Just looking for some help on these!

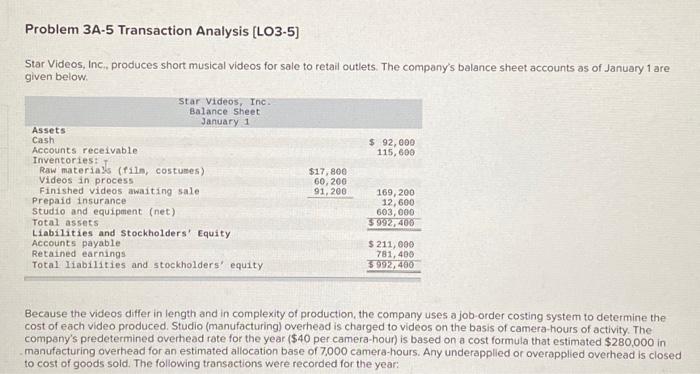

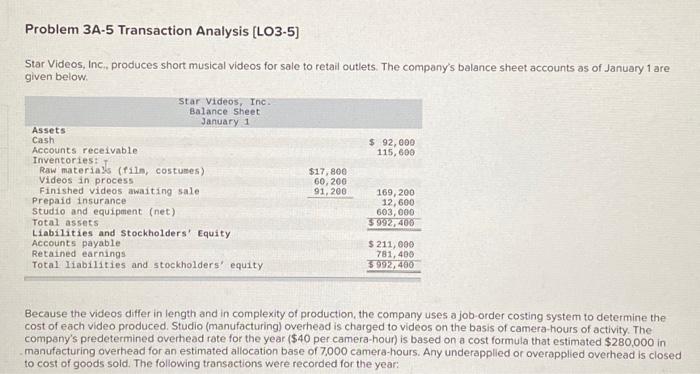

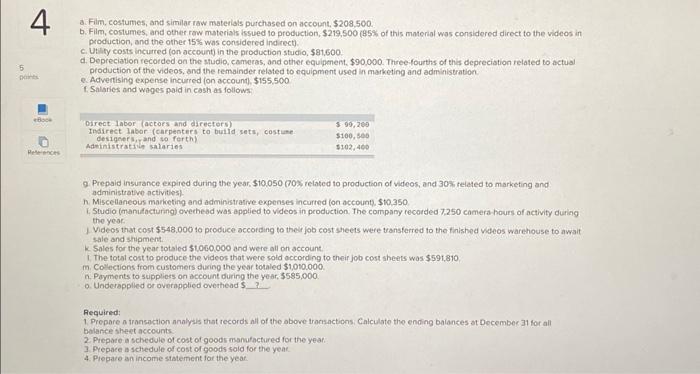

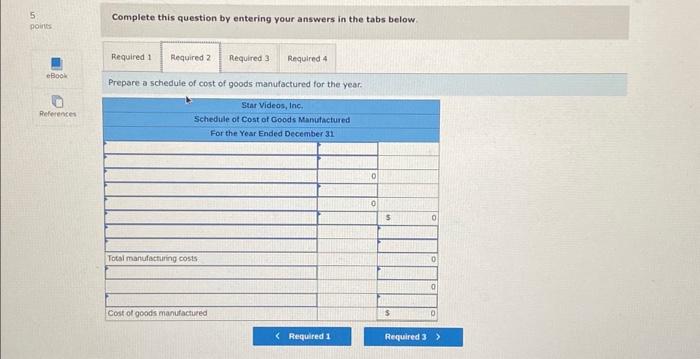

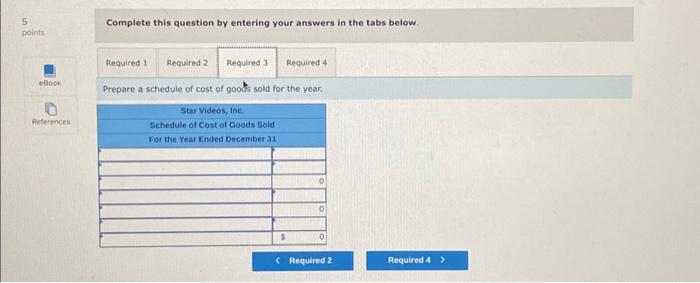

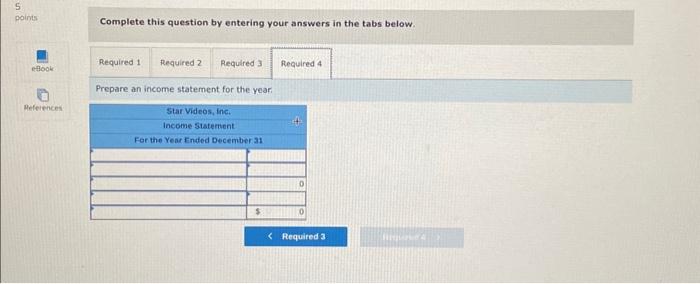

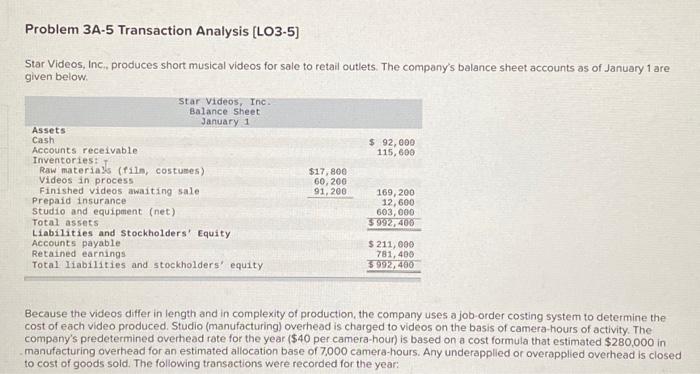

a. Film, cestumes, and similar raw materials purchased on account, $208,500 b. Film, costumes, and other raw materiak issued to production, $219,500 (85\% of this material was considered direct to the videos in procuction, and the other 15% was considered indirect). c. Utily costs incurted (on account) in the production studio, $81,600. d. Depreciation fecorded on the studio, cameras, and other equipenent, $90,000. Three-fourths of thes deprecistion related to actual production of the videos, and the remainder related to equipment used in marketing and administration. e. Advertising expense incurred fon account, $155,500 f. Salaries and wages paid in cash as follows: 9. Prepaid insurance expired during the year, $10.050 (703, related to production of videos, and 30 si related to marketing and administrative activitost. h. Miscellaneous marketing and administratrve expenses incurted fon account $ to 350 i. Studio (manufacturing) owerhed was applied to videos in production. The company recorded 7250 camera-hours of activity during the yeior. 1. Videos that cost $548,000 to produce according to thei job cost sheets were vansferred to the finished viteos warehouse to await sale and shipment. \& Soles for the year totsied $1000000 and were all on account 1. The total cost to produce the videos that were sold according to their