Just answer requirement 4 & 5, thank you!

Just answer requirement 4 & 5, thank you!

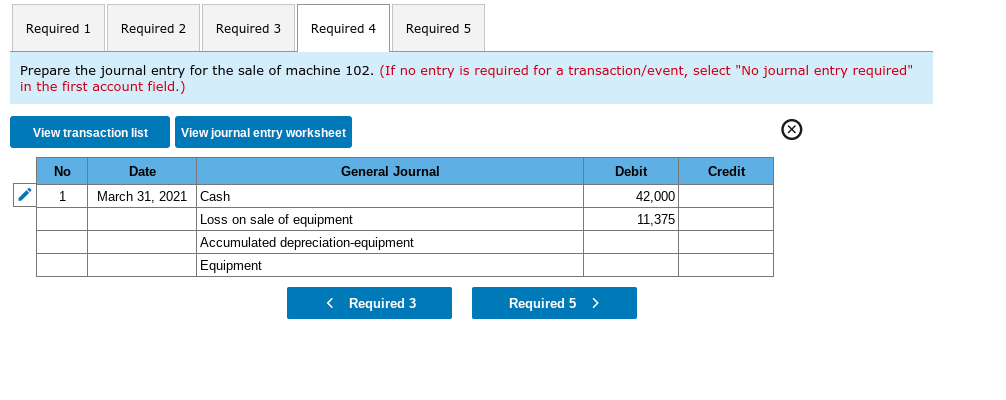

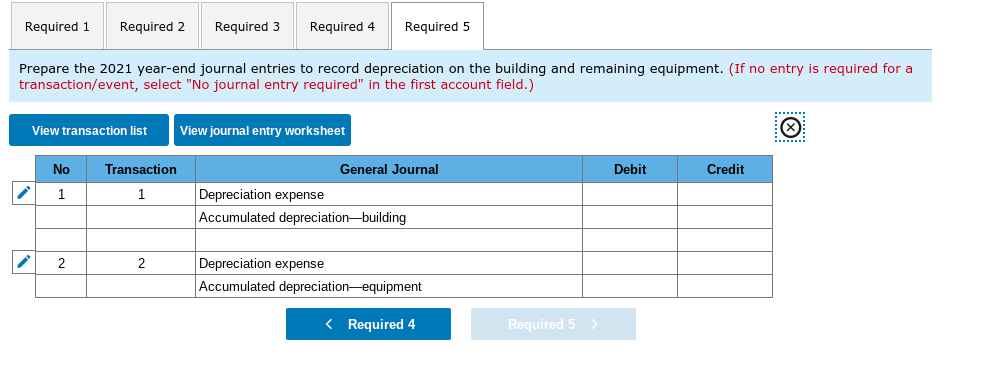

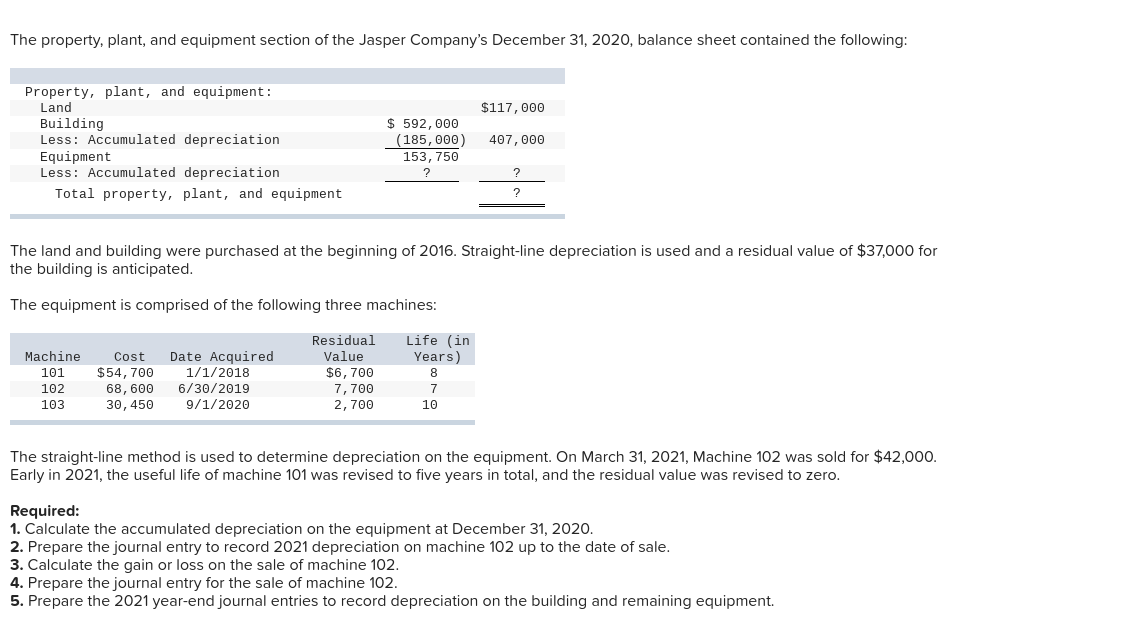

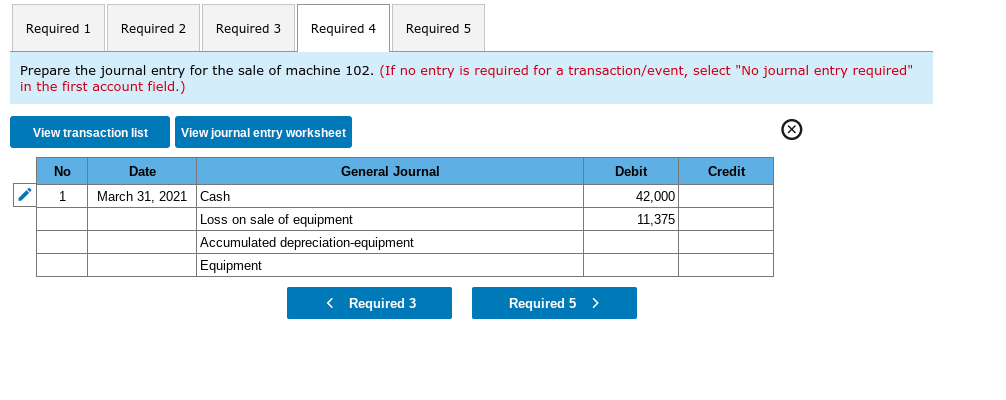

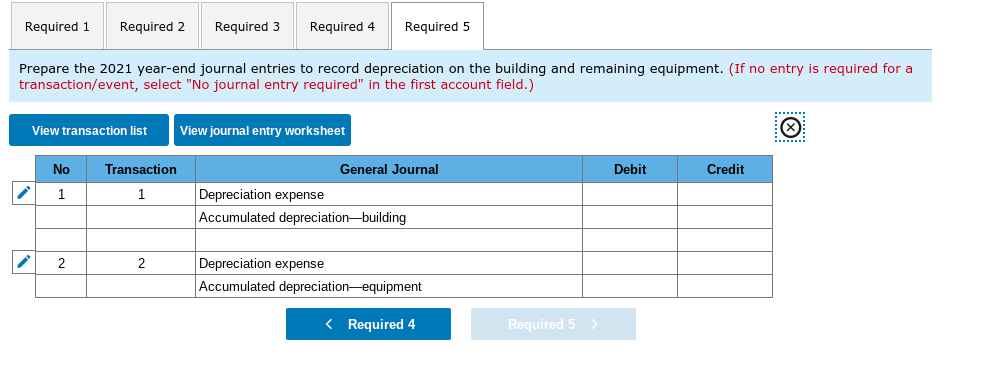

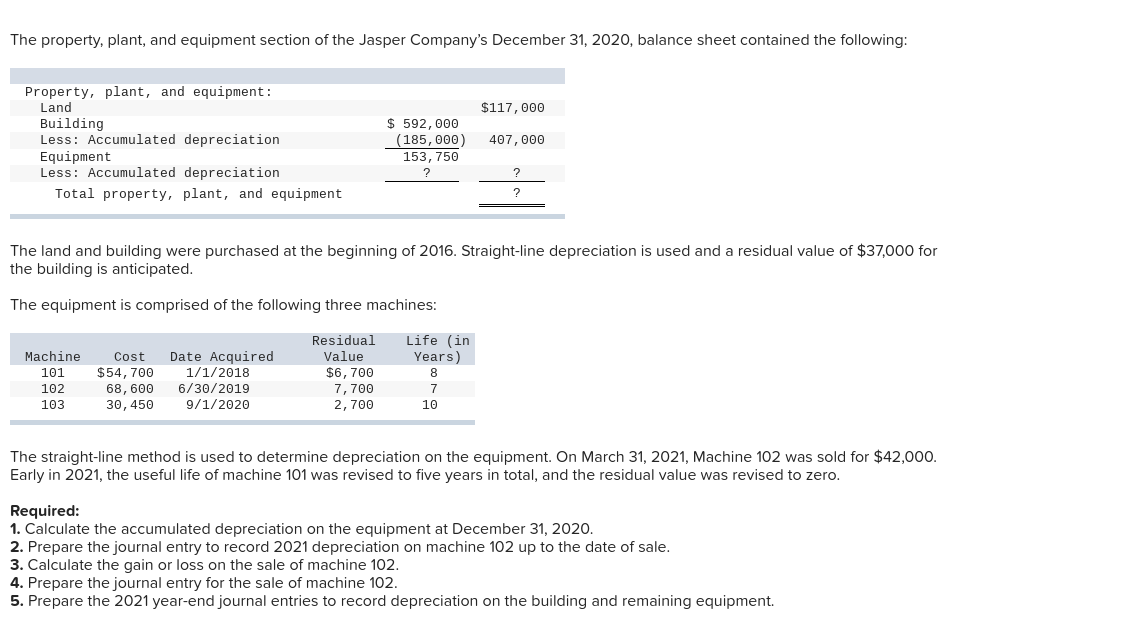

Required 1 Required 2 Required 3 Required 4 Required 5 Prepare the journal entry for the sale of machine 102. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list View journal entry worksheet No Date General Journal Debit Credit 1 42.000 11,375 March 31, 2021 Cash Loss on sale of equipment Accumulated depreciation-equipment Equipment Required 1 Required 2 Required 3 Required 4 Required 5 Prepare the 2021 year-end journal entries to record depreciation on the building and remaining equipment. