Answered step by step

Verified Expert Solution

Question

1 Approved Answer

just do the question that you can see clearly is fine thanks As it pertains to life insurance, which of the following statements about insurable

just do the question that you can see clearly is fine thanks

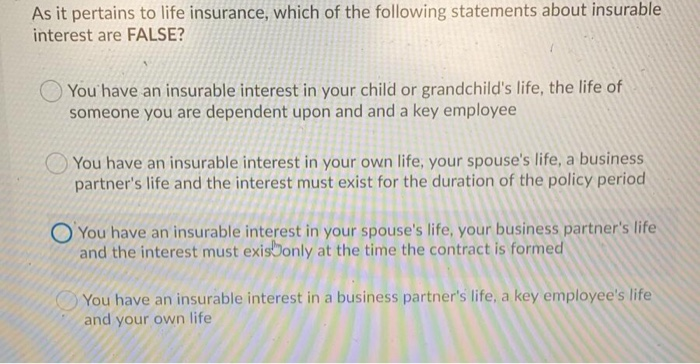

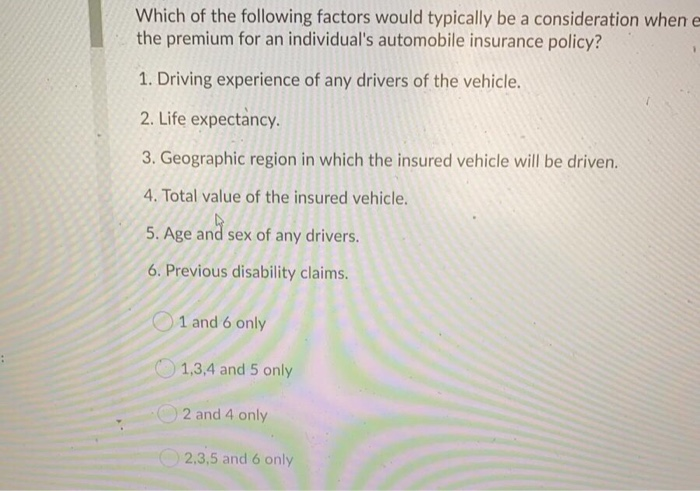

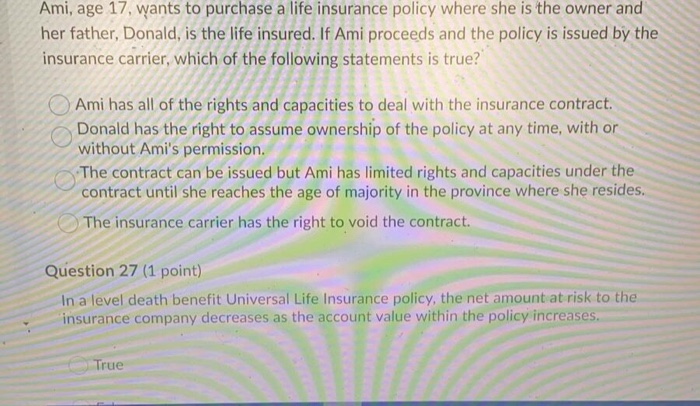

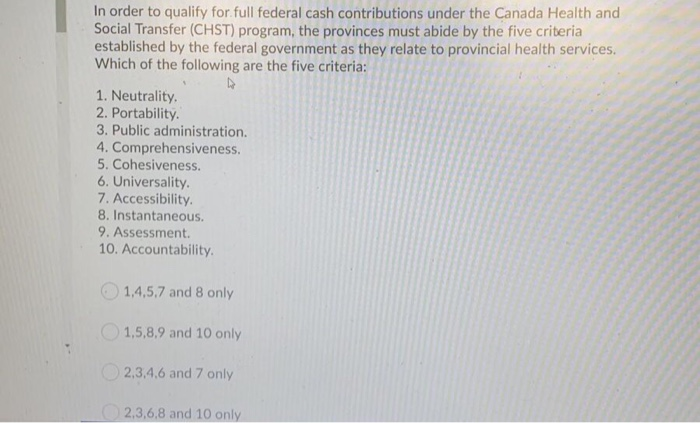

As it pertains to life insurance, which of the following statements about insurable interest are FALSE? You have an insurable interest in your child or grandchild's life, the life of someone you are dependent upon and and a key employee You have an insurable interest in your own life, your spouse's life, a business partner's life and the interest must exist for the duration of the policy period O You have an insurable interest in your spouse's life, your business partner's life and the interest must exis only at the time the contract is formed You have an insurable interest in a business partner's life, a key employee's life and your own life Which of the following factors would typically be a consideration when e the premium for an individual's automobile insurance policy? 1. Driving experience of any drivers of the vehicle. 2. Life expectancy 3. Geographic region in which the insured vehicle will be driven. 4. Total value of the insured vehicle. 5. Age and sex of any drivers. 6. Previous disability claims. 1 and 6 only 1,3,4 and 5 only 2 and 4 only 2.3,5 and 6 only Ami, age 17, wants to purchase a life insurance policy where she is the owner and her father, Donald, is the life insured. If Ami proceeds and the policy is issued by the insurance carrier, which of the following statements is true? Ami has all of the rights and capacities to deal with the insurance contract. Donald has the right to assume ownership of the policy at any time, with or without Ami's permission. The contract can be issued but Ami has limited rights and capacities under the contract until she reaches the age of majority in the province where she resides. The insurance carrier has the right to void the contract. Question 27 (1 point) In a level death benefit Universal Life Insurance policy, the net amount at risk to the insurance company decreases as the account value within the policy increases. True In order to qualify for full federal cash contributions under the Canada Health and Social Transfer (CHST) program, the provinces must abide by the five criteria established by the federal government as they relate to provincial health services. Which of the following are the five criteria: 1. Neutrality. 2. Portability 3. Public administration. 4. Comprehensiveness. 5. Cohesiveness. 6. Universality. 7. Accessibility 8. Instantaneous 9. Assessment 10. Accountability 1,4,5,7 and 8 only 1,5,8,9 and 10 only 2,3,4,6 and 7 only 2,3,6,8 and 10 only Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started