Just for the first question. Can you do it with showing formulas? Thank you.

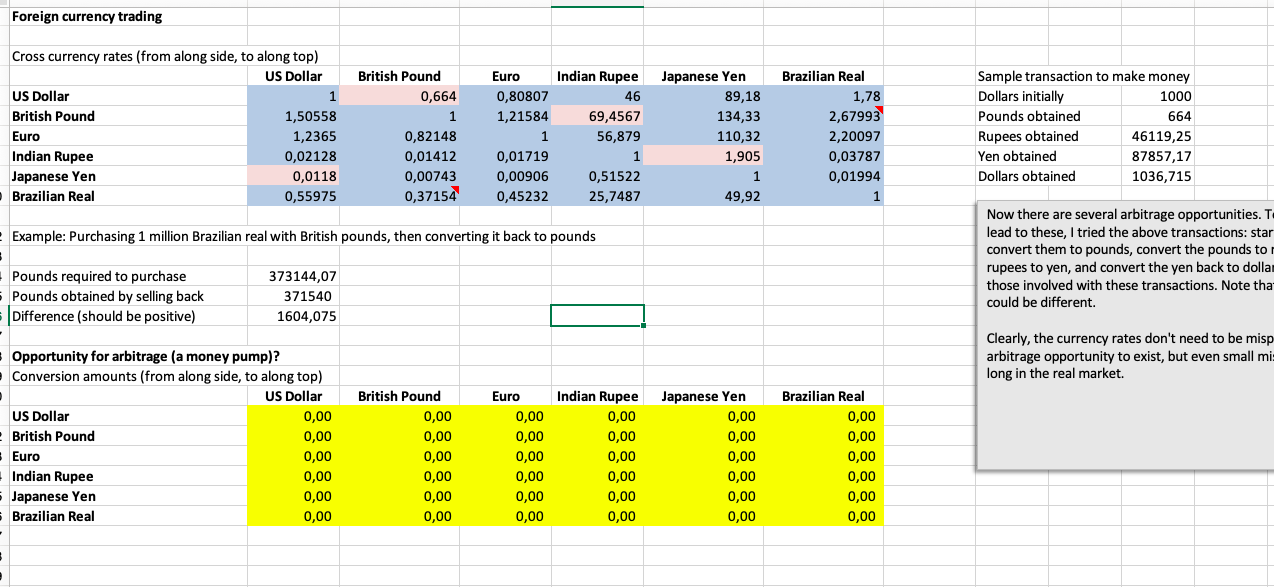

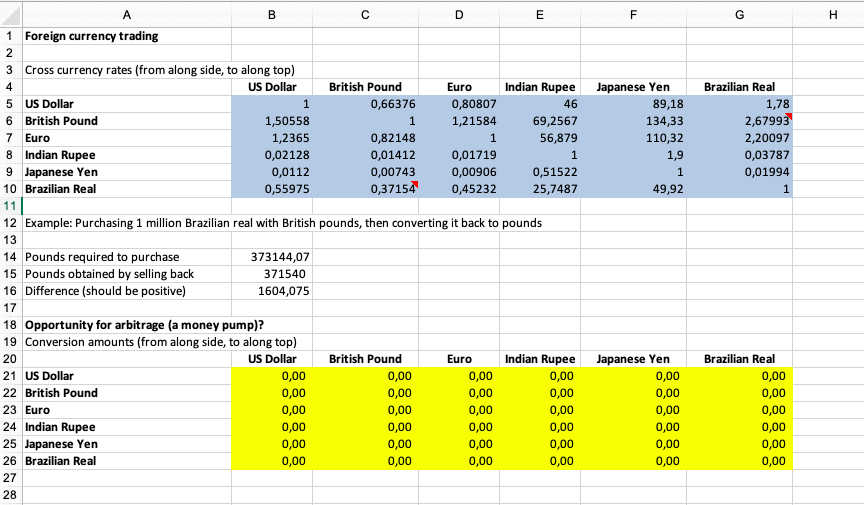

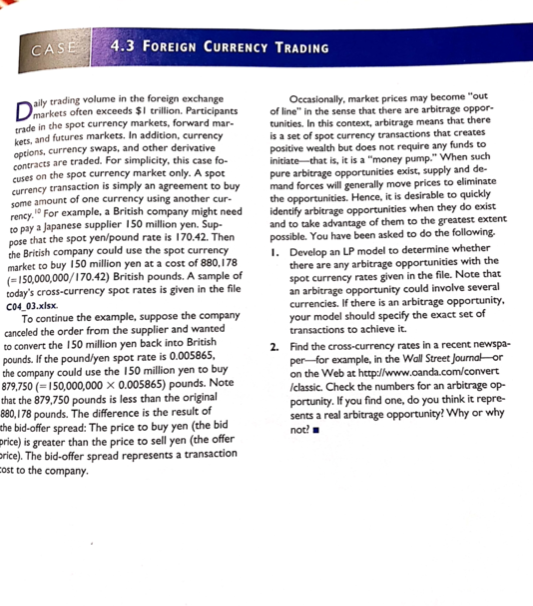

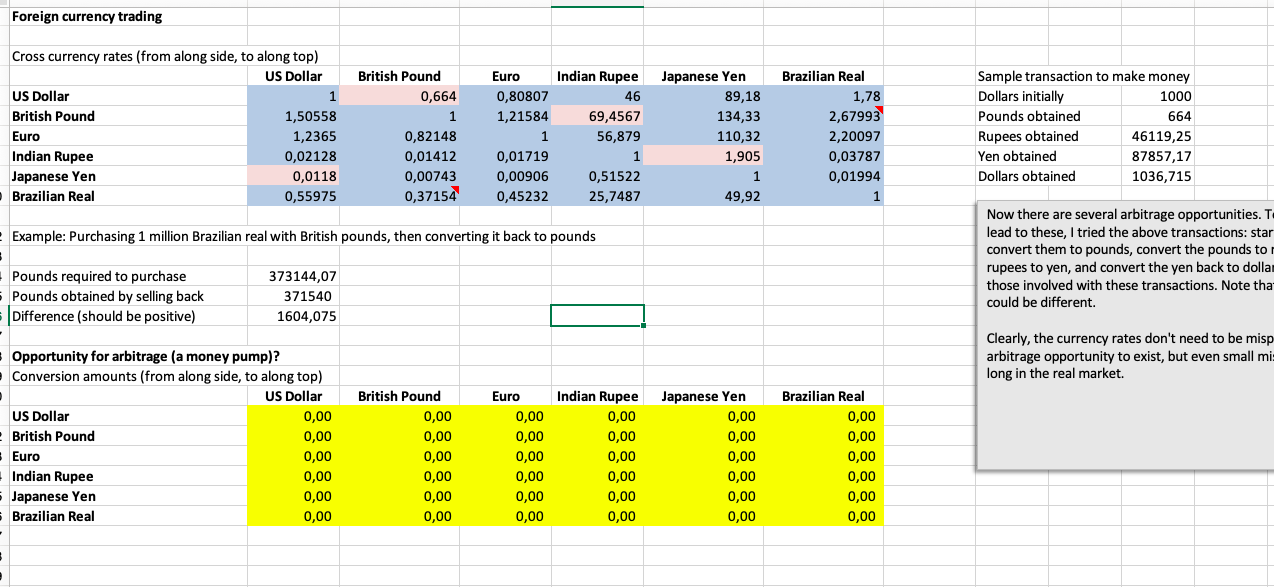

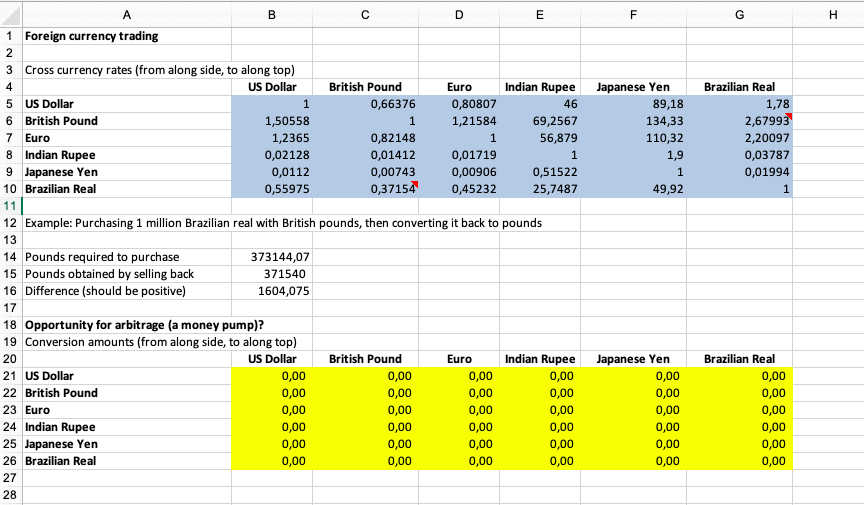

CASE 4.3 FOREIGN CURRENCY TRADING ally trading volume in the foreign exchange Dimarkets often exceeds $1 trillion. Participants trade in the spot currency markets, forward mar- kets, and futures markets. In addition, currency options, currency swaps, and other derivative contracts are traded. For simplicity, this case fo cuses on the spot currency market only. A spor currency transaction is simply an agreement to buy some amount of one currency using another cur rency. For example, a British company might need to pay a Japanese supplier 150 million yen. Sup- pose that the spot yen/pound rate is 170.42. Then the British company could use the spot currency market to buy 150 million yen at a cost of 880,178 (=150,000,000/170.42) British pounds. A sample of today's cross-currency spot rates is given in the file C04_03.xlsx To continue the example, suppose the company canceled the order from the supplier and wanted to convert the 150 million yen back into British pounds. If the poundlyen spot rate is 0.005865, the company could use the 150 million yen to buy 879,750 (150,000,000 X 0.005865) pounds. Note that the 879,750 pounds is less than the original 880,178 pounds. The difference is the result of the bid-offer spread: The price to buy yen (the bid orice) is greater than the price to sell yen (the offer Drice). The bid-offer spread represents a transaction Cost to the company. Occasionally, market prices may become out of line" in the sense that there are arbitrage oppor- tunities. In this context, arbitrage means that there is a set of spot currency transactions that creates positive wealth but does not require any funds to initiate that is, it is a "money pump." When such pure arbitrage opportunities exist, supply and de- mand forces will generally move prices to eliminate the opportunities. Hence, it is desirable to quickly identify arbitrage opportunities when they do exist and to take advantage of them to the greatest extent possible. You have been asked to do the following. 