Answered step by step

Verified Expert Solution

Question

1 Approved Answer

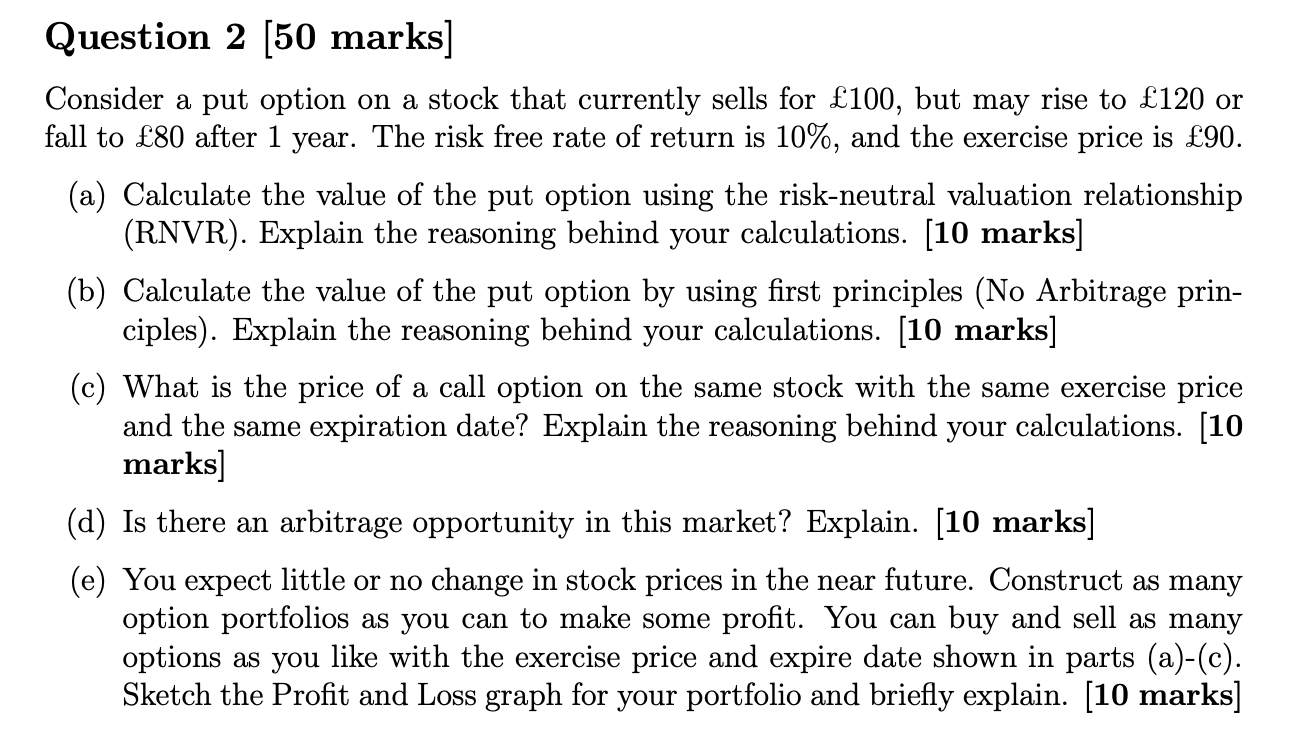

JUST E Question 2 (50 marks] Consider a put option on a stock that currently sells for 100, but may rise to 120 or fall

JUST E

Question 2 (50 marks] Consider a put option on a stock that currently sells for 100, but may rise to 120 or fall to 80 after 1 year. The risk free rate of return is 10%, and the exercise price is 90. (a) Calculate the value of the put option using the risk-neutral valuation relationship (RNVR). Explain the reasoning behind your calculations. [10 marks] (b) Calculate the value of the put option by using first principles (No Arbitrage prin- ciples). Explain the reasoning behind your calculations. [10 marks] (c) What is the price of a call option on the same stock with the same exercise price and the same expiration date? Explain the reasoning behind your calculations. [10 marks] (d) Is there an arbitrage opportunity in this market? Explain. [10 marks] (e) You expect little or no change in stock prices in the near future. Construct as many option portfolios as you can to make some profit. You can buy and sell as many options as you like with the exercise price and expire date shown in parts (a)-(c). Sketch the Profit and Loss graph for your portfolio and briefly explain. [10 marks] Question 2 (50 marks] Consider a put option on a stock that currently sells for 100, but may rise to 120 or fall to 80 after 1 year. The risk free rate of return is 10%, and the exercise price is 90. (a) Calculate the value of the put option using the risk-neutral valuation relationship (RNVR). Explain the reasoning behind your calculations. [10 marks] (b) Calculate the value of the put option by using first principles (No Arbitrage prin- ciples). Explain the reasoning behind your calculations. [10 marks] (c) What is the price of a call option on the same stock with the same exercise price and the same expiration date? Explain the reasoning behind your calculations. [10 marks] (d) Is there an arbitrage opportunity in this market? Explain. [10 marks] (e) You expect little or no change in stock prices in the near future. Construct as many option portfolios as you can to make some profit. You can buy and sell as many options as you like with the exercise price and expire date shown in parts (a)-(c). Sketch the Profit and Loss graph for your portfolio and briefly explain. [10 marks] Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started