just D, E, and F

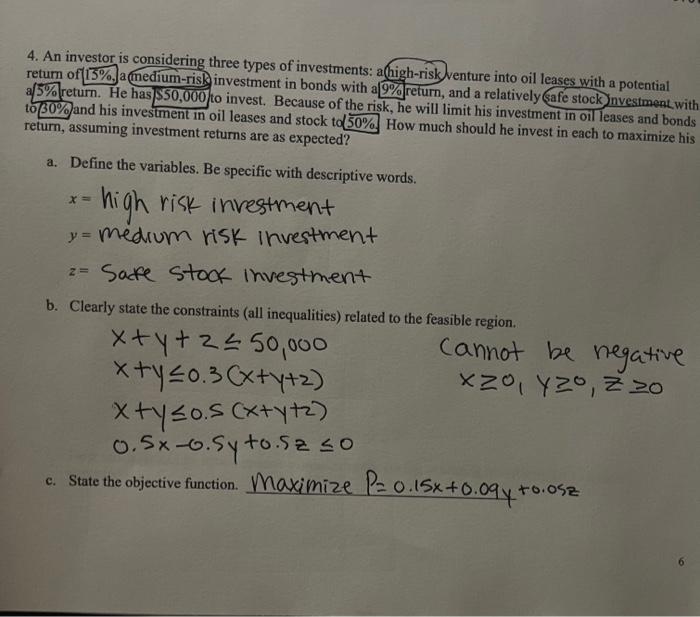

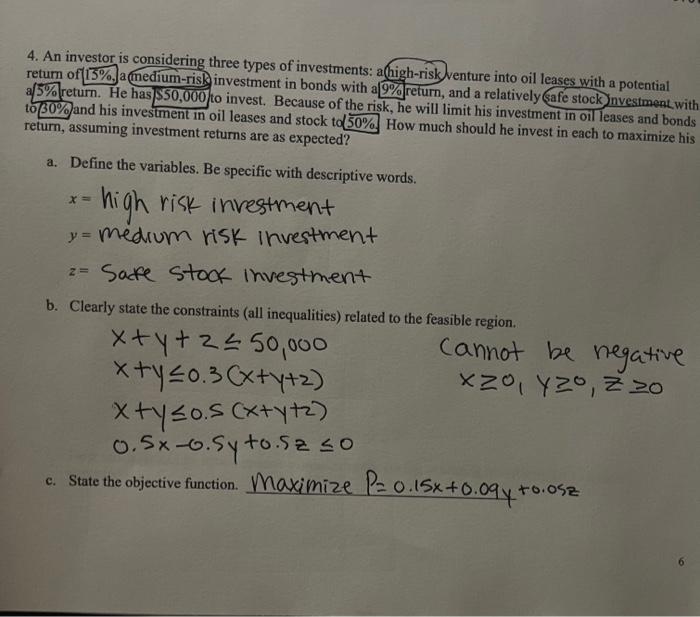

4. An investor is considering three types of investments: ahigh-risk venture into oil leases with a potential retum of 15%, Imedium-rish investment in bonds with a 9% return, and a relatively (afe stock) investment with a 5% return. He has 550,000 to invest. Because of the risk, he will limit his investment in oil leases and bonds to 30% and his investment in oil leases and stock to 50%. How much should he invest in each to maximize his return, assuming investment returns are as expected? a. Define the variables. Be specific with descriptive words. x= high risk investment y= medium risk investment z= Sarfe stook investment b. Clearly state the constraints (all inequalities) related to the feasible region. x+y+z50,000 Cannot be negative x+y0.3(x+y+2)x0,y0,z0 x+y0.5(x+y+2) 0.5x0.5y+0.5z0 c. State the objective function. Maximize P=0.15x+0.09y+0.05z d. Set up the initial simplex matrix needed to solve the linear programming problem using the Simplex Method. c. Perform all pivots necessary using row operations to transform the matrix until the solution is feasible. f. How much should he invest in each to maximize his return, assuming investment returns are as expected? 4. An investor is considering three types of investments: ahigh-risk venture into oil leases with a potential retum of 15%, Imedium-rish investment in bonds with a 9% return, and a relatively (afe stock) investment with a 5% return. He has 550,000 to invest. Because of the risk, he will limit his investment in oil leases and bonds to 30% and his investment in oil leases and stock to 50%. How much should he invest in each to maximize his return, assuming investment returns are as expected? a. Define the variables. Be specific with descriptive words. x= high risk investment y= medium risk investment z= Sarfe stook investment b. Clearly state the constraints (all inequalities) related to the feasible region. x+y+z50,000 Cannot be negative x+y0.3(x+y+2)x0,y0,z0 x+y0.5(x+y+2) 0.5x0.5y+0.5z0 c. State the objective function. Maximize P=0.15x+0.09y+0.05z d. Set up the initial simplex matrix needed to solve the linear programming problem using the Simplex Method. c. Perform all pivots necessary using row operations to transform the matrix until the solution is feasible. f. How much should he invest in each to maximize his return, assuming investment returns are as expected