just gotta see work and everything for this

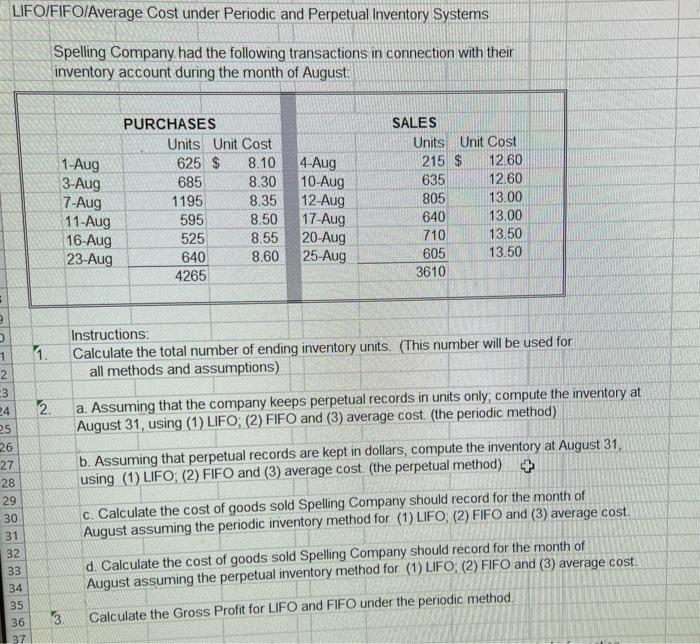

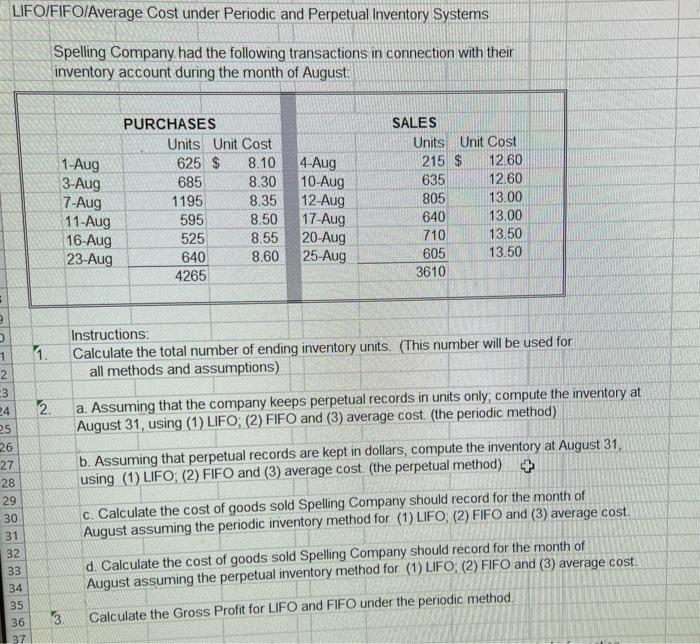

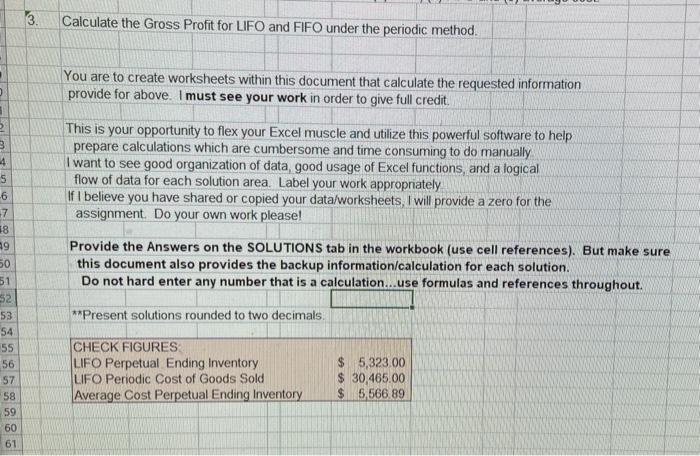

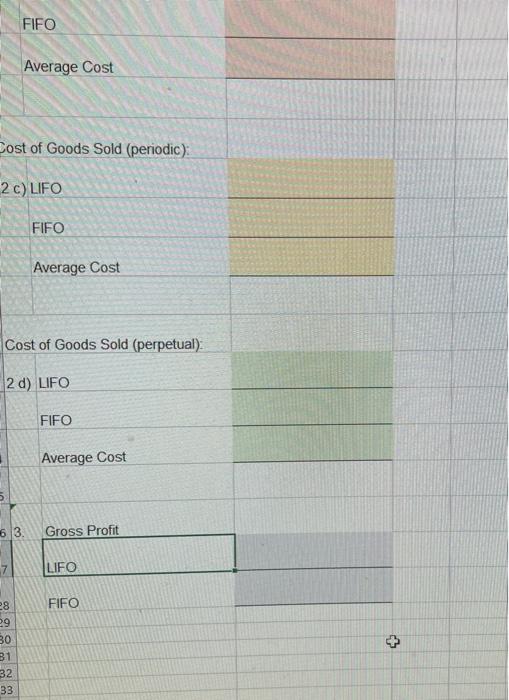

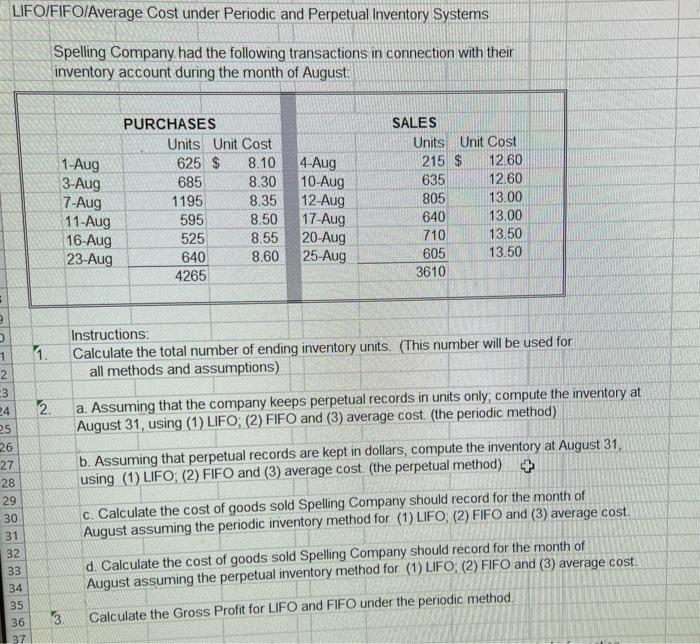

LIFO/FIFO/Average Cost under Periodic and Perpetual Inventory Systems Spelling Company had the following transactions in connection with their inventory account during the month of August 1-Aug 3-Aug 7-Aug 11-Aug 16-Aug 23-Aug PURCHASES Units Unit Cost 625 $ 8.10 685 8.30 1195 8.35 595 8.50 525 8.55 640 8.60 4265 4-Aug 10-Aug 12-Aug 17-Aug 20 Aug 25-Aug SALES Units Unit Cost 215 $ 12.60 635 12.60 805 13.00 640 13.00 710 13.50 605 13.50 3610 11. Instructions: Calculate the total number of ending inventory units. (This number will be used for all methods and assumptions) 2. a. Assuming that the company keeps perpetual records in units only, compute the inventory at August 31, using (1) LIFO; (2) FIFO and (3) average cost. (the periodic method) 1 2 -3 24 25 26 27 28 29 30 31 32 33 b. Assuming that perpetual records are kept in dollars, compute the inventory at August 31, using (1) LIFO; (2) FIFO and (3) average cost. (the perpetual method) c. Calculate the cost of goods sold Spelling Company should record for the month of August assuming the periodic inventory method for (1) LIFO; (2) FIFO and (3) average cost d. Calculate the cost of goods sold Spelling Company should record for the month of August assuming the perpetual inventory method for (1) LIFO (2) FIFO and (3) average cost. 34 35 36 37 3 Calculate the Gross Profit for LIFO and FIFO under the periodic method. Calculate the Gross Profit for LIFO and FIFO under the periodic method You are to create worksheets within this document that calculate the requested information provide for above. I must see your work in order to give full credit 1 This is your opportunity to flex your Excel muscle and utilize this powerful software to help prepare calculations which are cumbersome and time consuming to do manually I want to see good organization of data, good usage of Excel functions, and a logical flow of data for each solution area. Label your work appropriately If I believe you