Answered step by step

Verified Expert Solution

Question

1 Approved Answer

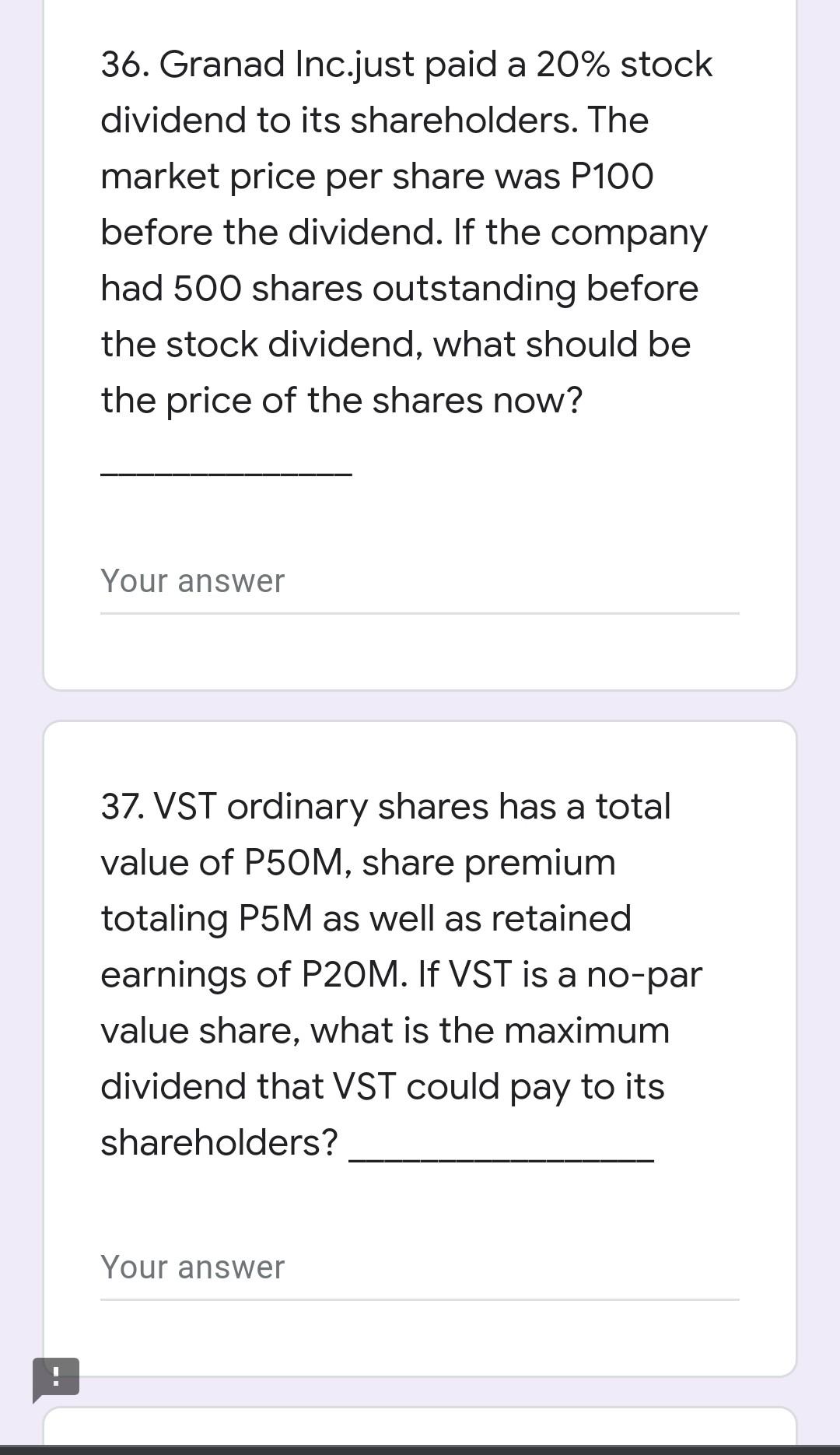

just follow the numbering in the picture thanks 36. Granad Inc.just paid a 20% stock dividend to its shareholders. The market price per share was

