just answer the excel sheet (the journal entries) with the type number. that's everything I have, thank you

just answer the excel sheet (the journal entries) with the type number. that's everything I have, thank you

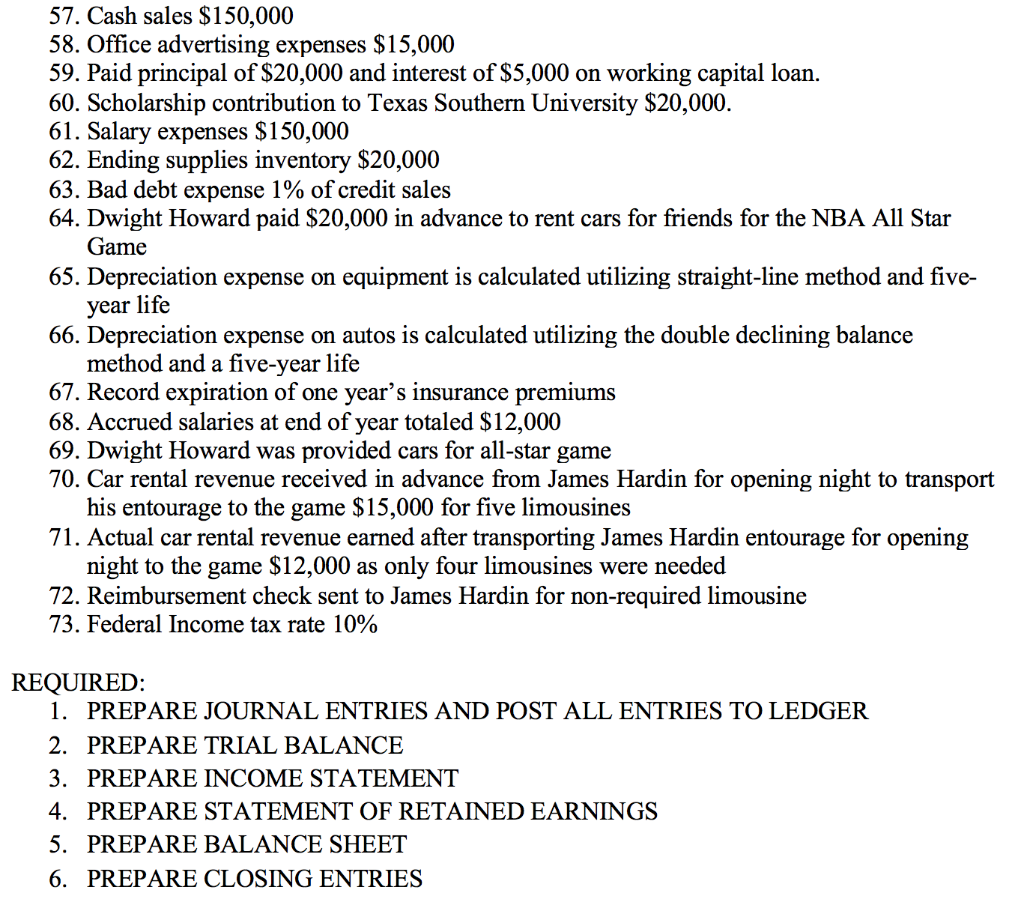

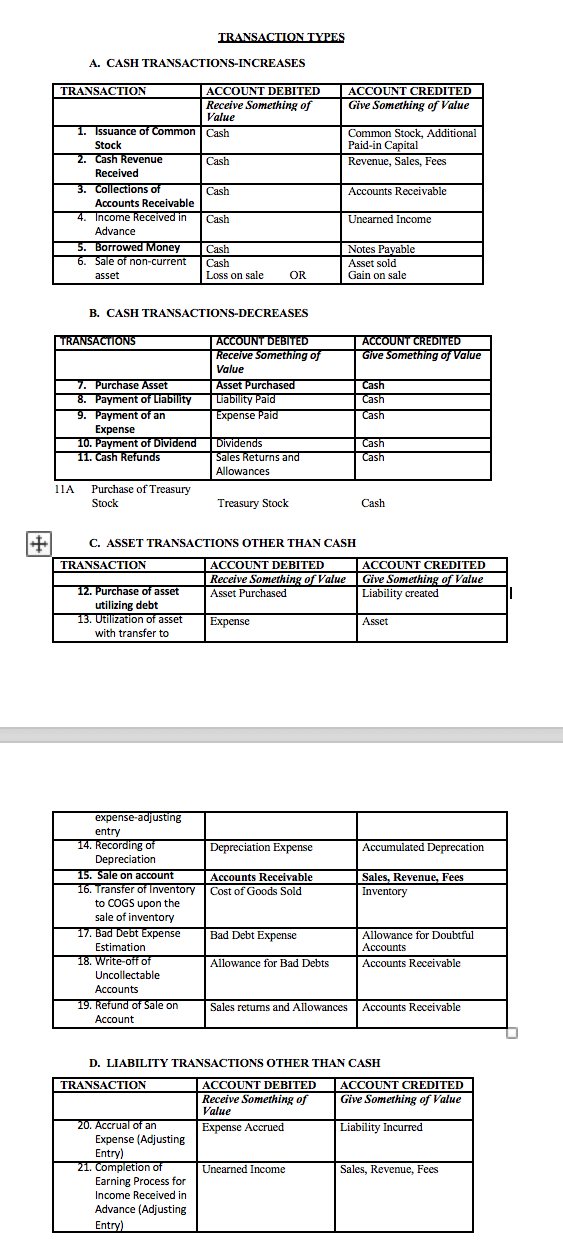

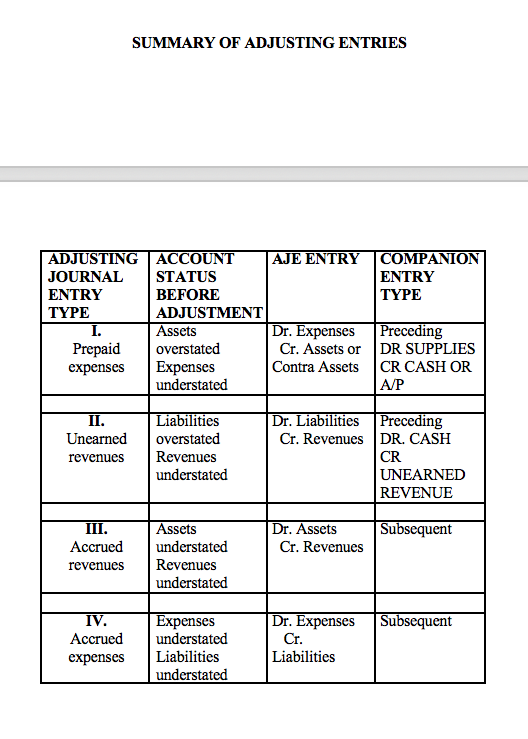

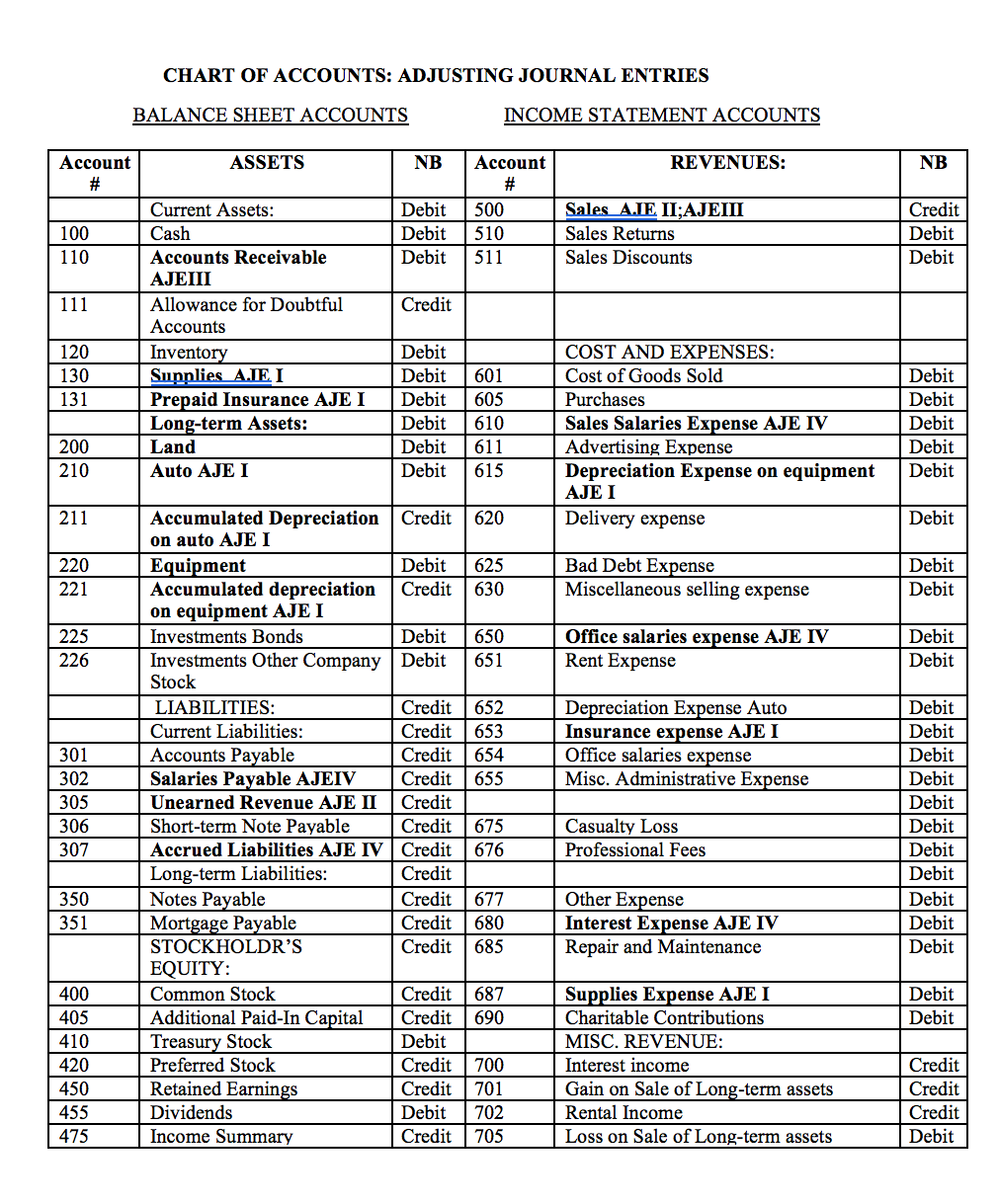

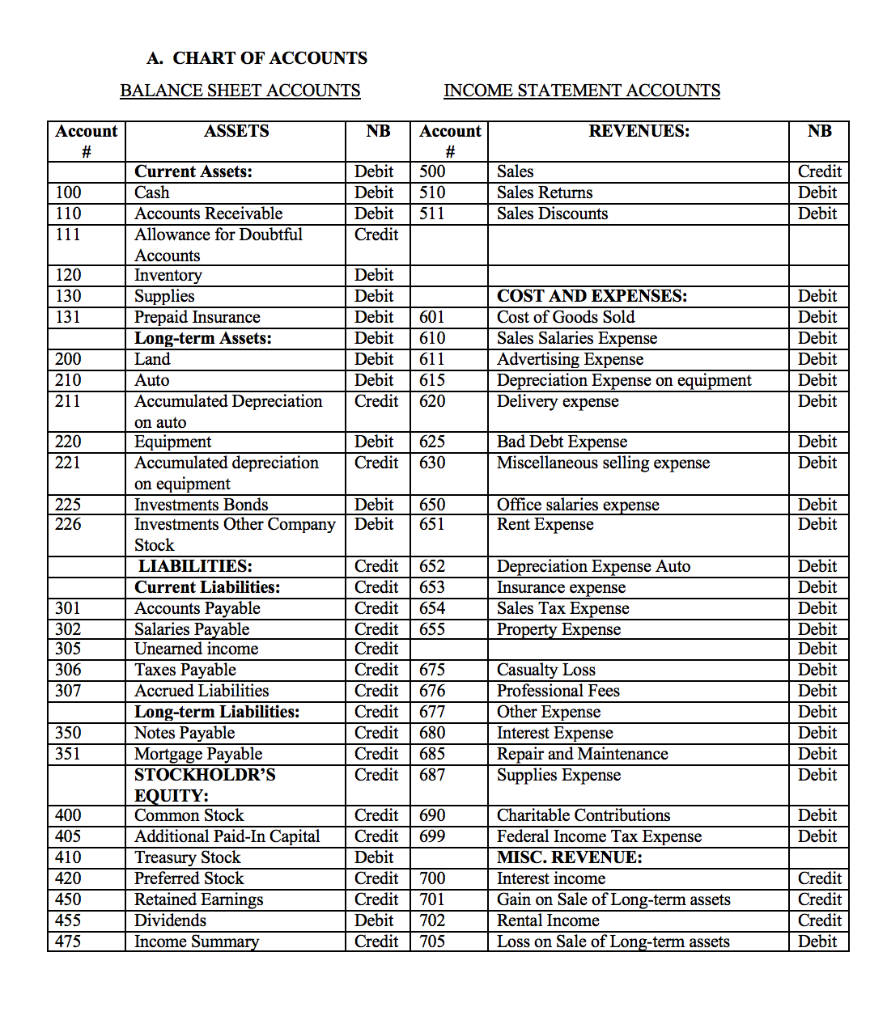

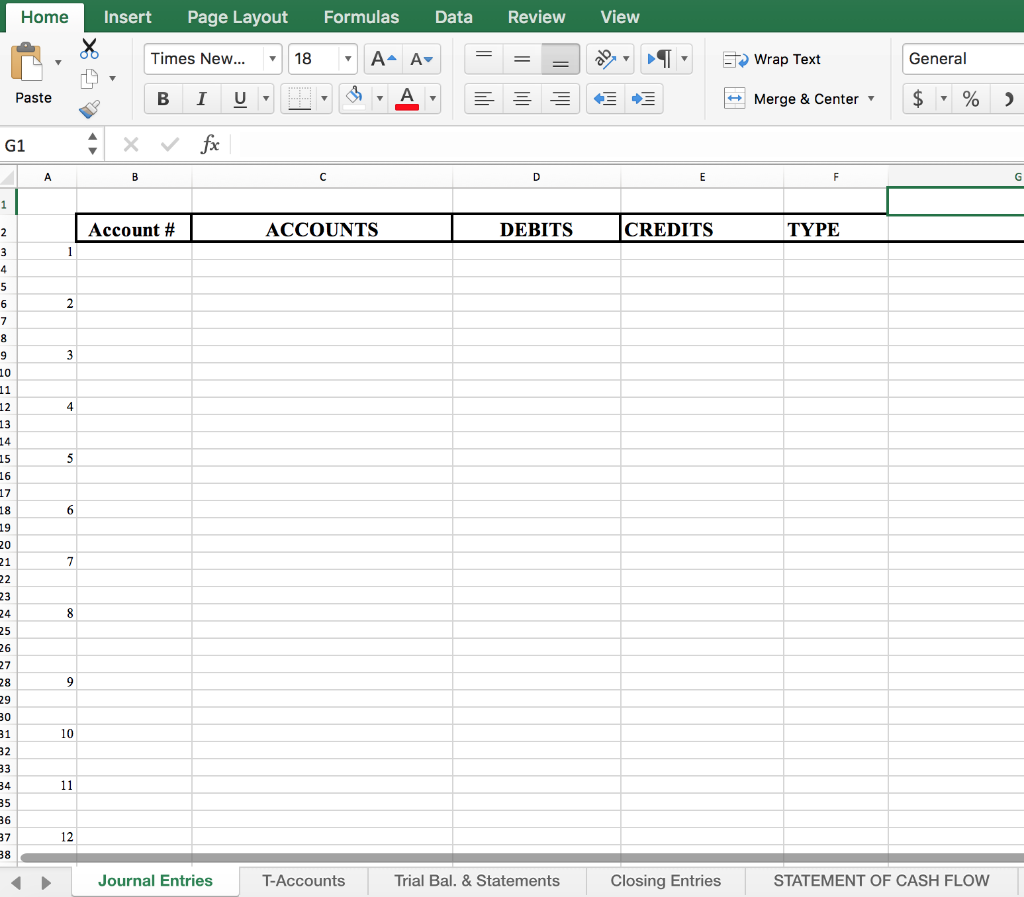

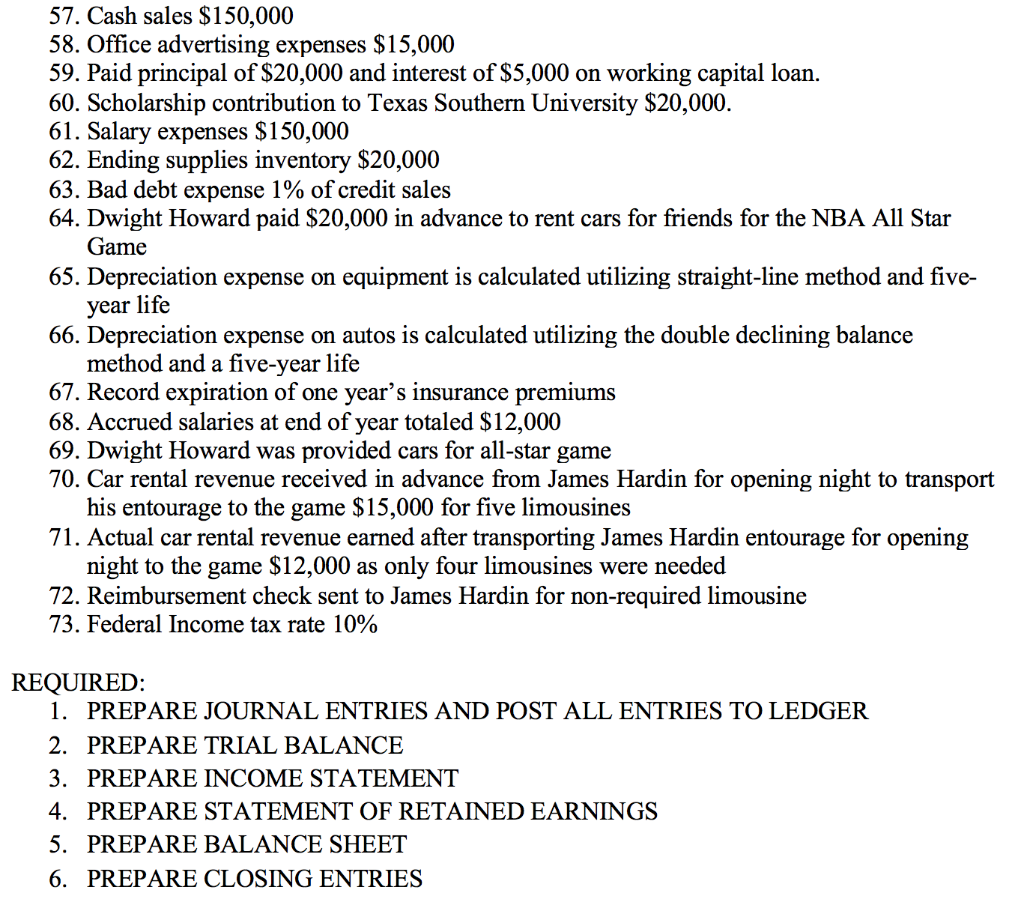

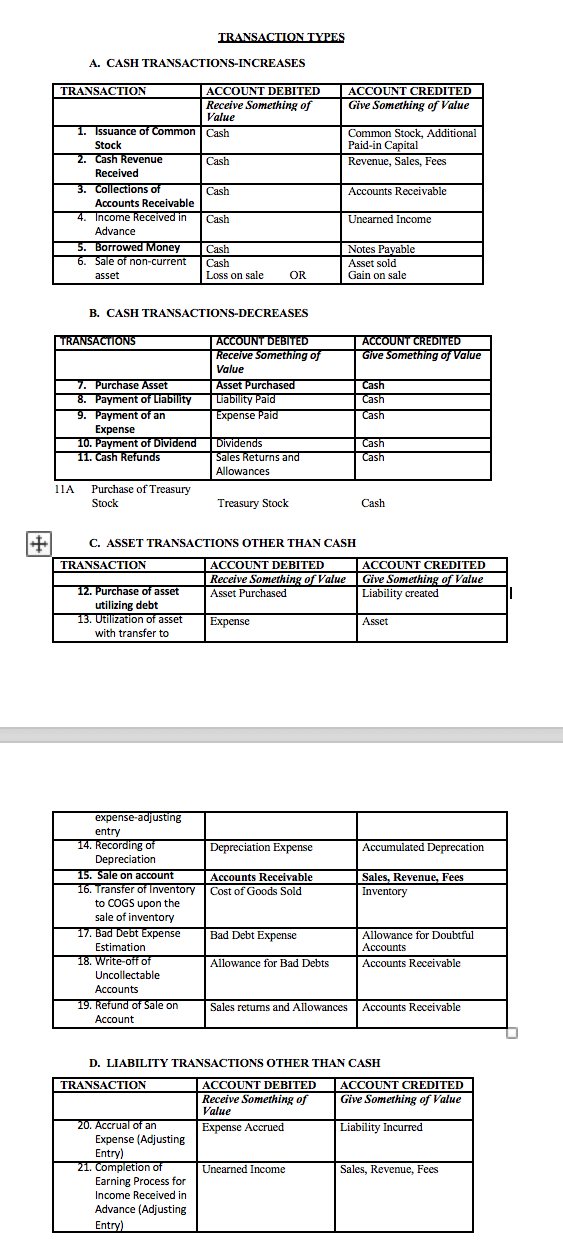

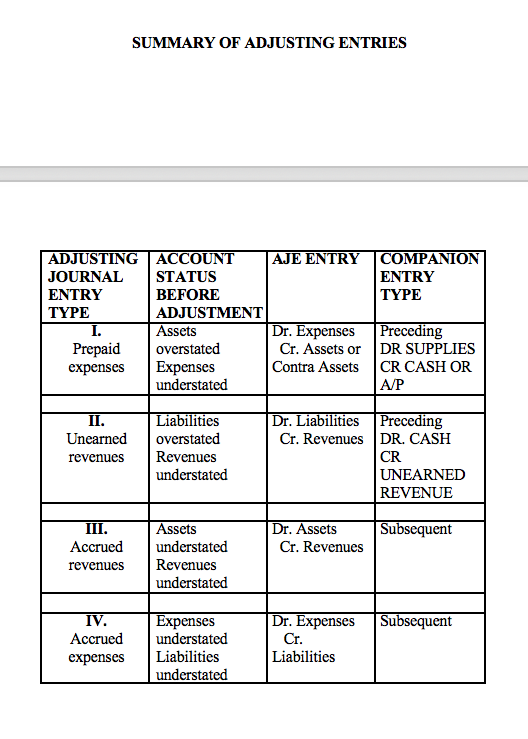

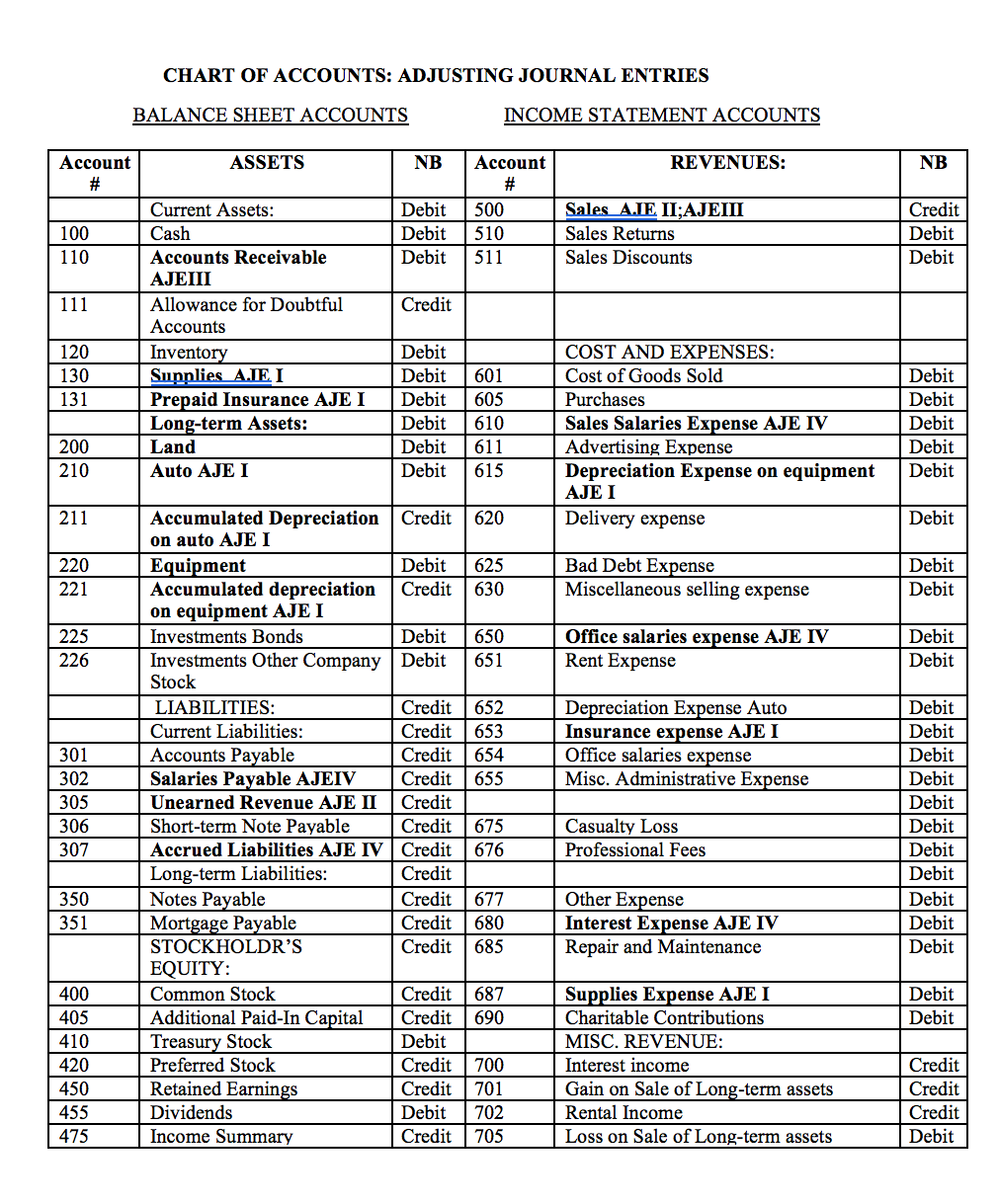

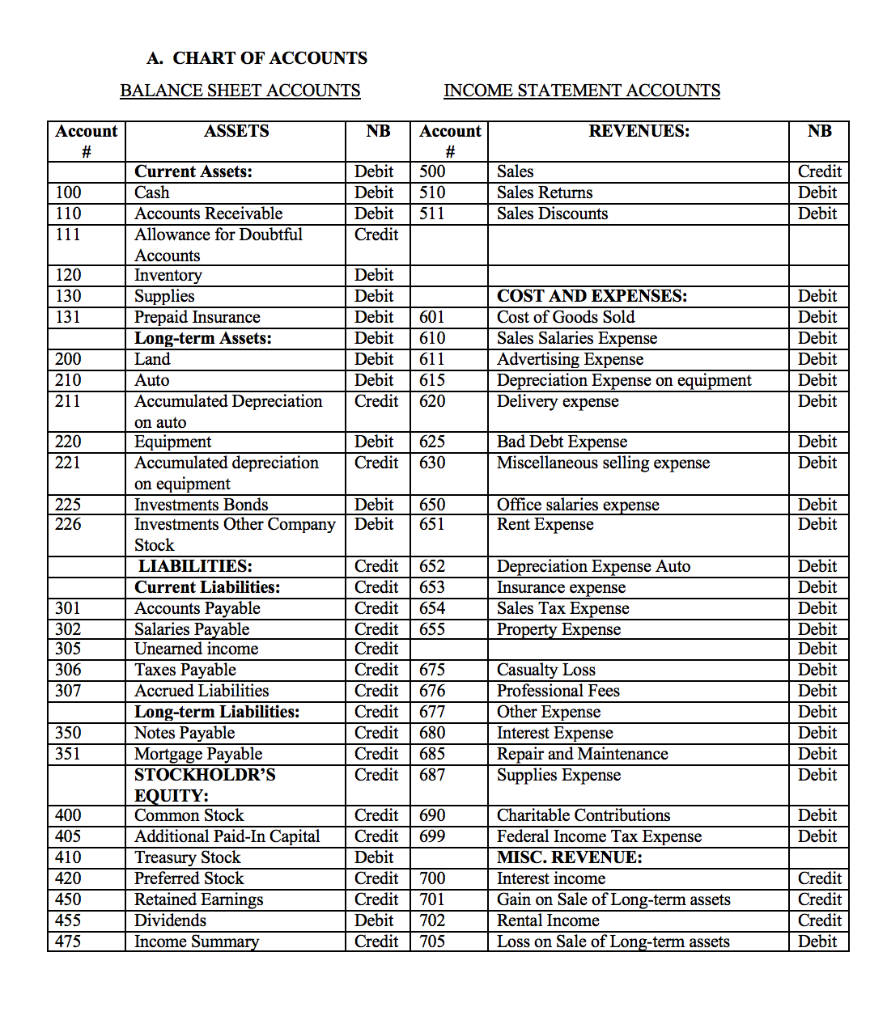

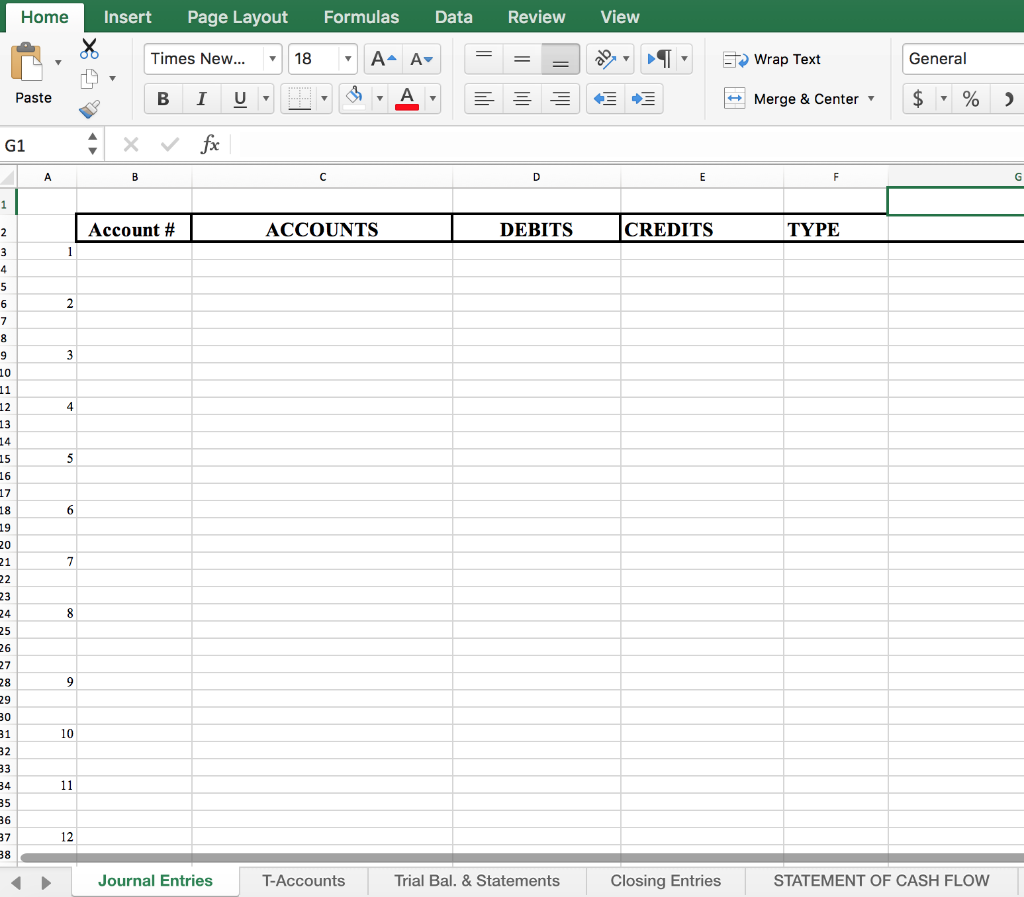

57. Cash sales $150,000 58. Office advertising expenses $15,000 59. Paid principal of $20,000 and interest of $5,000 on working capital loan. 60. Scholarship contribution to Texas Southern University $20,000. 61. Salary expenses $150,000 62. Ending supplies inventory $20,000 63. Bad debt expense 1% of credit sales 64. Dwight Howard paid $20,000 in advance to rent cars for friends for the NBA All Star Game 65. Depreciation expense on equipment is calculated utilizing straight-line method and five- year life 66. Depreciation expense on autos is calculated utilizing the double declining balance method and a five-year life 67. Record expiration of one year's insurance premiums 68. Accrued salaries at end of year totaled $12,000 69. Dwight Howard was provided cars for all-star game 70. Car rental revenue received in advance from James Hardin for opening night to transport his entourage to the game $15,000 for five limousines 71. Actual car rental revenue earned after transporting James Hardin entourage for opening night to the game $12,000 as only four limousines were needed 72. Reimbursement check sent to James Hardin for non-required limousine 73. Federal Income tax rate 10% REQUIRED: 1. PREPARE JOURNAL ENTRIES AND POST ALL ENTRIES TO LEDGER 2. PREPARE TRIAL BALANCE 3. PREPARE INCOME STATEMENT 4. PREPARE STATEMENT OF RETAINED EARNINGS 5. PREPARE BALANCE SHEET 6. PREPARE CLOSING ENTRIES TRANSACTION TYPES A. CASH TRANSACTIONS-INCREASES ACCOUNT CREDITED