1. Develop an LP model to determine whether there are any arbitrage opportunities with the spot currency rates given in the file. Note that an arbitrage opportunity could involve several currencies. If there is an arbitrage opportunity, your model should specify the exact set of transactions to achieve it. 2. Find the cross-currency rates in a recent newspa- per-for example, in the Wall Street Journal or on the Web at http://www.canda.com/convert I classic. Check the numbers for an arbitrage op- portunity. If you find one, do you think it repre- sents a real arbitrage opportunity! Why or why not! Foreign currency trading Cross currency rates (from along side, to along top) US Dollar US Dollar British Pound 1,50558 Euro 1,2365 Indian Rupee 0,02128 Japanese Yen 0,0118 Brazilian Real 0,55975 British Pound 0,664 1 0,82148 0,01412 0,00743 0,37154 Euro 0,80807 1,21584 1 0,01719 0,00906 0,45232 Indian Rupee 46 69,4567 56,879 1 0,51522 25,7487 Japanese Yen 89,18 134,33 110,32 1,905 1 49,92 Brazilian Real 1,78 2,67993 2,20097 0,03787 0,01994 1 Sample transaction to make money Dollars initially 1000 Pounds obtained 664 Rupees obtained 46119,25 Yen obtained 87857,17 Dollars obtained 1036,715 Example: Purchasing 1 million Brazilian real with British pounds, then converting it back to pounds Now there are several arbitrage opportunities. T lead to these, I tried the above transactions: star convert them to pounds, convert the pounds to rupees to yen, and convert the yen back to dollar those involved with these transactions. Note tha could be different. Pounds required to purchase - Pounds obtained by selling back Difference (should be positive) 373144,07 371540 1604,075 Clearly, the currency rates don't need to be misp arbitrage opportunity to exist, but even small mis long in the real market. Opportunity for arbitrage (a money pump)? Conversion amounts (from along side, to along top) US Dollar US Dollar 0,00 British Pound 0,00 0,00 Indian Rupee Japanese Yen 0,00 Brazilian Real 0,00 Euro British Pound 0,00 0,00 0,00 0,00 0,00 0,00 Euro 0,00 0,00 0,00 0,00 0,00 0,00 Indian Rupee 0,00 0,00 0,00 0,00 0,00 0,00 Japanese