have shared or copied your data/worksheets, I will provide a zero for the assignment. Do your own work please! Provide the Answers on the SOLUTIONS tab in the workbook (use cell references). But make sure this document also provides the backup information/calculation for each solution. Do not hard enter any number that is a calculation...use formulas and references throughout 3 4 5 -6 -7 18 19 50 51 52 53 54 55 56 57 58 59 60 61 **Present solutions rounded to two decimals. CHECK FIGURES LIFO Perpetual Ending Inventory LIFO Periodic Cost of Goods Sold Average Cost Perpetual Ending Inventory $ 5,323.00 $ 30,465.00 $ 5566 89 FIFO Average Cost Cost of Goods Sold (periodic): 2 c) LIFO FIFO Average Cost Cost of Goods Sold (perpetual) 2 d) LIFO FIFO Average Cost 63 Gross Profit 7 LIFO FIFO 28 29 30 31 32 33 3 B TUA Format Painter Clipboard Merge & Center $ % Font Alignment Numb B7 A B C D E G H 1 2 3 14 5 6 2 B 9 10 - 12 13 14 15 16 12 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 Instructions Solutions Data Data Data O Type here to search RE EP G e D E G Instructions Solutions Data Data Data BE Type here to search - G Clipboard Font Alignment 5 B D E F G H Instructions Solutions Data Data: G Type here to search LIFO/FIFO/Average Cost under Periodic and Perpetual Inventory Systems Spelling Company had the following transactions in connection with their inventory account during the month of August 1-Aug 3-Aug 7-Aug 11-Aug 16-Aug 23-Aug PURCHASES Units Unit Cost 625 $ 8.10 685 8.30 1195 8.35 595 8.50 525 8.55 640 8.60 4265 4-Aug 10-Aug 12-Aug 17-Aug 20 Aug 25-Aug SALES Units Unit Cost 215 $ 12.60 635 12.60 805 13.00 640 13.00 710 13.50 605 13.50 3610 11. Instructions: Calculate the total number of ending inventory units. (This number will be used for all methods and assumptions) 2. a. Assuming that the company keeps perpetual records in units only, compute the inventory at August 31, using (1) LIFO; (2) FIFO and (3) average cost. (the periodic method) 1 2 -3 24 25 26 27 28 29 30 31 32 33 b. Assuming that perpetual records are kept in dollars, compute the inventory at August 31, using (1) LIFO; (2) FIFO and (3) average cost. (the perpetual method) c. Calculate the cost of