JUST D,E,F PART PLEASE

JUST D,E,F PART PLEASE

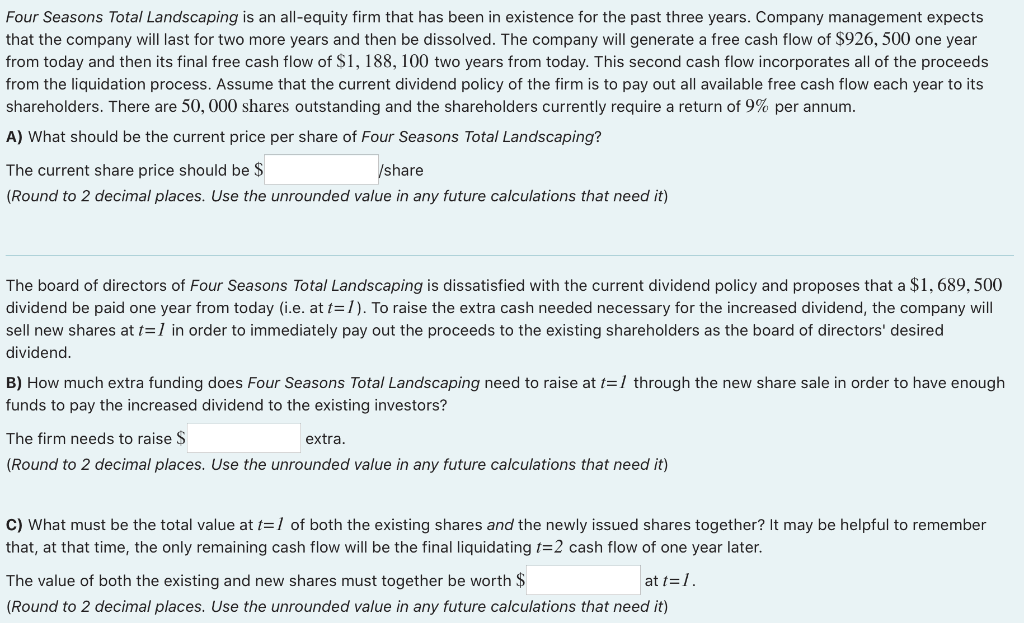

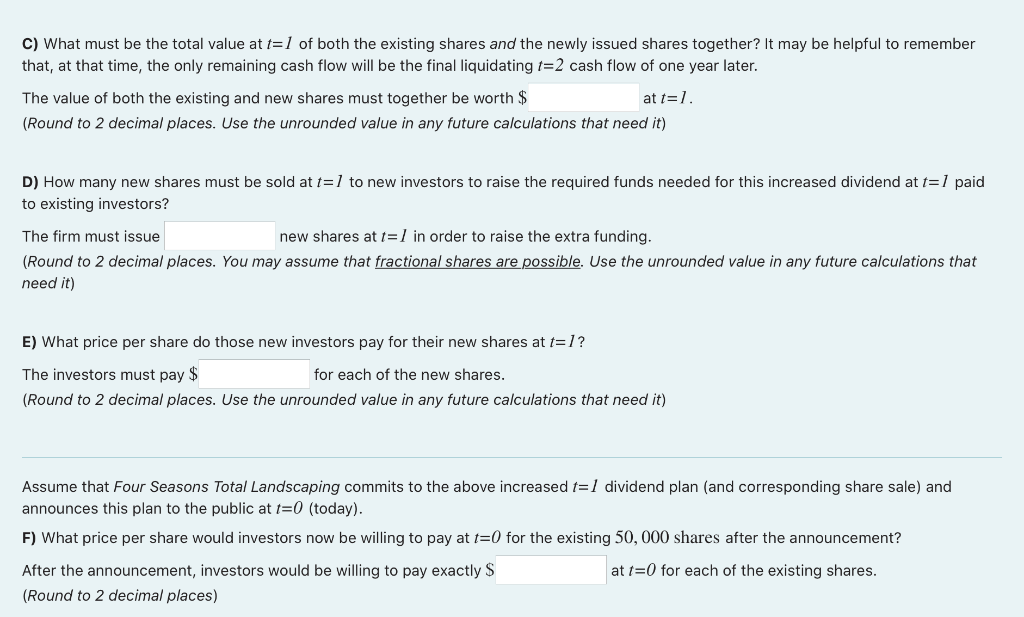

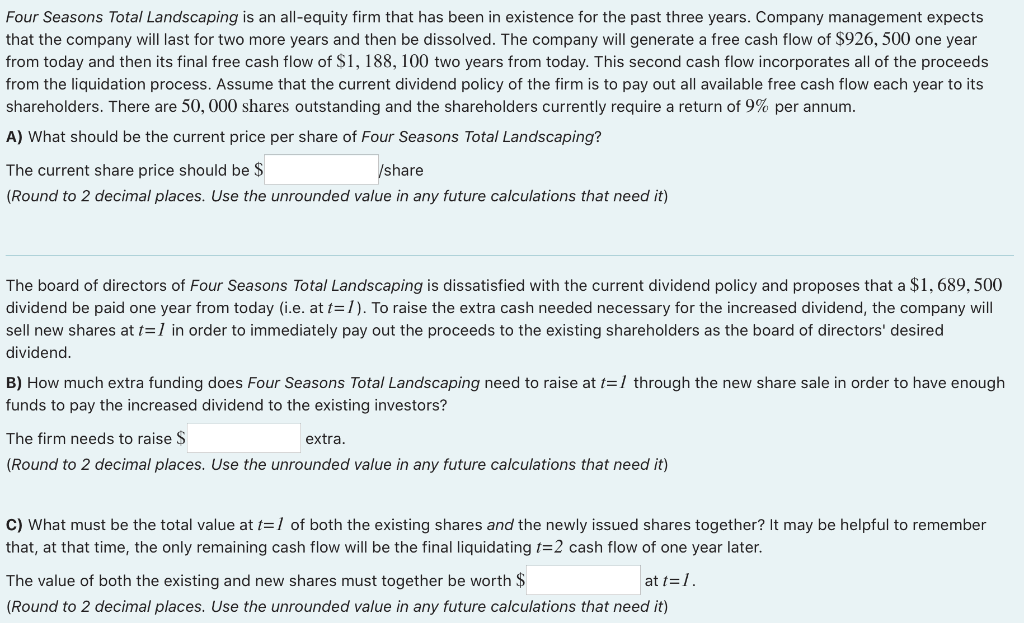

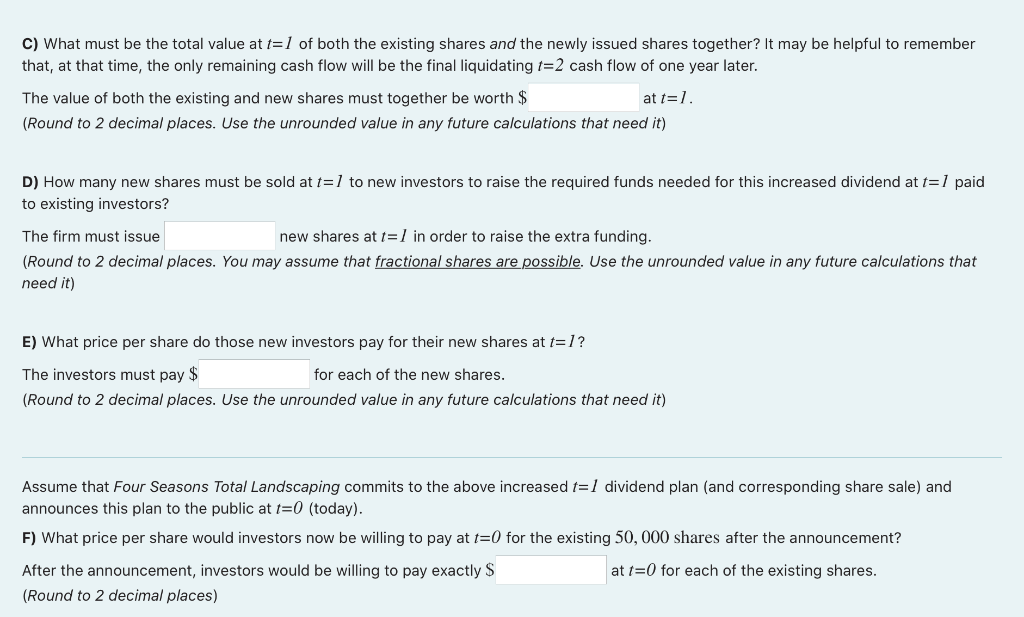

c) What must be the total value at t=1 of both the existing shares and the newly issued shares together? It may be helpful to remember that, at that time, the only remaining cash flow will be the final liquidating t=2 cash flow of one year later. The value of both the existing and new shares must together be worth $ at t=1 (Round to 2 decimal places. Use the unrounded value in any future calculations that need it) D) How many new shares must be sold at t=1 to new investors to raise the required funds needed for this increased dividend at t=1 paid to existing investors? The firm must issue new shares at t=1 in order to raise the extra funding. (Round to 2 decimal places. You may assume that fractional shares are possible. Use the unrounded value in any future calculations that need it) E) What price per share do those new investors pay for their new shares at t=1? The investors must pay $ for each of the new shares. (Round to 2 decimal places. Use the unrounded value in any future calculations that need it) Assume that Four Seasons Total Landscaping commits to the above increased t=1 dividend plan (and corresponding share sale) and announces this plan to the public at t=0 (today). F) What price per share would investors now be willing to pay at t=0 for the existing 50,000 shares after the announcement? at 1=0 for each of the existing shares. After the