Yen 0,00 0,00 0,00 0,00 0,00 0,00 Brazilian Real 0,00 0,00 0,00 0,00 0,00 0,00 0,00 A B D E F G H 4 1 Foreign currency trading 2 3 Cross currency rates (from along side, to along top) US Dollar 5 US Dollar 1 6 British Pound 1,50558 Euro 1,2365 8 Indian Rupee 0,02128 9 Japanese Yen 0,0112 10 Brazilian Real 0,55975 7 British Pound 0,66376 1 0,82148 0,01412 0,00743 0,37154 Euro 0,80807 1,21584 1 0,01719 0,00906 0,45232 Indian Rupee 46 69,2567 56,879 1 0,51522 25,7487 Japanese Yen 89,18 134,33 110,32 1,9 1 49,92 Brazilian Real 1,78 2,67993 2,20097 0,03787 0,01994 1 11 12 Example: Purchasing 1 million Brazilian real with British pounds, then converting it back to pounds 13 14 Pounds required to purchase 373144,07 15 Pounds obtained by selling back 371540 16 Difference (should be positive) 1604,075 17 18 Opportunity for arbitrage (a money pump)? 19 Conversion amounts (from along side, to along top) US Dollar British Pound Euro Indian Rupee 21 US Dollar 0,00 0,00 0,00 0,00 22 British Pound 0,00 0,00 0,00 0,00 23 Euro 0,00 0,00 0,00 0,00 24 Indian Rupee 0,00 0,00 0,00 0,00 25 Japanese Yen 0,00 0,00 0,00 0,00 26 Brazilian Real 0,00 0,00 0,00 0,00 27 28 20 Japanese Yen 0,00 0,00 0,00 0,00 0,00 0,00 Brazilian Real 0,00 0,00 0,00 0,00 0,00 0,00 CASE 4.3 FOREIGN CURRENCY TRADING ally trading volume in the foreign exchange Dimarkets often exceeds $1 trillion. Participants trade in the spot currency markets, forward mar- kets, and futures markets. In addition, currency options, currency swaps, and other derivative contracts are traded. For simplicity, this case fo cuses on the spot currency market only. A spor currency transaction is simply an agreement to buy some amount of one currency using another cur rency. For example, a British company might need to pay a Japanese supplier 150 million yen. Sup- pose that the spot yen/pound rate is 170.42. Then the British company could use the spot currency market to buy 150 million yen at a cost of 880,178 (=150,000,000/170.42) British pounds. A sample of today's cross-currency spot rates is given in the file C04_03.xlsx To continue the example, suppose the company canceled the order from the supplier and wanted to convert the 150 million yen back into