Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Just need 3 Please ASAP! NCB Manufacturing makes banjo tone rings for popular banjo builders. In order to expand capacity, the company decided to lease

Just need 3 Please ASAP!

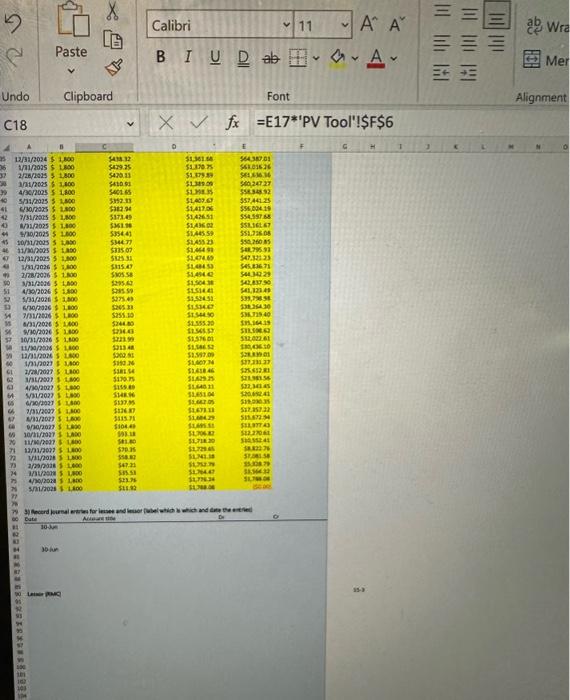

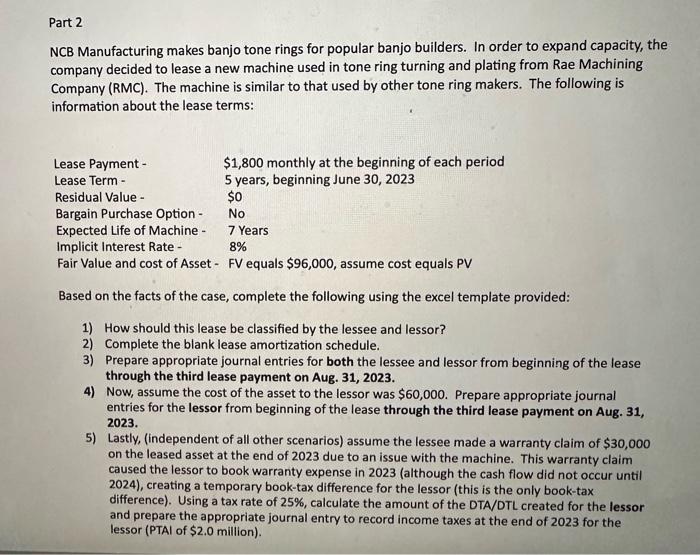

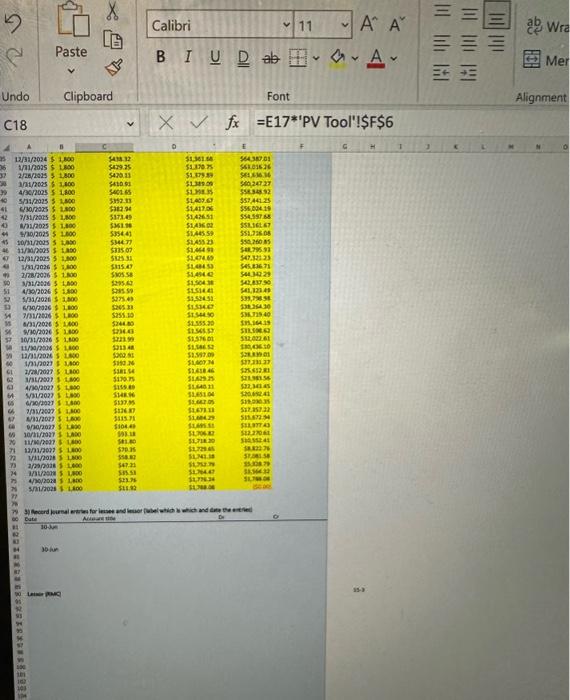

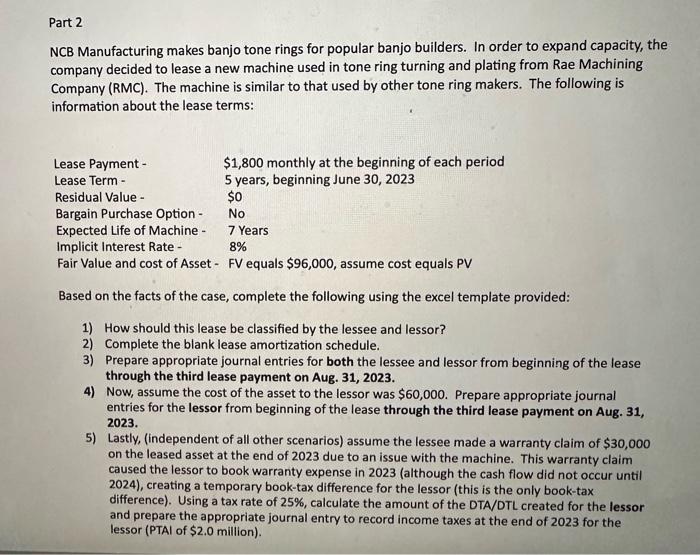

NCB Manufacturing makes banjo tone rings for popular banjo builders. In order to expand capacity, the company decided to lease a new machine used in tone ring turning and plating from Rae Machining Company (RMC). The machine is similar to that used by other tone ring makers. The following is information about the lease terms: Based on the facts of the case, complete the following using the excel template provided: 1) How should this lease be classified by the lessee and lessor? 2) Complete the blank lease amortization schedule. 3) Prepare appropriate journal entries for both the lessee and lessor from beginning of the lease through the third lease payment on Aug. 31, 2023. 4) Now, assume the cost of the asset to the lessor was $60,000. Prepare appropriate journal entries for the lessor from beginning of the lease through the third lease payment on Aug. 31, 2023. 5) Lastly, (independent of all other scenarios) assume the lessee made a warranty claim of $30,000 on the leased asset at the end of 2023 due to an issue with the machine. This warranty claim caused the lessor to book warranty expense in 2023 (although the cash flow did not occur until 2024), creating a temporary book-tax difference for the lessor (this is the only book-tax difference). Using a tax rate of 25%, calculate