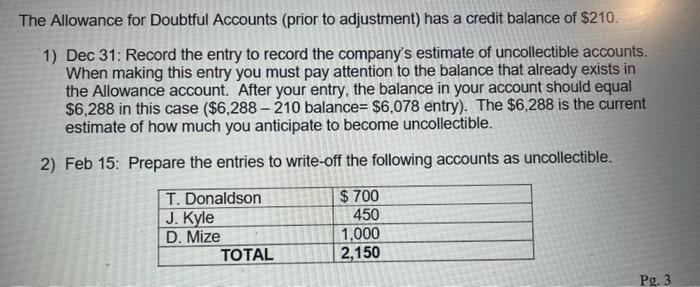

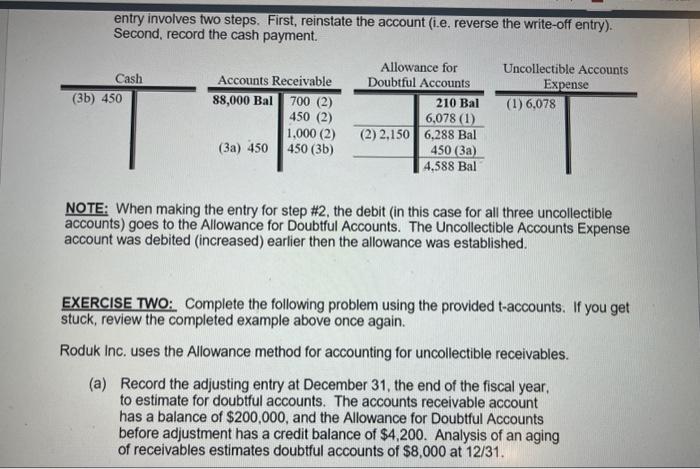

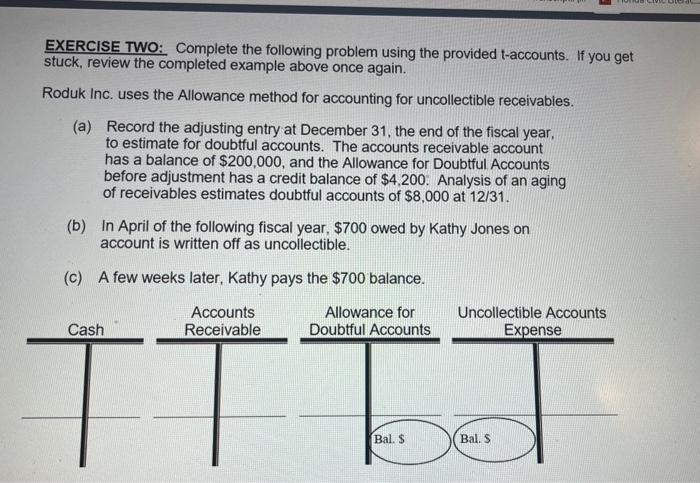

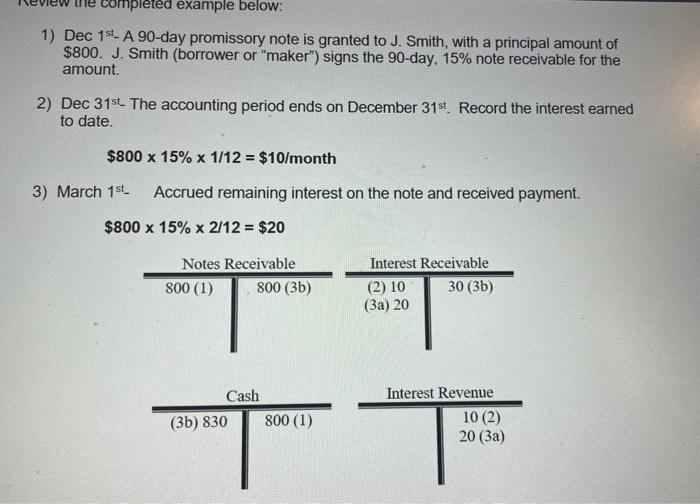

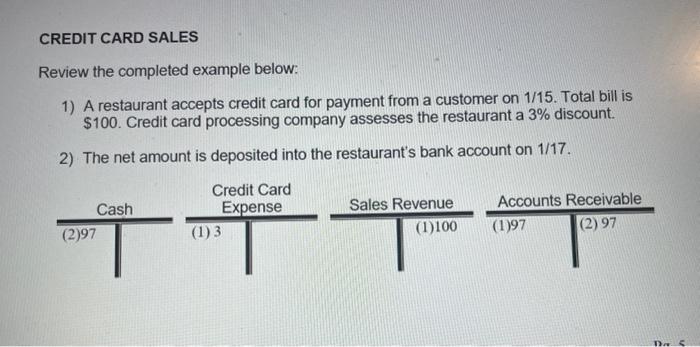

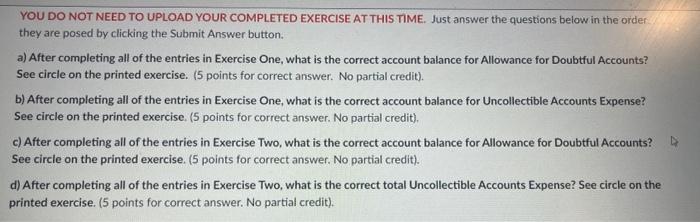

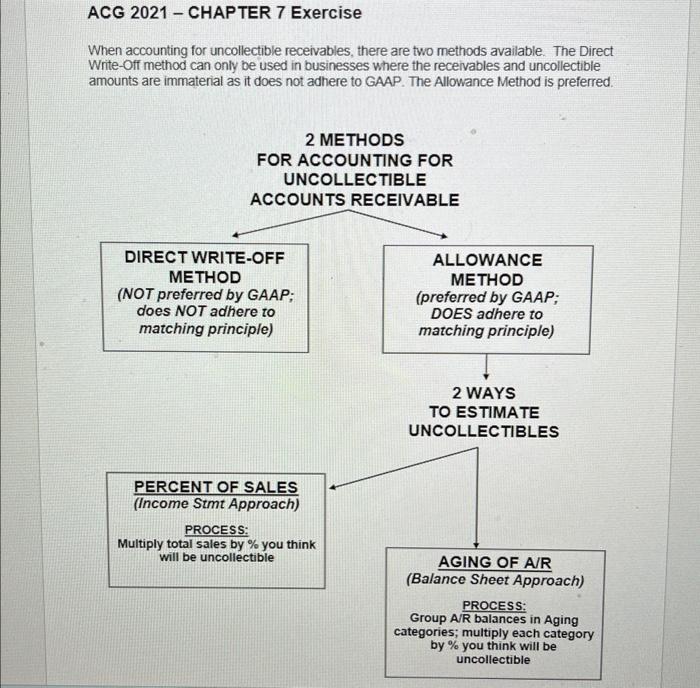

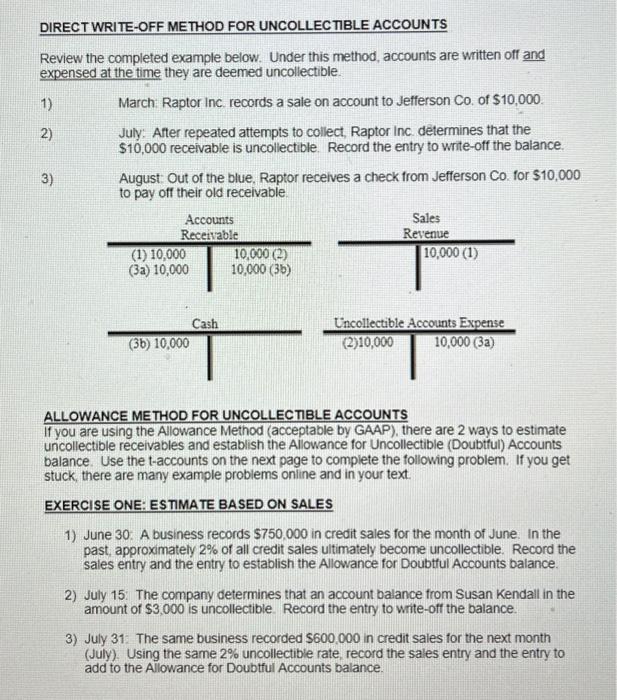

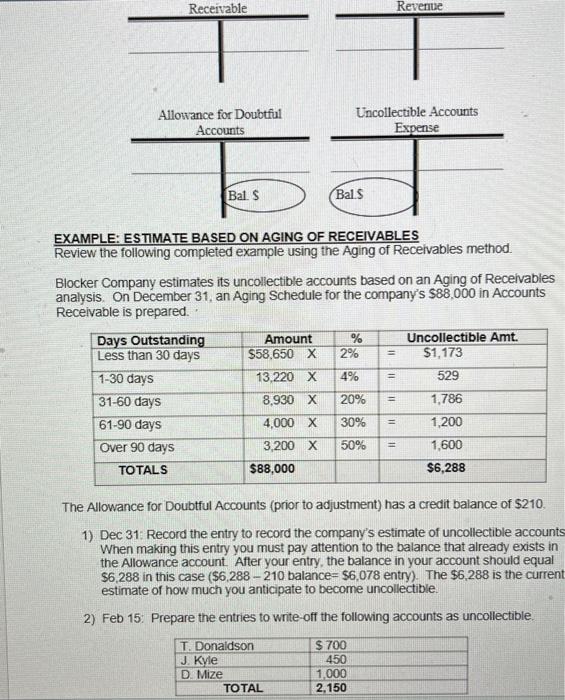

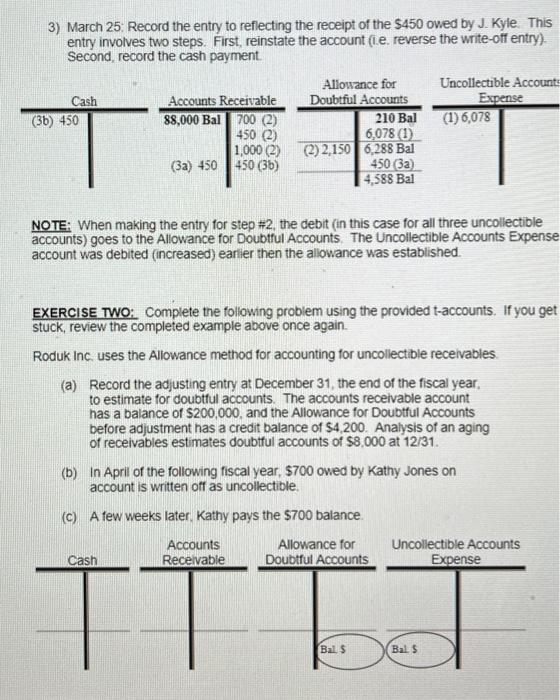

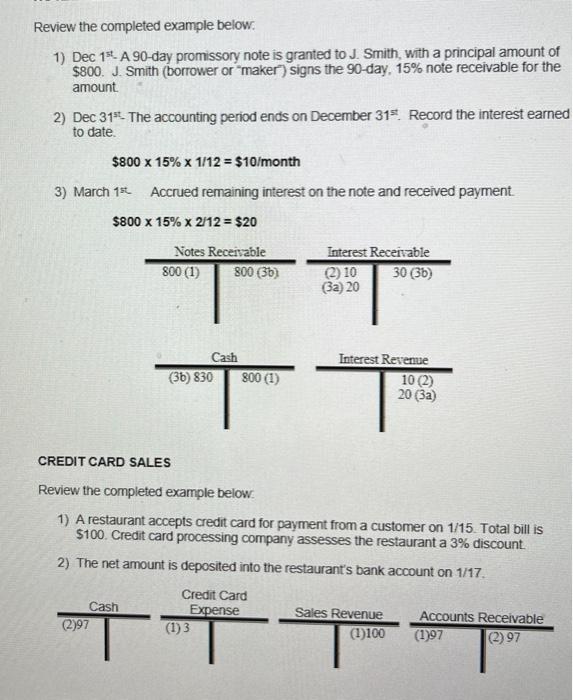

1) June 30: A business records $750,000 in credit sales for the month of June. In the past, approximately 2% of all credit sales ultimately become uncollectible. Record the sales entry and the entry to establish the Allowance for Doubtful Accounts balance. 2) July 15: The company determines that an account balance from Susan Kendall in the amount of $3,000 is uncollectible. Record the entry to write-off the balance. 3) July 31: The same business recorded $600,000 in credit sales for the next month (July). Using the same 2% uncollectible rate, record the sales entry and the entry to add to the Allowance for Doubtful Accounts balance. E: ESTIMATE BASED ON AGING OF RECEIVABLES EXAMPLE: ESTIMATE BASED ON AGING OF RECEIVABLES Review the following completed example using the Aging of Receivables method. Blocker Company estimates its uncollectible accounts based on an Aging of Receivables analysis. On December 31, an Aging Schedule for the company's $88,000 in Accounts Receivable is prepared. The Allowance for Doubtful Accounts (prior to adjustment) has a credit balance of $210. 1) Dec 31: Record the entry to record the company's estimate of uncollectible accounts. When making this entry you must pay attention to the balance that already exists in the Allowance account. After your entry, the balance in your account should equal $6,288 in this case ($6,288210 balance =$6,078 entry). The $6,288 is the current The Allowance for Doubtful Accounts (prior to adjustment) has a credit balance of $210. 