British pounds. If the poundlyen spot rate is 0.005865, the company could use the 150 million yen to buy 879,750 (150,000,000 X 0.005865) pounds. Note that the 879,750 pounds is less than the original 880,178 pounds. The difference is the result of the bid-offer spread: The price to buy yen (the bid orice) is greater than the price to sell yen (the offer Drice). The bid-offer spread represents a transaction Cost to the company. Occasionally, market prices may become out of line" in the sense that there are arbitrage oppor- tunities. In this context, arbitrage means that there is a set of spot currency transactions that creates positive wealth but does not require any funds to initiate that is, it is a "money pump." When such pure arbitrage opportunities exist, supply and de- mand forces will generally move prices to eliminate the opportunities. Hence, it is desirable to quickly identify arbitrage opportunities when they do exist and to take advantage of them to the greatest extent possible. You have been asked to do the following. 1. Develop an LP model to determine whether there are any arbitrage opportunities with the spot currency rates given in the file. Note that an arbitrage opportunity could involve several currencies. If there is an arbitrage opportunity, your model should specify the exact set of transactions to achieve it. 2. Find the cross-currency rates in a recent newspa- per-for example, in the Wall Street Journal or on the Web at http://www.canda.com/convert I classic. Check the numbers for an arbitrage op- portunity. If you find one, do you think it repre- sents a real arbitrage opportunity! Why or why not! Foreign currency trading Cross currency rates (from along side, to along top) US Dollar US Dollar British Pound 1,50558 Euro 1,2365 Indian Rupee 0,02128 Japanese Yen 0,0118 Brazilian Real 0,55975 British Pound 0,664 1 0,82148 0,01412 0,00743 0,37154 Euro 0,80807 1,21584 1 0,01719 0,00906 0,45232 Indian Rupee 46 69,4567 56,879 1 0,51522 25,7487 Japanese Yen 89,18 134,33 110,32 1,905 1 49,92 Brazilian Real 1,78 2,67993 2,20097 0,03787 0,01994 1 Sample transaction to make money Dollars initially 1000 Pounds obtained 664 Rupees obtained 46119,25 Yen obtained 87857,17 