Give Something of Value Common Stock, Additional Paid-in Capital Revenue, Sales, Fees TRANSACTION ACCOUNT DEBITED Receive Something of Value 1. Issuance of Common Cash Stock 2. Cash Revenue Cash Received 3. Collections of Cash Accounts Receivable 4. Income Received in Cash Advance 5. Borrowed Money Cash 6. Sale of non-current Cash asset Loss on sale OR Accounts Receivable Unearned Income Notes Payable Asset sold Gain on sale B. CASH TRANSACTIONS-DECREASES TRANSACTIONS ACCOUNT CREDITED Give Something of Value ACCOUNT DEBITED Receive Something of Value Asset Purchased Liability Paid Expense Paid Cash Cash Cash 7. Purchase Asset 3. Payment of Liability 9. Payment of an Expense 10. Payment of Dividend 11. Cash Refunds Dividends Sales Returns and Allowances Cash Cash IIA Purchase of Treasury Stock Treasury Stock Cash ++ C. ASSET TRANSACTIONS OTHER THAN CASH TRANSACTION ACCOUNT DEBITED ACCOUNT CREDITED Receive Something of Value Give Something of Value Asset Purchased Liability created 12. Purchase of asset utilizing debt 13. Utilization of asset with transfer to Expense Asset Depreciation Expense Accumulated Deprecation Accounts Receivable Cost of Goods Sold Sales, Revenue, Fees Inventory expense-adjusting entry 14. Recording of Depreciation 15. Sale on account 16. Transfer of Inventory to COGS upon the sale of inventory 17. Bad Debt Expense Estimation 18. Write-off of Uncollectable Accounts 19. Refund of Sale on Account Bad Debt Expense Allowance for Doubtful Accounts Accounts Receivable Allowance for Bad Debts Sales retums and Allowances Accounts Receivable D. LIABILITY TRANSACTIONS OTHER THAN CASH TRANSACTION ACCOUNT CREDITED Give Something of Value ACCOUNT DEBITED Receive Something of Value Expense Accrued Liability Incurred Unearned Income Sales, Revenue, Fees 20. Accrual of an Expense (Adjusting Entry) 21. Completion of Earning Process for Income Received in Advance (Adjusting Entry) SUMMARY OF ADJUSTING ENTRIES ADJUSTING ACCOUNT AJE ENTRY COMPANION JOURNAL STATUS ENTRY ENTRY BEFORE TYPE TYPE ADJUSTMENT I. Assets Dr. Expenses Preceding Prepaid overstated Cr. Assets or DR SUPPLIES expenses Expenses Contra Assets CR CASH OR understated A/P II. Unearned