1) Dec 31: Record the entry to record the company's estimate of uncollectible accounts. When making this entry you must pay attention to the balance that already exists in the Allowance account. After your entry, the balance in your account should equal $6,288 in this case ($6,288210 balance =$6,078 entry). The $6,288 is the current estimate of how much you anticipate to become uncollectible. entry involves two steps. First, reinstate the account (i.e. reverse the write-off entry). Second, record the cash payment. NOTE: When making the entry for step \#2, the debit (in this case for all three uncollectible accounts) goes to the Allowance for Doubtful Accounts. The Uncollectible Accounts Expense account was debited (increased) earlier then the allowance was established. EXERCISE TWO: Complete the following problem using the provided t-accounts. If you get stuck, review the completed example above once again. Roduk Inc. uses the Allowance method for accounting for uncollectible receivables. (a) Record the adjusting entry at December 31 , the end of the fiscal year, to estimate for doubtful accounts. The accounts receivable account has a balance of $200,000, and the Allowance for Doubtful Accounts before adjustment has a credit balance of $4,200. Analysis of an aging of receivables estimates doubtful accounts of $8,000 at 12/31. EXERCISE TWO: Complete the following problem using the provided t-accounts. If you get stuck, review the completed example above once again. Roduk Inc. uses the Allowance method for accounting for uncollectible receivables. (a) Record the adjusting entry at December 31 , the end of the fiscal year, to estimate for doubtful accounts. The accounts receivable account has a balance of $200,000, and the Allowance for Doubtful Accounts before adjustment has a credit balance of $4,200. Analysis of an aging of receivables estimates doubtful accounts of $8,000 at 12/31. (b) In April of the following fiscal year, $700 owed by Kathy Jones on account is written off as uncollectible. (c) A few weeks later, Kathy pays the $700 balance. 1) Dec 1st - A 90-day promissory note is granted to J. Smith, with a principal amount of $800. J. Smith (borrower or "maker") signs the 90 -day, 15% note receivable for the amount. 