Answered step by step

Verified Expert Solution

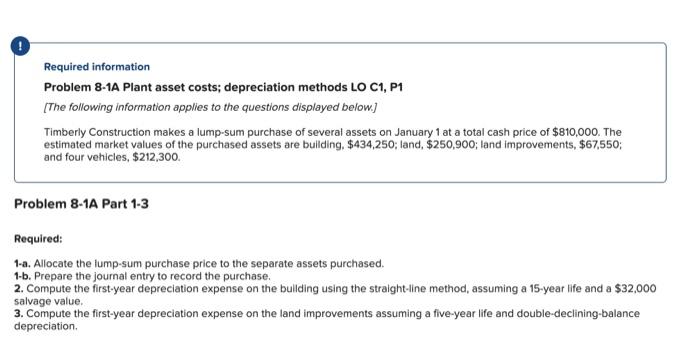

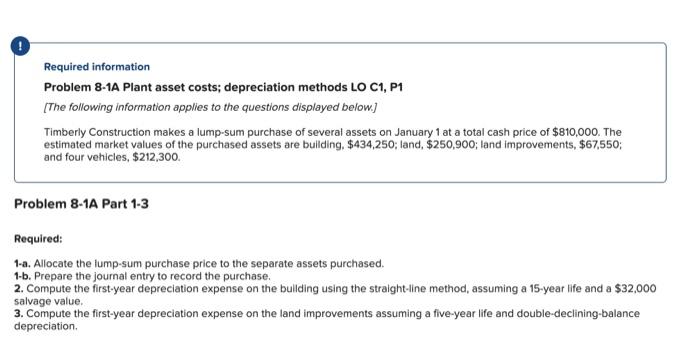

Question

1 Approved Answer

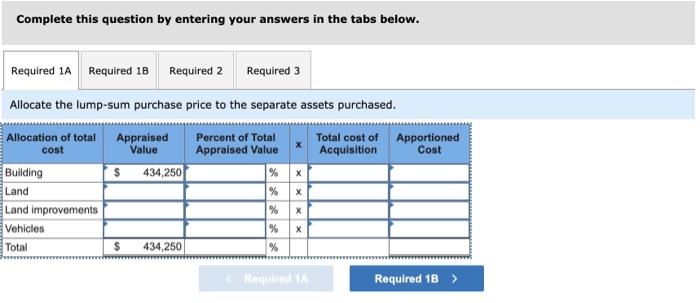

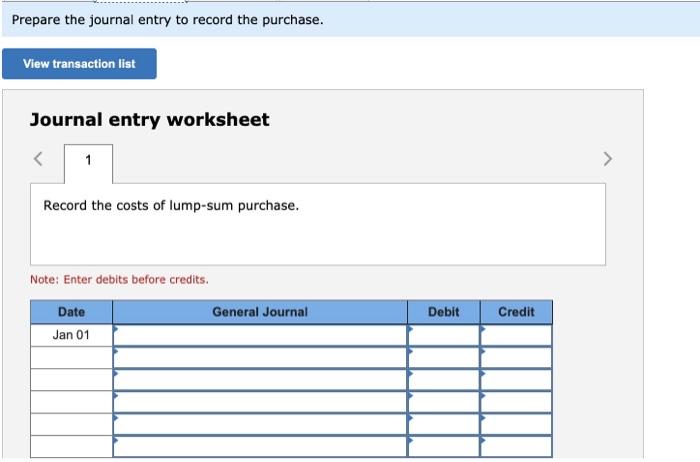

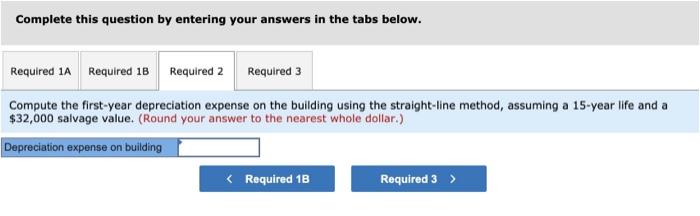

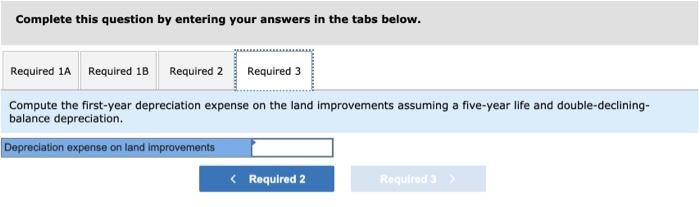

Just FYI the third photo is required 1B. Additionally, I just wanted to thank you guys for taking the time to answer these questions. I

Just FYI the third photo is "required 1B".

Additionally, I just wanted to thank you guys for taking the time to answer these questions. I know your paid to do so, however, I still greatly appreciate it. Thought I would add this as I haven't seen many other students show gratitude!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started