just follow the numbering in the picture thanks

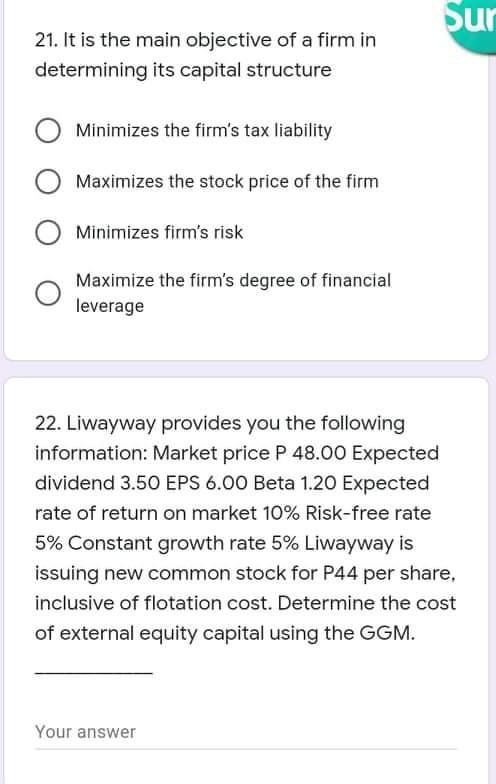

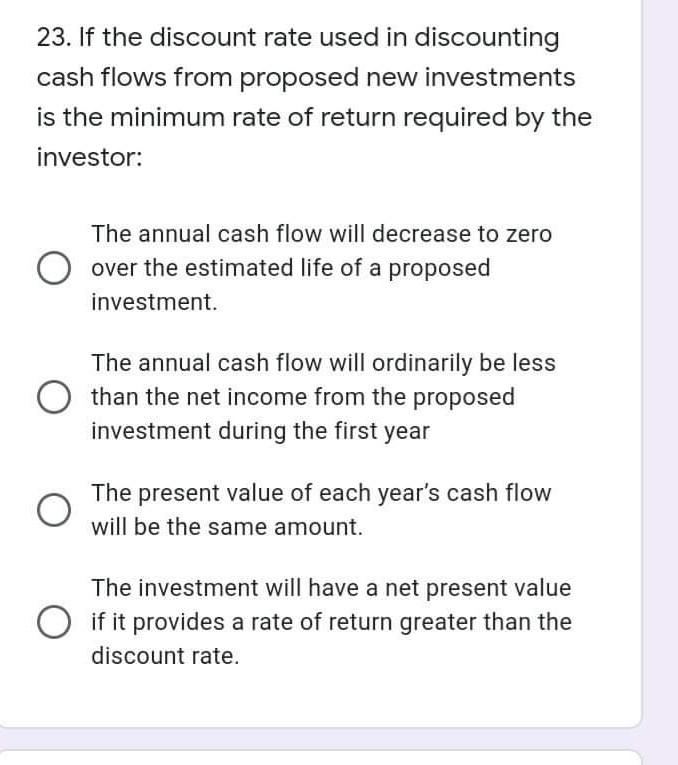

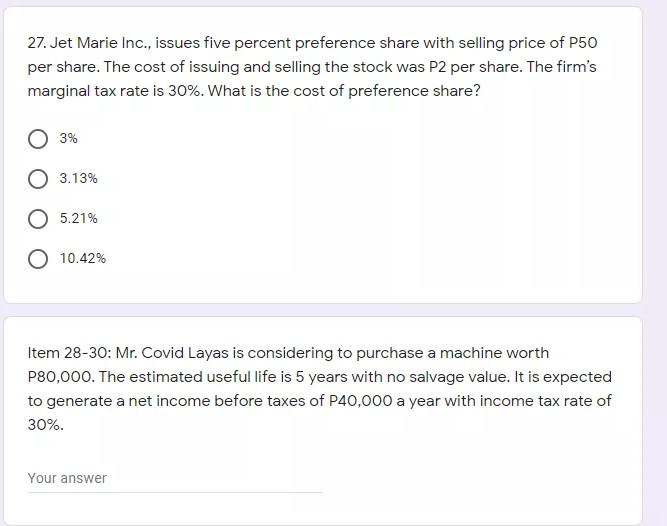

36. Granad Inc.just paid a 20% stock dividend to its shareholders. The market price per share was P100 before the dividend. If the company had 500 shares outstanding before the stock dividend, what should be the price of the shares now? Your answer 37. VST ordinary shares has a total value of P50M, share premium totaling P5M as well as retained earnings of P2OM. If VST is a no-par value share, what is the maximum dividend that VST could pay to its shareholders? Your answer Sur 21. It is the main objective of a firm in determining its capital structure Minimizes the firm's tax liability Maximizes the stock price of the firm Minimizes firm's risk Maximize the firm's degree of financial leverage 22. Liwayway provides you the following information: Market price P 48.00 Expected dividend 3.50 EPS 6.00 Beta 1.20 Expected rate of return on market 10% Risk-free rate 5% Constant growth rate 5% Liwayway is issuing new common stock for P44 per share, inclusive of flotation cost. Determine the cost of external equity capital using the GGM. Your answer 23. If the discount rate used in discounting cash flows from proposed new investments is the minimum rate of return required by the investor: The annual cash flow will decrease to zero over the estimated life of a proposed investment. The annual cash flow will ordinarily be less than the net income from the proposed investment during the first year The present value of each year's cash flow will be the same amount. The investment will have a net present value if it provides a rate of return greater than the discount rate. 27. Jet Marie Inc., issues five percent preference share with selling price of P50 per share. The cost of issuing and selling the stock was P2 per share. The firm's marginal tax rate is 30%. What is the cost of preference share? 3% 3.13% O 5.21% 10.42% Item 28-30: Mr. Covid Layas is considering to purchase a machine worth P80,000. The estimated useful life is 5 years with no salvage value. It is expected to generate a net income before taxes of P40,000 a year with income tax rate of 30%. YourStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started