2) Dec 31st - The accounting period ends on December 31st. Record the interest earned to date. $80015%1/12=$10/month 3) March \( 1^{\text {st_ }} \quad \) Accrued remaining interest on the note and received payment. $80015%2/12=$20 CREDIT CARD SALES Review the completed example below: 1) A restaurant accepts credit card for payment from a customer on 1/15. Total bill is $100. Credit card processing company assesses the restaurant a 3% discount. 2) The net amount is deposited into the restaurant's bank account on 1/17. YOU DO NOT NEED TO UPLOAD YOUR COMPLETED EXERCISE AT THIS TIME. Just answer the questions below in the order they are posed by clicking the Submit Answer button. a) After completing all of the entries in Exercise One, what is the correct account balance for Allowance for Doubtful Accounts? See circle on the printed exercise. ( 5 points for correct answer. No partial credit). b) After completing all of the entries in Exercise One, what is the correct account balance for Uncollectible Accounts Expense? See circle on the printed exercise. ( 5 points for correct answer. No partial credit). c) After completing all of the entries in Exercise Two, what is the correct account balance for Allowance for Doubtful Accounts? See circle on the printed exercise. ( 5 points for correct answer. No partial credit). d) After completing all of the entries in Exercise Two, what is the correct total Uncollectible Accounts Expense? See circle on the printed exercise. (5 points for correct answer. No partial credit). When accounting for uncollectible receivables, there are two methods available. The Direct Write-off method can only be used in businesses where the receivables and uncollectible amounts are immaterial as it does not adhere to GAAP. The Allowance Method is preferred. DIRECT WRITE-OFF METHOD FOR UNCOLLECTIBLE ACCOUNTS Review the completed example below. Under this method, accounts are written off and expensed at the time they are deemed uncollectible. 