job cost sheets was $591,810. m. Collections from customers during the year totaled $1,050.000 n. Peyments to stippliers on account during the year, 5585,000 . o. Underapplied or averapplied overthead's? Required: 1. Prepare a tronsaction analysis that records all of the obove transactions Calculate the ending balances at December 31 for all balance shect accounts. 2. Prepare a schedule of cost of goods manufactured for the year. 3. Prepace a schedule of cost of goods sold for the year. 4. Prepare an income statement for the year. Problem 3A-5 Transaction Analysis [LO3-5] Star Videos, Inc., produces short musical videos for sale to retail outlets. The company's balance sheet accounts as of January 1 are given below. Because the videos differ in length and in complexity of production, the company uses a job-order costing system to determine the cost of each video produced. Studio (manufacturing) overhead is charged to videos on the basis of camera-hours of activity. The company's predetermined overhead rate for the year ( $40 per camera-hour) is based on a cost formula that estimated $280,000 in manufacturing overhead for an estimated allocation base of 7,000 camera-hours. Any underapplied or overapplied overhead is closed to cost of goods sold. The following transactions were recorded for the year: Complete this question by entering your answers in the tabs below. Prepare an income statement for the year: Complete this question by entering your answers in the tabs below. Prepare a schedule of cost of goods manufactured for the year. Complete this question by entering your answers in the tabs below. Prepare a schedule of cost of goots sold for the year