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list View journal entry worksheet No Transaction Debit Credit 1 1 General Journal Depreciation expense Accumulated depreciation building 2 2 Depreciation expense Accumulated depreciation equipment > The property, plant, and equipment section of the Jasper Company's December 31, 2020, balance sheet contained the following: $117,000 Property, plant, and equipment: Land Building Less: Accumulated depreciation Equipment Less: Accumulated depreciation Total property, plant, and equipment $ 592,000 (185, 000) 153, 750 ? 407,000 ? The land and building were purchased at the beginning of 2016. Straight-line depreciation is used and a residual value of $37,000 for the building is anticipated. The equipment is comprised of the following three machines: Machine 101 102 103 Cost $54,700 68,600 30, 450 Date Acquired 1/1/2018 6/30/2019 9/1/2020 Residual Value $6,700 7,700 2,700 Life (in Years) 8 7 10 The straight-line method is used to determine depreciation on the equipment. On March 31, 2021, Machine 102 was sold for $42,000. Early in 2021, the useful life of machine 101 was revised to five years in total, and the residual value was revised to zero. Required: 1. Calculate the accumulated depreciation on the equipment at December 31, 2020. 2. Prepare the journal entry to record 2021 depreciation on machine 102 up to the date of sale. 3. Calculate the gain or loss on the sale of machine 102. 4. Prepare the journal entry for the sale of machine 102. 5. Prepare the 2021 year-end journal entries to record depreciation on the building and remaining equipment

Just answer requirement 4 & 5, thank you!

Just answer requirement 4 & 5, thank you!