1) March: Raptor Inc. records a sale on account to Jefferson C0. of $10,000. 2) July: After repeated attempts to collect, Raptor inc determines that the $10,000 receivable is uncollectible. Record the entry to write-off the balance. 3) August: Out of the blue, Raptor receives a check from Jefferson Co. for $10,000 to pay off their old receivable. ALLOWANCE METHOD FOR UNCOLLECTIBLE ACCOUNTS If you are using the Allowance Method (acceptable by GAAP), there are 2 ways to estimate uncollectible receivables and establish the Allowance for Uncollectible (Doubtiul) Accounts balance. Use the t-accounts on the next page to complete the following problem. If you get stuck, there are many example problems online and in your text. EXERCISE ONE: ESTIMATE BASED ON SALES 1) June 30: A business records $750,000 in credit sales for the month of June. In the past, approximately 2% of all credit sales ultimately become uncollectible. Record the sales entry and the entry to establish the Allowance for Doubttul Accounts balance. 2) July 15: The company determines that an account balance from Susan Kendall in the amount of $3,000 is uncollectible. Record the entry to write-off the balance. 3) July 31: The same business recorded $600,000 in credit sales for the next month (July). Using the same 2% uncollectible rate, record the sales entry and the entry to add to the Allowance for Doubtful Accounts balance. EXAMPLE: ESTIMATE BASED ON AGING OF RECEIVABLES Review the following completed example using the Aging of Receivables method. Blocker Company estimates its uncollectible accounts based on an Aging of Recelvables analysis. On December 31 , an Aging Schedule for the company's $88,000 in Accounts Receivable is prepared. The Allowance for Doubtful Accounts (prior to adjustment) has a credit balance of $210. 1) Dec 31: Record the entry to record the company's estimate of uncollectible accounts When making this entry you must pay attention to the balance that already exists in the Allowance account. After your entry, the balance in your account should equal $6,288 in this case ($6,288210 balance =$6,078 entry). The $6,288 is the current estimate of how much you anticipate to become uncollectible. 