Dollars obtained 1036,715 Example: Purchasing 1 million Brazilian real with British pounds, then converting it back to pounds Now there are several arbitrage opportunities. T lead to these, I tried the above transactions: star convert them to pounds, convert the pounds to rupees to yen, and convert the yen back to dollar those involved with these transactions. Note tha could be different. Pounds required to purchase - Pounds obtained by selling back Difference (should be positive) 373144,07 371540 1604,075 Clearly, the currency rates don't need to be misp arbitrage opportunity to exist, but even small mis long in the real market. Opportunity for arbitrage (a money pump)? Conversion amounts (from along side, to along top) US Dollar US Dollar 0,00 British Pound 0,00 0,00 Indian Rupee Japanese Yen 0,00 Brazilian Real 0,00 Euro British Pound 0,00 0,00 0,00 0,00 0,00 0,00 Euro 0,00 0,00 0,00 0,00 0,00 0,00 Indian Rupee 0,00 0,00 0,00 0,00 0,00 0,00 Japanese Yen 0,00 0,00 0,00 0,00 0,00 0,00 Brazilian Real 0,00 0,00 0,00 0,00 0,00 0,00 0,00 A B D E F G H 4 1 Foreign currency trading 2 3 Cross currency rates (from along side, to along top) US Dollar 5 US Dollar 1 6 British Pound 1,50558 Euro 1,2365 8 Indian Rupee 0,02128 9 Japanese Yen 0,0112 10 Brazilian Real 0,55975 7 British Pound 0,66376 1 0,82148 0,01412 0,00743 0,37154 Euro 0,80807 1,21584 1 0,01719 0,00906 0,45232 Indian Rupee 46 69,2567 56,879 1 0,51522 25,7487 Japanese Yen 89,18 134,33 110,32 1,9 1 49,92 Brazilian Real 1,78 2,67993 2,20097 0,03787 0,01994 1 11 12 Example: Purchasing 1 million Brazilian real with British pounds, then converting it back to pounds 13 14 Pounds required to purchase 373144,07 15 Pounds obtained by selling back 371540 16 Difference (should be positive) 1604,075 17 18 Opportunity for arbitrage (a money pump)? 19 Conversion amounts (from along side, to along top) US Dollar British Pound Euro Indian Rupee 21 US Dollar 0,00 0,00 0,00 0,00 22 British Pound 0,00 0,00 0,00 0,00 23 Euro 0,00 0,00 0,00 0,00 24 Indian Rupee 0,00 0,00 0,00 0,00 25 Japanese Yen 0,00 0,00 0,00 0,00 26 Brazilian Real 0,00 0,00 0,00 0,00 27 28 20 Japanese Yen 0,00 0,00 0,00 0,00 0,00 0,00 Brazilian Real 0,00 0,00 0,00 0,00 0,00 0,00