Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Just Dew It Corporation reports the following balance sheet information for 2020 and 2021. JUST DEW IT CORPORATION 2020 and 2021 Balance Sheets Assets 2020

| Just Dew It Corporation reports the following balance sheet information for 2020 and 2021. |

| JUST DEW IT CORPORATION | |||||

|---|---|---|---|---|---|

| 2020 and 2021 Balance Sheets | |||||

| Assets | 2020 | 2021 | Liabilities and Owners Equity | 2020 | 2021 |

| Current assets | Current liabilities | ||||

| Cash | $ 11,250 | $ 19,440 | Accounts payable | $ 30,600 | $ 49,200 |

| Accounts receivable | 11,850 | 16,080 | Notes payable | 24,900 | 31,200 |

| Inventory | 39,150 | 60,240 | |||

| Total | $ 62,250 | $ 95,760 | Total | $ 55,500 | $ 80,400 |

| Long-term debt | $ 27,000 | $ 24,000 | |||

| Owners equity | |||||

| Common stock and paid-in surplus | $ 48,000 | $ 48,000 | |||

| Retained earnings | 169,500 | 327,600 | |||

| Net plant and equipment | $ 237,750 | $ 384,240 | Total | $ 217,500 | $ 375,600 |

| Total assets | $ 300,000 | $ 480,000 | Total liabilities and owners equity | $ 300,000 | $ 480,000 |

| Based on the balance sheets given for Just Dew It: |

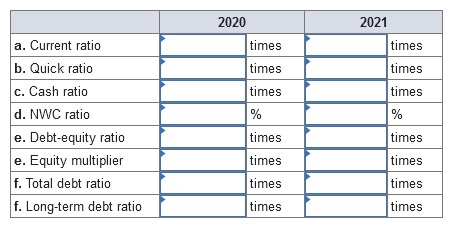

| a. | Calculate the current ratio for each year. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) |

| b. | Calculate the quick ratio for each year. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) |

| c. | Calculate the cash ratio for each year. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) |

| d. | Calculate the NWC to total assets ratio for each year. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) |

| e. | Calculate the debt-equity ratio and equity multiplier for each year. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) |

| f. | Calculate the total debt ratio and long-term debt ratio for each year. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) |

\begin{tabular}{|l|l|l|l|} \hline & \multicolumn{2}{|c|}{2020} & \multicolumn{2}{|c|}{2021} \\ \hline a. Current ratio & & times & times \\ \hline b. Quick ratio & times & & times \\ \hline c. Cash ratio & times & & times \\ \hline d. NWC ratio & % & % \\ \hline e. Debt-equity ratio & times & times \\ \hline e. Equity multiplier & times & times \\ \hline f. Total debt ratio & times & times \\ \hline f. Long-term debt ratio & times & times \\ \hline \end{tabular}

\begin{tabular}{|l|l|l|l|} \hline & \multicolumn{2}{|c|}{2020} & \multicolumn{2}{|c|}{2021} \\ \hline a. Current ratio & & times & times \\ \hline b. Quick ratio & times & & times \\ \hline c. Cash ratio & times & & times \\ \hline d. NWC ratio & % & % \\ \hline e. Debt-equity ratio & times & times \\ \hline e. Equity multiplier & times & times \\ \hline f. Total debt ratio & times & times \\ \hline f. Long-term debt ratio & times & times \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started