2) Feb 15: Prepare the entries to write-off the following accounts as uncollectible. 3) March 25: Record the entry to reflecting the receipt of the $450 owed by J. Kyle. This entry involves two steps. First, reinstate the account (i.e. reverse the write-off entry) Second, record the cash payment. NOTE: When making the entry for step #2, the debit (in this case for all three uncollectible accounts) goes to the Allowance for Doubtful Accounts. The Uncollectible Accounts Expense account was debited (increased) earlier then the allowance was established. EXERCISE TWO: Complete the following problem using the provided t-accounts. If you get stuck, review the completed example above once again. Roduk Inc. uses the Allowance method for accounting for uncollectible recelvables. (a) Record the adjusting entry at December 31 , the end of the fiscal year. to estimate for doubtful acoounts. The accounts recelvable account has a balance of $200,000, and the Allowance for Doubtful Accounts before adjustment has a credit balance of $4,200. Analysis of an aging of receivables estimates doubtful accounts of $8,000 at 12/31. (b) In April of the following fiscal year, $700 owed by Kathy Jones on account is written off as uncollectible. (c) A few weeks later. Kathy pays the $700 balance. Review the completed example below: 1) Dec 1st A 90 -day promissory note is granted to J. Smith, with a principal amount of $800. J. Smith (borrower or "maker') signs the 90 day, 15% note receivable for the amount. 2) Dec 31st - The accounting period ends on December 31st. Record the interest earned to date. $80015%1/12=$10/month 3) March 1st. Accrued remaining interest on the note and received payment. $80015%2/12=$20 CREDIT CARD SALES Review the completed example below 1) A restaurant accepts credit card for payment from a customer on 1/15. Total bill is $100. Credit card processing company assesses the restaurant a 3% discount. 2) The net amount is deposited into the restaurant's bank account on 1/17