the amount of the DTA/DTL created for the lessor and prepare the appropriate journal entry to record income taxes at the end of 2023 for the lessor (PTAl of $2.0 million). NCB Manufacturing makes banjo tone rings for popular banjo builders. In order to expand capacity, the company decided to lease a new machine used in tone ring turning and plating from Rae Machining Company (RMC). The machine is similar to that used by other tone ring makers. The following is information about the lease terms: Based on the facts of the case, complete the following using the excel template provided: 1) How should this lease be classified by the lessee and lessor? 2) Complete the blank lease amortization schedule. 3) Prepare appropriate journal entries for both the lessee and lessor from beginning of the lease through the third lease payment on Aug. 31, 2023. 4) Now, assume the cost of the asset to the lessor was $60,000. Prepare appropriate journal entries for the lessor from beginning of the lease through the third lease payment on Aug. 31, 2023. 5) Lastly, (independent of all other scenarios) assume the lessee made a warranty claim of $30,000 on the leased asset at the end of 2023 due to an issue with the machine. This warranty claim caused the lessor to book warranty expense in 2023 (although the cash flow did not occur until 2024), creating a temporary book-tax difference for the lessor (this is the only book-tax difference). Using a tax rate of 25%, calculate the amount of the DTA/DTL created for the lessor and prepare the appropriate journal entry to record income taxes at the end of 2023 for the lessor (PTAl of $2.0 million)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started