revenues Liabilities overstated Revenues understated Dr. Liabilities Preceding Cr. Revenues DR. CASH CR UNEARNED REVENUE III. Accrued revenues Dr. Assets Cr. Revenues Subsequent Assets understated Revenues understated Subsequent IV. Accrued expenses Expenses understated Liabilities understated Dr. Expenses Cr. Liabilities CHART OF ACCOUNTS: ADJUSTING JOURNAL ENTRIES BALANCE SHEET ACCOUNTS INCOME STATEMENT ACCOUNTS ASSETS NB REVENUES: NB Account # Account # 500 510 511 Debit Debit Debit 100 110 Sales AJE II;AJEIII Sales Returns Sales Discounts Credit Debit Debit 111 Credit Current Assets: Cash Accounts Receivable AJEIII Allowance for Doubtful Accounts Inventory Supplies AJE I Prepaid Insurance AJE I Long-term Assets: Land Auto AJE I 120 130 131 Debit Debit Debit Debit Debit Debit 601 605 610 611 615 COST AND EXPENSES: Cost of Goods Sold Purchases Sales Salaries Expense AJE IV Advertising Expense Depreciation Expense on equipment AJE I Delivery expense Debit Debit Debit Debit Debit 200 210 211 Credit 620 Debit 220 Debit Credit 625 630 Bad Debt Expense Miscellaneous selling expense Debit Debit 221 225 Debit Debit 650 651 Office salaries expense AJE IV Rent Expense Debit Debit 226 Depreciation Expense Auto Insurance expense AJE I Office salaries expense Misc. Administrative Expense 301 302 655 305 306 307 Accumulated Depreciation on auto AJE I Equipment Accumulated depreciation on equipment AJE I Investments Bonds Investments Other Company Stock LIABILITIES: Current Liabilities: Accounts Payable Salaries Payable AJEIV Unearned Revenue AJE II Short-term Note Payable Accrued Liabilities AJE IV Long-term Liabilities: Notes Payable Mortgage Payable STOCKHOLDR'S EQUITY: Common Stock Additional Paid-In Capital Treasury Stock Preferred Stock Retained Earnings Dividends Income Summary Credit 652 Credit 653 Credit 654 Credit Credit Credit 675 Credit 676 Credit Credit 677 Credit 680 Credit 685 Casualty Loss Professional Fees Debit Debit Debit Debit Debit Debit Debit Debit Debit Debit Debit 350 351 Other Expense Interest Expense AJE IV Repair and Maintenance 687 690 Debit Debit 400 405 410 420 450 455 475 Credit Credit Debit Credit Credit Debit Credit 700 701 702 705 