goods sold Spelling Company should record for the month of August assuming the periodic inventory method for (1) LIFO; (2) FIFO and (3) average cost d. Calculate the cost of goods sold Spelling Company should record for the month of August assuming the perpetual inventory method for (1) LIFO (2) FIFO and (3) average cost. 34 35 36 37 3 Calculate the Gross Profit for LIFO and FIFO under the periodic method. Calculate the Gross Profit for LIFO and FIFO under the periodic method You are to create worksheets within this document that calculate the requested information provide for above. I must see your work in order to give full credit 1 This is your opportunity to flex your Excel muscle and utilize this powerful software to help prepare calculations which are cumbersome and time consuming to do manually I want to see good organization of data, good usage of Excel functions, and a logical flow of data for each solution area. Label your work appropriately If I believe you have shared or copied your data/worksheets, I will provide a zero for the assignment. Do your own work please! Provide the Answers on the SOLUTIONS tab in the workbook (use cell references). But make sure this document also provides the backup information/calculation for each solution. Do not hard enter any number that is a calculation...use formulas and references throughout 3 4 5 -6 -7 18 19 50 51 52 53 54 55 56 57 58 59 60 61 **Present solutions rounded to two decimals. CHECK FIGURES LIFO Perpetual Ending Inventory LIFO Periodic Cost of Goods Sold Average Cost Perpetual Ending Inventory $ 5,323.00 $ 30,465.00 $ 5566 89 FIFO Average Cost Cost of Goods Sold (periodic): 2 c) LIFO FIFO Average Cost Cost of Goods Sold (perpetual) 2 d) LIFO FIFO Average Cost 63 Gross Profit 7 LIFO FIFO 28 29 30 31 32 33 3 B TUA Format Painter Clipboard Merge & Center $ % Font Alignment Numb B7 A B C D E G H 1 2 3 14 5 6 2 B 9 10 - 12 13 14 15 16 12 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 Instructions Solutions Data Data Data O Type here to search RE EP G e D E G Instructions Solutions Data Data Data BE Type here to search - G Clipboard Font Alignment 5 B D E F G H Instructions Solutions Data Data: G Type here to search