announcement, investors would be willing to pay exactly $ (Round to 2 decimal places) c) What must be the total value at t=1 of both the existing shares and the newly issued shares together? It may be helpful to remember that, at that time, the only remaining cash flow will be the final liquidating t=2 cash flow of one year later. The value of both the existing and new shares must together be worth $ at t=1 (Round to 2 decimal places. Use the unrounded value in any future calculations that need it) D) How many new shares must be sold at t=1 to new investors to raise the required funds needed for this increased dividend at t=1 paid to existing investors? The firm must issue new shares at t=1 in order to raise the extra funding. (Round to 2 decimal places. You may assume that fractional shares are possible. Use the unrounded value in any future calculations that need it) E) What price per share do those new investors pay for their new shares at t=1? The investors must pay $ for each of the new shares. (Round to 2 decimal places. Use the unrounded value in any future calculations that need it) Assume that Four Seasons Total Landscaping commits to the above increased t=1 dividend plan (and corresponding share sale) and announces this plan to the public at t=0 (today). F) What price per share would investors now be willing to pay at t=0 for the existing 50,000 shares after the announcement? at 1=0 for each of the existing shares. After the announcement, investors would be willing to pay exactly $ (Round to 2 decimal places)

JUST D,E,F PART PLEASE

JUST D,E,F PART PLEASE