Supplies Expense AJE I Charitable Contributions MISC. REVENUE: Interest income Gain on Sale of Long-term assets Rental Income Loss on Sale of Long-term assets Credit Credit Credit Debit A. CHART OF ACCOUNTS BALANCE SHEET ACCOUNTS INCOME STATEMENT ACCOUNTS REVENUES: NB Account # 500 510 511 100 Sales Sales Returns Sales Discounts Credit Debit Debit 601 610 611 615 620 COST AND EXPENSES: Cost of Goods Sold Sales Salaries Expense Advertising Expense Depreciation Expense on equipment Delivery expense Debit Debit Debit Debit Debit Debit 211 220 625 630 Bad Debt Expense Miscellaneous selling expense Debit Debit 650 651 Office salaries expense Rent Expense Debit Debit Account ASSETS NB # Current Assets: Debit Cash Debit 110 Accounts Receivable Debit 111 Allowance for Doubtful Credit Accounts 120 Inventory Debit 130 Supplies Debit 131 Prepaid Insurance Debit Long-term Assets: Debit 200 Land Debit 210 Auto Debit Accumulated Depreciation Credit on auto Equipment Debit 221 Accumulated depreciation Credit on equipment 225 Investments Bonds Debit 226 Investments Other Company Debit Stock LIABILITIES: Credit Current Liabilities: Credit 301 Accounts Payable Credit 302 Salaries Payable Credit 305 Unearned income Credit 306 Taxes Payable Credit 307 Accrued Liabilities Credit Long-term Liabilities: Credit 350 Notes Payable Credit 351 Mortgage Payable Credit STOCKHOLDR'S Credit EQUITY: 400 Common Stock Credit 405 Additional Paid-In Capital Credit 410 Treasury Stock Debit 420 Preferred Stock Credit 450 Retained Earnings Credit 455 Dividends Debit 475 Income Summary Credit 652 653 654 655 Depreciation Expense Auto Insurance expense Sales Tax Expense Property Expense 675 676 677 680 685 687 Casualty Loss Professional Fees Other Expense Interest Expense Repair and Maintenance Supplies Expense Debit Debit Debit Debit Debit Debit Debit Debit Debit Debit Debit Debit 690 699 Debit 700 701 702 705 Charitable Contributions Federal Income Tax Expense MISC. REVENUE: Interest income Gain on Sale of Long-term assets Rental Income Loss on Sale of Long-term assets Credit Credit Credit Debit Home Insert Page Layout Formulas Data Review View Times New... 18 A- A- Wrap Text General Paste B I U + Merge & Center $ % > G1 fxx A B D E F G 1 Account # ACCOUNTS DEBITS CREDITS TYPE 1 2 3 4 5 6 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 7 8 9 10 11 12 Journal Entries T-Accounts Trial Bal. & Statements Closing Entries STATEMENT OF CASH FLOW 57. Cash sales $150,000 58. Office advertising expenses $15,000 59. Paid principal of $20,000 and interest of $5,000 on working capital loan. 60. Scholarship contribution to Texas Southern University $20,000. 61. Salary expenses $150,000 62. Ending supplies inventory $20,000 63. Bad debt expense 1% of credit sales 64. Dwight Howard paid $20,000 in advance to rent cars for friends for the NBA All Star Game 65. Depreciation expense on equipment is calculated utilizing straight-line method and five- year life 66. Depreciation expense on autos is calculated utilizing the double declining balance method and a five-year life 67. Record expiration of one year's insurance premiums 68. Accrued salaries at end of year totaled $12,000 69. Dwight Howard was provided cars for all-star game 70. Car rental revenue received in advance from James Hardin for opening night to transport his entourage to the game $15,000 for five limousines 71. Actual car rental revenue earned after transporting James Hardin entourage for opening night to the game $12,000 as only four limousines were needed 72. Reimbursement check sent to James Hardin for non-required limousine 73. Federal Income tax rate 10% REQUIRED: 1. PREPARE JOURNAL ENTRIES AND POST ALL ENTRIES TO LEDGER 2. PREPARE TRIAL BALANCE 3. PREPARE INCOME STATEMENT 4. PREPARE STATEMENT OF RETAINED EARNINGS 5. PREPARE BALANCE SHEET 6. PREPARE CLOSING ENTRIES TRANSACTION TYPES A. CASH TRANSACTIONS-INCREASES ACCOUNT CREDITED Give Something of Value Common Stock, Additional Paid-in Capital Revenue, Sales, Fees TRANSACTION ACCOUNT DEBITED Receive Something of Value 1. Issuance of Common Cash Stock 2. Cash Revenue Cash Received 3. Collections of Cash Accounts Receivable 4. Income Received in Cash Advance 5. Borrowed Money Cash 6. Sale of non-current Cash asset Loss on sale OR Accounts Receivable Unearned Income Notes Payable Asset sold Gain on sale B. CASH TRANSACTIONS-DECREASES TRANSACTIONS