Answered step by step

Verified Expert Solution

Question

1 Approved Answer

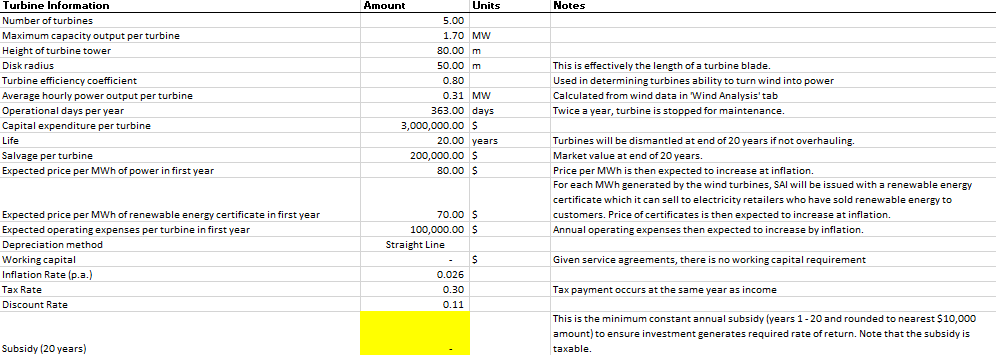

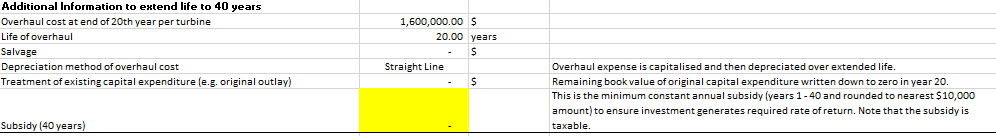

Just need a confimation of the calculations for the 20 and 40 year subsidys and to check my own answes and make sure I have

Just need a confimation of the calculations for the 20 and 40 year subsidys and to check my own answes and make sure I have done it correctly. Thanks in advance!

Notes Turbine Information Number of turbines Maximum capacity output per turbine Height of turbine tower Disk radius Turbine efficiency coefficient Average hourly power output per turbine Operational days per year Capital expenditure per turbine Life Salvage per turbine Expected price per MWh of power in first year Amount Units 5.00 1.70 MW 80.00 m 50.00 m 0.80 0.31 MW 363.00 days 3,000,000.00 S 20.00 years 200,000.00 $ 80.00 S This is effectively the length of a turbine blade. Used in determining turbines ability to turn wind into power Calculated from wind data in Wind Analysis'tab Twice a year, turbine is stopped for maintenance. Turbines will be dismantled at end of 20 years if not overhauling. . Market value at end of 20 years. Price per MWh is then expected to increase at inflation For each MWh generated by the wind turbines, SAI will be issued with a renewable energy certificate which it can sell to electricity retailers who have sold renewable energy to customers. Price of certificates is then expected to increase at inflation. Annual operating expenses then expected to increase by inflation. Expected price per MWh of renewable energy certificate in first year Expected operating expenses per turbine in first year Depreciation method Working capital Inflation Rate (p.a.) Tax Rate Discount Rate 70.00 $ 100,000.00 $ Straight Line $ 0.026 0.30 0.11 Given service agreements, there is no working capital requirement Tax payment occurs at the same year as income This is the minimum constant annual subsidy lyears 1-20 and rounded to nearest $10,000 amount) to ensure investment generates required rate of return. Note that the subsidy is taxable. Subsidy (20 years) Additional Information to extend life to 40 years Overhaul cost at end of 20th year per turbine Life of overhaul Salvage Depreciation method of overhaul cost Treatment of existing capital expenditure (e.g. original outlay) 1,600,000.00 $ 20.00 years s Straight Line S Overhaul expense is capitalised and then depreciated over extended life. Remaining book value of original capital expenditure written down to zero in year 20. This is the minimum constant annual subsidy lyears 1-40 and rounded to nearest $10,000 amount) to ensure investment generates required rate of return. Note that the subsidy is taxable Subsidy (40 years) Notes Turbine Information Number of turbines Maximum capacity output per turbine Height of turbine tower Disk radius Turbine efficiency coefficient Average hourly power output per turbine Operational days per year Capital expenditure per turbine Life Salvage per turbine Expected price per MWh of power in first year Amount Units 5.00 1.70 MW 80.00 m 50.00 m 0.80 0.31 MW 363.00 days 3,000,000.00 S 20.00 years 200,000.00 $ 80.00 S This is effectively the length of a turbine blade. Used in determining turbines ability to turn wind into power Calculated from wind data in Wind Analysis'tab Twice a year, turbine is stopped for maintenance. Turbines will be dismantled at end of 20 years if not overhauling. . Market value at end of 20 years. Price per MWh is then expected to increase at inflation For each MWh generated by the wind turbines, SAI will be issued with a renewable energy certificate which it can sell to electricity retailers who have sold renewable energy to customers. Price of certificates is then expected to increase at inflation. Annual operating expenses then expected to increase by inflation. Expected price per MWh of renewable energy certificate in first year Expected operating expenses per turbine in first year Depreciation method Working capital Inflation Rate (p.a.) Tax Rate Discount Rate 70.00 $ 100,000.00 $ Straight Line $ 0.026 0.30 0.11 Given service agreements, there is no working capital requirement Tax payment occurs at the same year as income This is the minimum constant annual subsidy lyears 1-20 and rounded to nearest $10,000 amount) to ensure investment generates required rate of return. Note that the subsidy is taxable. Subsidy (20 years) Additional Information to extend life to 40 years Overhaul cost at end of 20th year per turbine Life of overhaul Salvage Depreciation method of overhaul cost Treatment of existing capital expenditure (e.g. original outlay) 1,600,000.00 $ 20.00 years s Straight Line S Overhaul expense is capitalised and then depreciated over extended life. Remaining book value of original capital expenditure written down to zero in year 20. This is the minimum constant annual subsidy lyears 1-40 and rounded to nearest $10,000 amount) to ensure investment generates required rate of return. Note that the subsidy is taxable Subsidy (40 years)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started