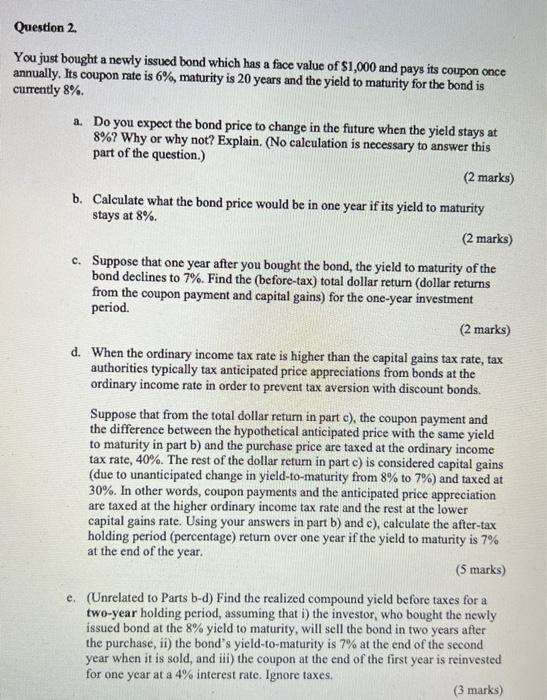

just bought a newly issued bond which has a face value of $1,000 and pays its coupon once ally. Its coupon rate is 6%, maturity is 20 years and the yield to maturity for the bond is ntly 8%. a. Do you expect the bond price to change in the future when the yield stays at 8% ? Why or why not? Explain. (No calculation is necessary to answer this part of the question.) (2 marks) b. Calculate what the bond price would be in one year if its yield to maturity stays at 8% (2 marks) c. Suppose that one year after you bought the bond, the yield to maturity of the bond declines to 7%. Find the (before-tax) total dollar return (dollar returns from the coupon payment and capital gains) for the one-year investment period. (2 marks) d. When the ordinary income tax rate is higher than the capital gains tax rate, tax authorities typically tax anticipated price appreciations from bonds at the ordinary income rate in order to prevent tax aversion with discount bonds. Suppose that from the total dollar return in part c), the coupon payment and the difference between the hypothetical anticipated price with the same yield to maturity in part b) and the purchase price are taxed at the ordinary income tax rate, 40%. The rest of the dollar return in part c) is considered capital gains (due to unanticipated change in yield-to-maturity from 8% to 7% ) and taxed at 30%. In other words, coupon payments and the anticipated price appreciation are taxed at the higher ordinary income tax rate and the rest at the lower capital gains rate. Using your answers in part b) and c), calculate the after-tax holding period (percentage) return over one year if the yield to maturity is 7% at the end of the year. (5 marks) e. (Unrelated to Parts b-d) Find the realized compound yield before taxes for a two-year holding period, assuming that i) the investor, who bought the newly issued bond at the 8% yield to maturity, will sell the bond in two years after the purchase, ii) the bond's yield-to-maturity is 7% at the end of the second year when it is sold, and iii) the coupon at the end of the first year is reinvested for one year at a 4% interest rate. Ignore taxes