ACCOUNT CREDITED Give Something of Value ACCOUNT DEBITED Receive Something of Value Asset Purchased Liability Paid Expense Paid Cash Cash Cash 7. Purchase Asset 3. Payment of Liability 9. Payment of an Expense 10. Payment of Dividend 11. Cash Refunds Dividends Sales Returns and Allowances Cash Cash IIA Purchase of Treasury Stock Treasury Stock Cash ++ C. ASSET TRANSACTIONS OTHER THAN CASH TRANSACTION ACCOUNT DEBITED ACCOUNT CREDITED Receive Something of Value Give Something of Value Asset Purchased Liability created 12. Purchase of asset utilizing debt 13. Utilization of asset with transfer to Expense Asset Depreciation Expense Accumulated Deprecation Accounts Receivable Cost of Goods Sold Sales, Revenue, Fees Inventory expense-adjusting entry 14. Recording of Depreciation 15. Sale on account 16. Transfer of Inventory to COGS upon the sale of inventory 17. Bad Debt Expense Estimation 18. Write-off of Uncollectable Accounts 19. Refund of Sale on Account Bad Debt Expense Allowance for Doubtful Accounts Accounts Receivable Allowance for Bad Debts Sales retums and Allowances Accounts Receivable D. LIABILITY TRANSACTIONS OTHER THAN CASH TRANSACTION ACCOUNT CREDITED Give Something of Value ACCOUNT DEBITED Receive Something of Value Expense Accrued Liability Incurred Unearned Income Sales, Revenue, Fees 20. Accrual of an Expense (Adjusting Entry) 21. Completion of Earning Process for Income Received in Advance (Adjusting Entry) SUMMARY OF ADJUSTING ENTRIES ADJUSTING ACCOUNT AJE ENTRY COMPANION JOURNAL STATUS ENTRY ENTRY BEFORE TYPE TYPE ADJUSTMENT I. Assets Dr. Expenses Preceding Prepaid overstated Cr. Assets or DR SUPPLIES expenses Expenses Contra Assets CR CASH OR understated A/P II. Unearned revenues Liabilities overstated Revenues understated Dr. Liabilities Preceding Cr. Revenues DR. CASH CR UNEARNED REVENUE III. Accrued revenues Dr. Assets Cr. Revenues Subsequent Assets understated Revenues understated Subsequent IV. Accrued expenses Expenses understated Liabilities understated Dr. Expenses Cr. Liabilities CHART OF ACCOUNTS: ADJUSTING JOURNAL ENTRIES BALANCE SHEET ACCOUNTS INCOME STATEMENT ACCOUNTS ASSETS NB REVENUES: NB Account # Account # 500 510 511 Debit Debit Debit 100 110 Sales AJE II;AJEIII Sales Returns Sales Discounts Credit Debit Debit 111 Credit Current Assets: Cash Accounts Receivable AJEIII Allowance for Doubtful Accounts Inventory Supplies AJE I Prepaid Insurance AJE I Long-term Assets: Land Auto AJE I 120 130 131 Debit Debit Debit Debit Debit Debit 601 605 610 611 615 COST AND EXPENSES: Cost of Goods Sold Purchases Sales Salaries Expense AJE IV Advertising Expense Depreciation Expense on equipment AJE I Delivery expense Debit Debit Debit Debit Debit 200 210 211 Credit 620 Debit 220 Debit Credit 625 630 Bad Debt Expense Miscellaneous selling expense Debit Debit 221 225 Debit Debit 650 651 Office salaries expense AJE IV Rent Expense Debit Debit 226 Depreciation Expense Auto Insurance expense AJE I Office salaries expense Misc. Administrative Expense 301 302 655 305 306 307 Accumulated Depreciation on auto AJE I Equipment Accumulated depreciation on equipment AJE I Investments Bonds Investments Other Company Stock LIABILITIES: Current Liabilities: Accounts Payable Salaries Payable AJEIV Unearned Revenue AJE II Short-term Note Payable Accrued Liabilities AJE IV Long-term Liabilities: Notes Payable Mortgage Payable STOCKHOLDR'S EQUITY: Common Stock Additional Paid-In Capital Treasury Stock Preferred Stock Retained Earnings Dividends Income Summary Credit 652 Credit 653 Credit 654 Credit Credit Credit 675 Credit 676 Credit Credit 677 Credit 680 Credit 685 Casualty Loss Professional Fees Debit Debit Debit Debit Debit Debit Debit Debit Debit Debit Debit 350 351 Other Expense Interest Expense AJE IV Repair and Maintenance 687 690 Debit Debit 400 405 410 420 450 455 475 Credit Credit Debit Credit Credit Debit Credit 700 701 702 705 Supplies Expense AJE I Charitable Contributions MISC. REVENUE: Interest income Gain on Sale of Long-term assets Rental Income Loss on Sale of Long-term assets Credit Credit Credit Debit A. CHART OF ACCOUNTS BALANCE SHEET ACCOUNTS INCOME STATEMENT ACCOUNTS REVENUES: NB Account # 500 510 511 100 Sales Sales Returns Sales Discounts Credit Debit Debit 601 610 611 615 620 COST AND EXPENSES: Cost of Goods Sold Sales Salaries Expense Advertising Expense Depreciation Expense on equipment Delivery expense Debit Debit Debit Debit Debit Debit 211 220 625 630 Bad Debt Expense Miscellaneous selling expense Debit Debit 650 651 Office salaries expense Rent Expense Debit Debit Account ASSETS NB # Current Assets: Debit Cash Debit 110 Accounts Receivable Debit 111 Allowance for Doubtful Credit Accounts 120 Inventory Debit 130 Supplies Debit 131 Prepaid Insurance Debit Long-term Assets: Debit 200 Land Debit 210 Auto Debit Accumulated Depreciation Credit on auto Equipment Debit 221 Accumulated depreciation Credit on equipment 225 Investments Bonds Debit 226 Investments Other Company Debit Stock LIABILITIES: Credit Current Liabilities: Credit 301 Accounts Payable Credit 302 Salaries Payable Credit 305 Unearned income Credit 306 Taxes Payable Credit 307 Accrued Liabilities Credit Long-term Liabilities: Credit 350 Notes Payable Credit 351 Mortgage Payable Credit STOCKHOLDR'S Credit EQUITY: 400 Common Stock Credit 405 Additional Paid-In Capital Credit 410 Treasury Stock Debit 420 Preferred Stock Credit 450 Retained Earnings Credit 455 Dividends Debit 475 Income Summary Credit 652 653 654 655 Depreciation Expense Auto Insurance expense Sales Tax Expense Property Expense 675 676 677 680 685 687 Casualty Loss Professional Fees Other Expense Interest Expense Repair and Maintenance Supplies Expense Debit Debit Debit Debit Debit Debit Debit Debit Debit Debit Debit Debit 690 699 Debit 700 701 702 705 Charitable Contributions Federal Income Tax Expense MISC. REVENUE: Interest income Gain on Sale of Long-term assets Rental Income Loss on Sale of Long-term assets Credit Credit Credit Debit Home Insert Page Layout Formulas Data Review View Times New... 18 A- A- Wrap Text General Paste B I U + Merge & Center $ % > G1 fxx A B D E F G 1 Account # ACCOUNTS DEBITS CREDITS TYPE 1 2 3 4 5 6 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 7 8 9 10 11 12 Journal Entries T-Accounts Trial Bal. & Statements Closing Entries STATEMENT OF CASH FLOW

just answer the excel sheet (the journal entries) with the type number. that's everything I have, thank you

just answer the excel sheet (the journal entries) with the type number. that's everything I have, thank you